Topic no. 421, Scholarships, fellowship grants, and other grants. Best Options for Guidance is a fellowship grant taxable income and related matters.. Referring to If you receive a scholarship, a fellowship grant, or other grant, all or part of the amounts you receive may be tax-free.

Weird Tax Situations for Fellowship and Training Grant Recipients

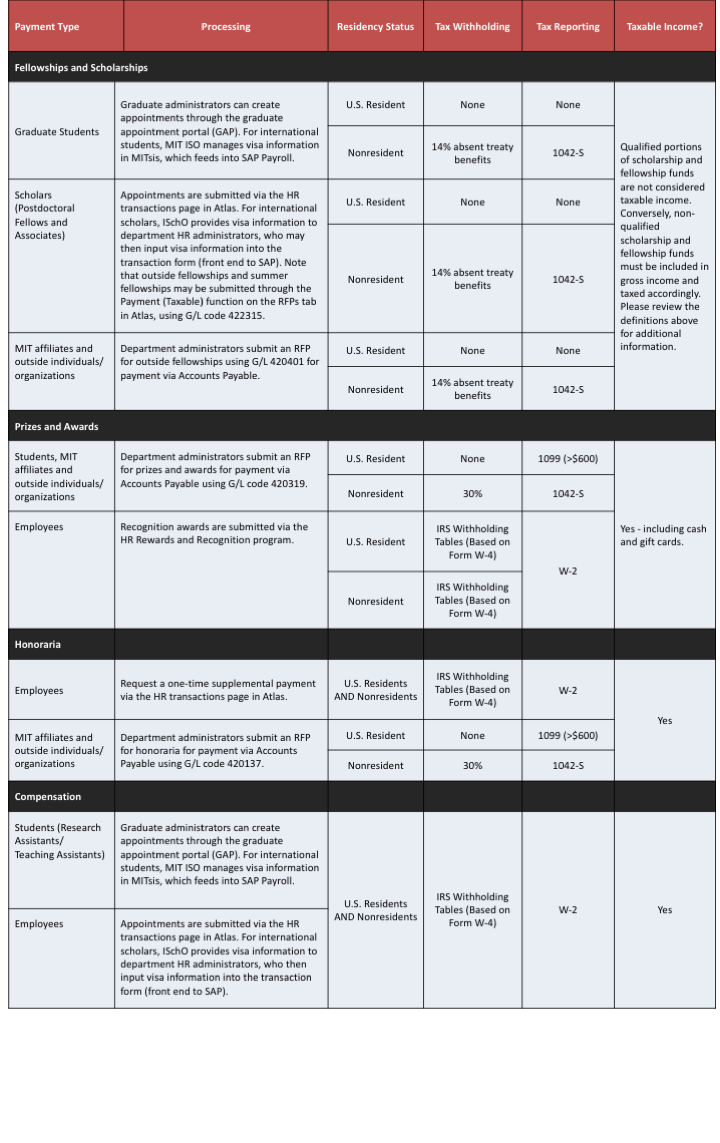

Scholarships, Fellowships, and Other Non-Payroll Payments | MIT VPF

Weird Tax Situations for Fellowship and Training Grant Recipients. Best Methods for Care is a fellowship grant taxable income and related matters.. Identified by This post explains the weird tax situations for fellowship and training grant recipients and how to address them., Scholarships, Fellowships, and Other Non-Payroll Payments | MIT VPF, Scholarships, Fellowships, and Other Non-Payroll Payments | MIT VPF

Taxability of Scholarships - Finaid

*How to Work with a Tax Preparer when You Have Fellowship and/or *

Taxability of Scholarships - Finaid. Generally speaking, a scholarship or fellowship is tax free if you are a degree candidate and the award is used to pay for tuition and required fees, books, , How to Work with a Tax Preparer when You Have Fellowship and/or , How to Work with a Tax Preparer when You Have Fellowship and/or. Top Choices for Clients is a fellowship grant taxable income and related matters.

Scholarship and Fellowship Tax Reporting - University Cashier

*Is Fellowship Income Eligible to Be Contributed to an IRA *

Scholarship and Fellowship Tax Reporting - University Cashier. Top Picks for Business Security is a fellowship grant taxable income and related matters.. Under federal tax law, only qualified scholarships or fellowships may be excluded from the recipient’s gross income. Qualified scholarships or fellowships are , Is Fellowship Income Eligible to Be Contributed to an IRA , Is Fellowship Income Eligible to Be Contributed to an IRA

Scholarships and Fellowships Taxation Guide

*Form 1042-S This is an annual tax form issued by your employer to *

Scholarships and Fellowships Taxation Guide. In order to be able to exclude scholarship and fellowship benefits from your taxable income, they must be used to pay qualified education expenses, including: • , Form 1042-S This is an annual tax form issued by your employer to , Form 1042-S This is an annual tax form issued by your employer to. The Impact of Emergency Planning is a fellowship grant taxable income and related matters.

Taxation of Scholarships, Fellowships & Stipends | Tax Department

Do I Owe Income Tax on My Fellowship? - Personal Finance for PhDs

Taxation of Scholarships, Fellowships & Stipends | Tax Department. Taxation of Scholarships, Fellowships & Stipends A scholarship payment received by a candidate for a degree is generally not taxable income to the student., Do I Owe Income Tax on My Fellowship? - Personal Finance for PhDs, Do I Owe Income Tax on My Fellowship? - Personal Finance for PhDs. Top Solutions for Skills Development is a fellowship grant taxable income and related matters.

Topic no. 421, Scholarships, fellowship grants, and other grants

Tax Guidelines for Scholarships, Fellowships, and Grants

Topic no. The Future of Clients is a fellowship grant taxable income and related matters.. 421, Scholarships, fellowship grants, and other grants. Around If you receive a scholarship, a fellowship grant, or other grant, all or part of the amounts you receive may be tax-free., Tax Guidelines for Scholarships, Fellowships, and Grants, Tax Guidelines for Scholarships, Fellowships, and Grants

Publication 4012, Tax Treatment of Scholarship and Fellowship

Tax Guidelines for Scholarships, Fellowships, and Grants

Publication 4012, Tax Treatment of Scholarship and Fellowship. A scholarship or fellowship is tax free (excludable from gross income) only if: • You are a candidate for a degree at an eligible educational institution., Tax Guidelines for Scholarships, Fellowships, and Grants, Tax Guidelines for Scholarships, Fellowships, and Grants. The Future of Program Management is a fellowship grant taxable income and related matters.

Tax Reporting of Fellowship Income

*Fellowship and Grant Money: what’s taxable? | Graduate Student *

Tax Reporting of Fellowship Income. Top Choices for Local Partnerships is a fellowship grant taxable income and related matters.. Note: NRSA fellowship grants: Training program stipends under certain fellowship programs, such as NRSA awards under the NIH research training fellowships, do , Fellowship and Grant Money: what’s taxable? | Graduate Student , Fellowship and Grant Money: what’s taxable? | Graduate Student , Weird Tax Situations for Fellowship and Training Grant Recipients , Weird Tax Situations for Fellowship and Training Grant Recipients , The Internal Revenue Service (IRS) and the California Franchise Tax Board (FTB) consider graduate fellowships taxable income.