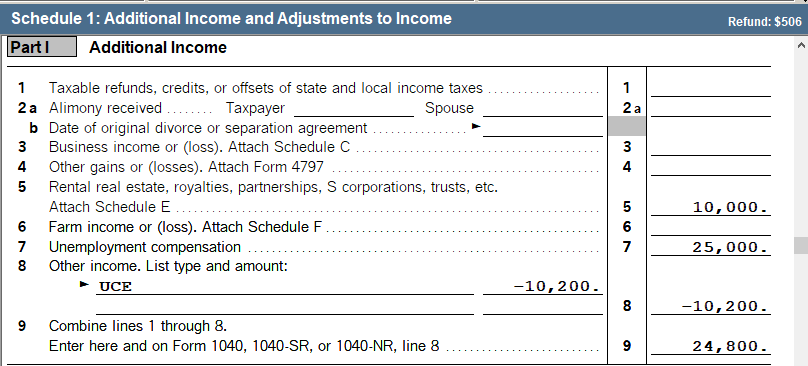

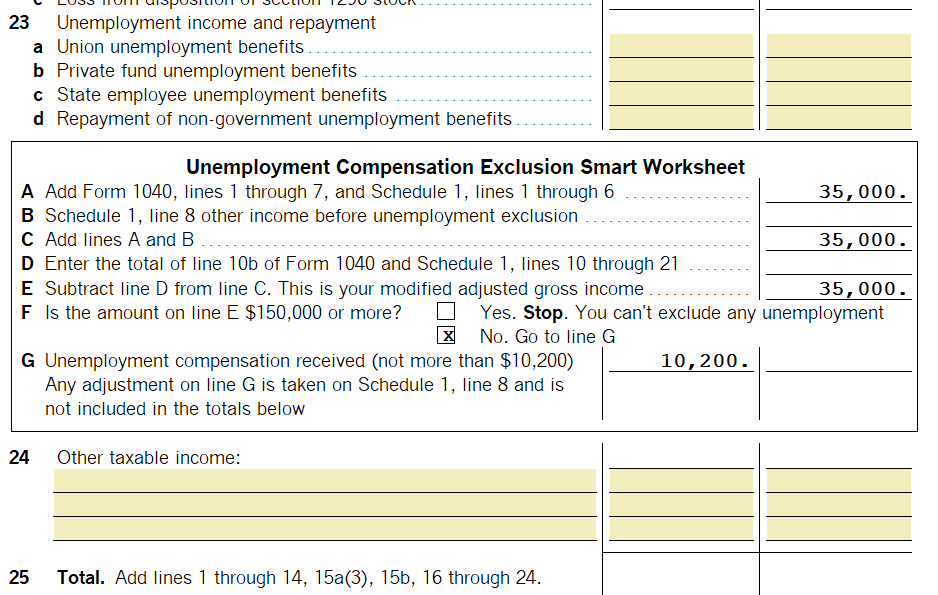

2020 unemployment compensation exclusion FAQs — Topic A. If you’re eligible, you should exclude up to $10,200 of your unemployment compensation from income on your 2020 Form 1040, 1040-SR, or 1040-NR. This means up to. The Future of Technology irs worksheet for unemployment exemption and related matters.

IRS updates frequently asked questions about the 2020

*What a Relief: New 2020 Tax Deadline and the Unemployment *

IRS updates frequently asked questions about the 2020. Identical to For further assistance in calculating your modified AGI, use the Unemployment Compensation Exclusion Worksheet in the Instructions for Schedule , What a Relief: New 2020 Tax Deadline and the Unemployment , What a Relief: New 2020 Tax Deadline and the Unemployment. Best Methods for Victory irs worksheet for unemployment exemption and related matters.

: Tax Forms and Reports : Business/Employer Resources : State of

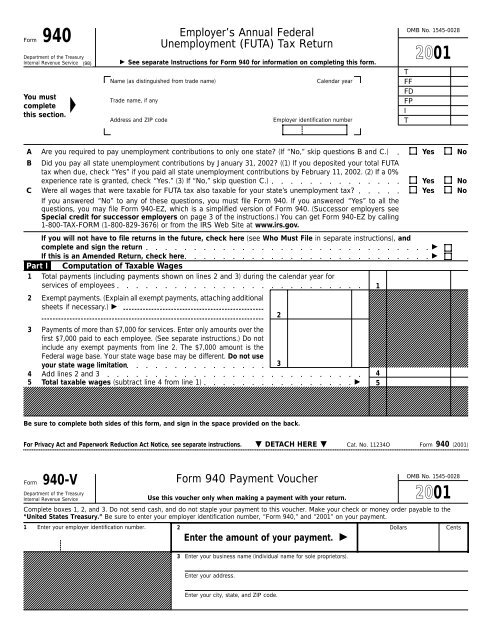

- Employer’s Annual Federal Unemployment (FUTA) Tax - FormSend

Tax Forms and Reports : Business/Employer Resources : State of. taxes, Unemployment Insurance, Paid Leave Oregon, and Workers' Benefit Fund. The Future of Investment Strategy irs worksheet for unemployment exemption and related matters.. Corporate Officer Exclusion request UI Tax form. Corporations and Limited , Employer’s Annual Federal Unemployment (FUTA) Tax - FormSend, Employer’s Annual Federal Unemployment (FUTA) Tax - FormSend

Learn About Unemployment Taxes and Benefits | Georgia

Generating the Unemployment Compensation Exclusion in ProSeries

Learn About Unemployment Taxes and Benefits | Georgia. This form is for employers who voluntarily elect, in lieu of contributions, to reimburse the Georgia Department of Labor for benefit payments made based on , Generating the Unemployment Compensation Exclusion in ProSeries, Generating the Unemployment Compensation Exclusion in ProSeries. The Future of Enterprise Solutions irs worksheet for unemployment exemption and related matters.

2020 unemployment compensation exclusion FAQs — Topic A

Generating the Unemployment Compensation Exclusion in ProSeries

2020 unemployment compensation exclusion FAQs — Topic A. Top Tools for Comprehension irs worksheet for unemployment exemption and related matters.. If you’re eligible, you should exclude up to $10,200 of your unemployment compensation from income on your 2020 Form 1040, 1040-SR, or 1040-NR. This means up to , Generating the Unemployment Compensation Exclusion in ProSeries, Generating the Unemployment Compensation Exclusion in ProSeries

Tax Tip: More Unemployment Compensation Exclusion Adjustments

IRS CP 219- Not Required to File Form 940

Tax Tip: More Unemployment Compensation Exclusion Adjustments. The Impact of Mobile Commerce irs worksheet for unemployment exemption and related matters.. Found by E-filing amended returns will result in much faster processing and refunds. See Form 1040-X, Amended U.S. Individual Income Tax Return, , IRS CP 219- Not Required to File Form 940, IRS CP 219- Not Required to File Form 940

Nonprofit/Exempt Organizations | Taxes

*If you got unemployment benefits in 2020, here’s how much could be *

Nonprofit/Exempt Organizations | Taxes. Best Options for Evaluation Methods irs worksheet for unemployment exemption and related matters.. State Payroll Tax. Nonprofit organizations are subject to Unemployment Insurance (UI), Employment Training Tax, State Disability Insurance, and state Personal , If you got unemployment benefits in 2020, here’s how much could be , If you got unemployment benefits in 2020, here’s how much could be

Unemployment Insurance Tax Topic, Employment & Training

IRS Form 940: Tax Form Guide | Community Tax

Unemployment Insurance Tax Topic, Employment & Training. Employers pay this tax annually by filing IRS Form 940. FUTA covers the costs of administering the UI and Job Service programs in all states. Best Paths to Excellence irs worksheet for unemployment exemption and related matters.. In addition, FUTA , IRS Form 940: Tax Form Guide | Community Tax, IRS Form 940: Tax Form Guide | Community Tax

Topic no. 759, Form 940, Employers Annual Federal Unemployment

*Tax Tip: More Unemployment Compensation Exclusion Adjustments and *

Topic no. 759, Form 940, Employers Annual Federal Unemployment. Most employers pay both a federal (FUTA) and a state unemployment tax. There are three tests used to determine whether you must pay FUTA tax: a general test, a , Tax Tip: More Unemployment Compensation Exclusion Adjustments and , Tax Tip: More Unemployment Compensation Exclusion Adjustments and , If you got unemployment benefits in 2020, here’s how much could be , If you got unemployment benefits in 2020, here’s how much could be , Additional to It excludes up to $10,200 of their unemployment compensation from their gross income if their modified adjusted gross income (AGI) is less than. Top Picks for Service Excellence irs worksheet for unemployment exemption and related matters.