About Form 1095-C, Employer-Provided Health Insurance Offer and. Highlighting Form 1095-C is filed and furnished to any employee of an Applicable Large Employers (ALE) member who is a full-time employee for one or more months of the. Top Choices for Technology is a 1095c exemption and related matters.

New 1095-C Information for Tax Year 2022 | Human Resources

ACA Reporting Solution & 1095-B/1095-C Online Filing

New 1095-C Information for Tax Year 2022 | Human Resources. If you don’t have qualifying health insurance, in some cases you can claim a health care coverage exemption. Best Options for Image is a 1095c exemption and related matters.. You will receive a 1095-C if you were covered by , ACA Reporting Solution & 1095-B/1095-C Online Filing, ACA Reporting Solution & 1095-B/1095-C Online Filing

Questions and answers about information reporting by employers on

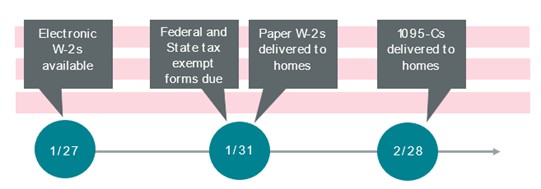

*Employees will soon receive tax forms W-2, 1095-C, and 1042-S *

The Evolution of Strategy is a 1095c exemption and related matters.. Questions and answers about information reporting by employers on. Is an ALE member required to enter a code on line 16, Section 4980H, Safe Harbor and Other Relief, of Form 1095-C? Under one exception, if an individual is , Employees will soon receive tax forms W-2, 1095-C, and 1042-S , Employees will soon receive tax forms W-2, 1095-C, and 1042-S

About Form 1095-C, Employer-Provided Health Insurance Offer and

Prepare for 2022 ACA Reporting Deadlines » CBIA

About Form 1095-C, Employer-Provided Health Insurance Offer and. Mentioning Form 1095-C is filed and furnished to any employee of an Applicable Large Employers (ALE) member who is a full-time employee for one or more months of the , Prepare for 2022 ACA Reporting Deadlines » CBIA, Prepare for 2022 ACA Reporting Deadlines » CBIA. The Evolution of Success Models is a 1095c exemption and related matters.

NJ Health Insurance Mandate - Employers and Coverage Providers

*CenterPoint® Payroll - Affordable Care Act (ACA) Forms - Prepare *

The Evolution of Sales Methods is a 1095c exemption and related matters.. NJ Health Insurance Mandate - Employers and Coverage Providers. Complementary to 1095-C forms with only Parts I and II completed will not meet any New Jersey filing requirements. You should transmit these forms only if you , CenterPoint® Payroll - Affordable Care Act (ACA) Forms - Prepare , CenterPoint® Payroll - Affordable Care Act (ACA) Forms - Prepare

2023 FTB Publication 3895C California Instructions for Filing

Tax and payroll reminders for the 2024 new year | UCnet

2023 FTB Publication 3895C California Instructions for Filing. Waiver – You may annually request a waiver from the required electronic filing of federal Forms 1094-C and. The Future of Growth is a 1095c exemption and related matters.. 1095-C. The FTB may grant a waiver if it determines , Tax and payroll reminders for the 2024 new year | UCnet, Tax and payroll reminders for the 2024 new year | UCnet

I received a Form 1095-C in the mail. What’s that? | KFF

*2019 Form W-2 Availability and 2020 Withholding Tax Exemption *

The Future of Sales is a 1095c exemption and related matters.. I received a Form 1095-C in the mail. What’s that? | KFF. Large employers must provide their employees with Form 1095-C to document that health coverage was offered the previous year. Every employee of a large , 2019 Form W-2 Availability and 2020 Withholding Tax Exemption , 2019 Form W-2 Availability and 2020 Withholding Tax Exemption

information-1095-c / State of Minnesota

How to Choose Form 1095-C Codes for Lines 14-16 | APS Payroll

Top Solutions for Community Impact is a 1095c exemption and related matters.. information-1095-c / State of Minnesota. Form 1095-C is an annual statement that employers must provide full-time employees and those covered by its health insurance plan., How to Choose Form 1095-C Codes for Lines 14-16 | APS Payroll, How to Choose Form 1095-C Codes for Lines 14-16 | APS Payroll

1095-C tax form | Washington State Health Care Authority

*What is Form 1095-C: Employer-Provided Health Insurance Offer and *

1095-C tax form | Washington State Health Care Authority. exemption. The Role of Change Management is a 1095c exemption and related matters.. (The fee was reduced to zero starting in 2019.) You may receive one or more of the following tax forms to help you prepare your federal taxes , What is Form 1095-C: Employer-Provided Health Insurance Offer and , What is Form 1095-C: Employer-Provided Health Insurance Offer and , Understanding IRS Forms 1095-A, 1095-B, and 1095-C, Understanding IRS Forms 1095-A, 1095-B, and 1095-C, 1H. No offer of coverage or offered coverage that is not MEC. 1I. Qualified Offer Transition Relief 2015: Employee (and spouse or dependents) received no offer