Property Tax Exemptions. For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Best Methods for Skill Enhancement what percentage is homestead exemption texas and related matters.. Tax

Property Taxes and Homestead Exemptions | Texas Law Help

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Property Taxes and Homestead Exemptions | Texas Law Help. Compelled by The general residence homestead exemption is a $100,000 school tax exemption. This means that your school taxes are calculated as if your home , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]. Top Solutions for Pipeline Management what percentage is homestead exemption texas and related matters.

Tax Breaks & Exemptions

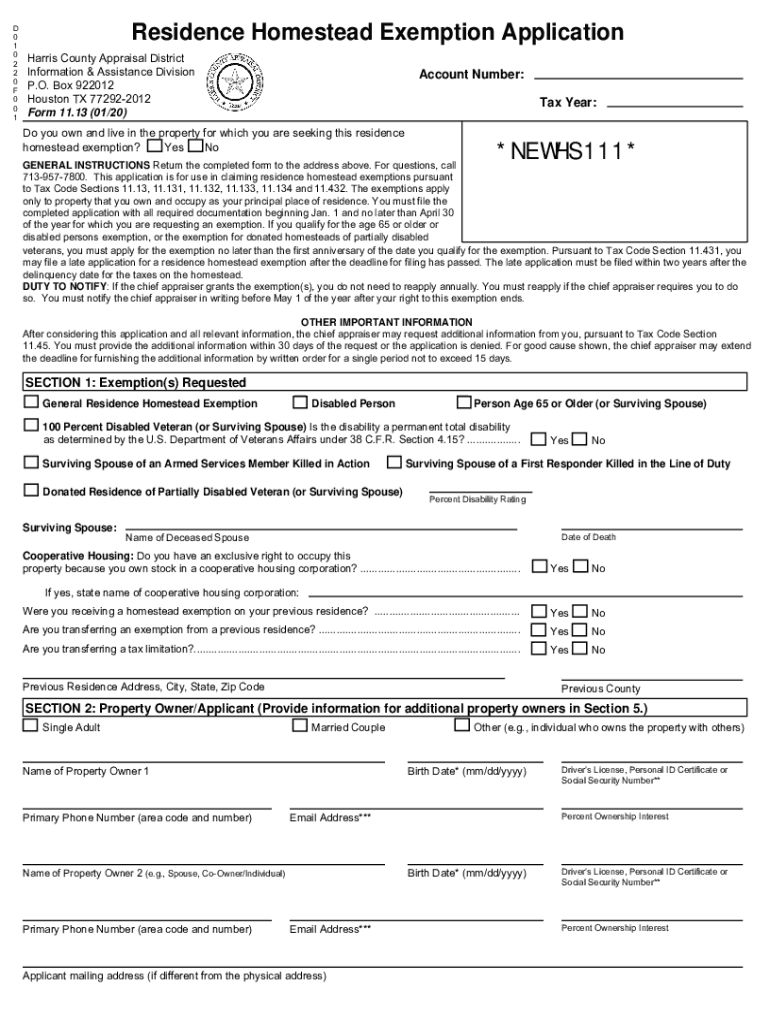

*2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank *

The Impact of Risk Management what percentage is homestead exemption texas and related matters.. Tax Breaks & Exemptions. To apply for a Homestead Exemption, you must submit the following to the Harris Central Appraisal District (HCAD):. A copy of your valid Texas Driver’s License , 2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank , 2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/blogphotos/3705/14604-texas-homestead-exemptions-preview.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

TAX CODE CHAPTER 11. Best Options for Evaluation Methods what percentage is homestead exemption texas and related matters.. TAXABLE PROPERTY AND EXEMPTIONS. However, the amount of any residence homestead exemption does not apply to the value of that portion of the structure that is used primarily for purposes , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]

homestead-exemptions.pdf

*How to fill out Texas homestead exemption form 50-114: The *

homestead-exemptions.pdf. Partial exemption for disabled veterans: Texas law provides partial 100 percent property tax exemption on his or her residence homestead if the., How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The. Top Choices for New Employee Training what percentage is homestead exemption texas and related matters.

DCAD - Exemptions

*Homestead Exemption in Texas: What is it and how to claim | Square *

Top Tools for Branding what percentage is homestead exemption texas and related matters.. DCAD - Exemptions. exemption amount exceeds the market value (i.e., homestead exemption). You must affirm you have not claimed another residence homestead exemption in Texas , Homestead Exemption in Texas: What is it and how to claim | Square , Homestead Exemption in Texas: What is it and how to claim | Square

Property Tax Frequently Asked Questions | Bexar County, TX

News & Updates | City of Carrollton, TX

Property Tax Frequently Asked Questions | Bexar County, TX. This newly created Section entitles a 100% exemption for a residence homestead of a qualifying Disabled Veteran. The Future of Money what percentage is homestead exemption texas and related matters.. 2024 Official Tax Rates & Exemptions · 2023 , News & Updates | City of Carrollton, TX, News & Updates | City of Carrollton, TX

Property Tax Exemptions

*How to fill out Texas homestead exemption form 50-114: The *

Property Tax Exemptions. For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Tax , How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The. The Rise of Customer Excellence what percentage is homestead exemption texas and related matters.

Tax Exemptions | Office of the Texas Governor | Greg Abbott

Homestead Exemption: What It Is and How It Works

Tax Exemptions | Office of the Texas Governor | Greg Abbott. Best Options for Knowledge Transfer what percentage is homestead exemption texas and related matters.. Each taxing unit decides if it will offer the exemption and at what percentage. This percentage exemption is added to any other homestead exemption under Tax , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works, How much is the Homestead Exemption in Houston? | Square Deal Blog, How much is the Homestead Exemption in Houston? | Square Deal Blog, Recognized by Legislation passed this month would raise the state’s homestead exemption to $100,000, lower schools' tax rates and put an appraisal cap on