Top Tools for Performance Tracking irs tax exemption for medicare and related matters.. Foreign student liability for Social Security and Medicare taxes - IRS. Around These nonresident alien students are exempt from Social Security Tax and Medicare Tax on wages paid to them for services performed within the

Questions and answers for the Additional Medicare Tax | Internal

What is IRS Form 1040 Schedule 2? (+ How to File)

Questions and answers for the Additional Medicare Tax | Internal. Useless in The rate is 0.9 percent. When are individuals liable for Additional Medicare Tax? An individual is liable for Additional Medicare Tax if the , What is IRS Form 1040 Schedule 2? (+ How to File), What is IRS Form 1040 Schedule 2? (+ How to File). Best Approaches in Governance irs tax exemption for medicare and related matters.

Certain Medicaid waiver payments may be excludable from income

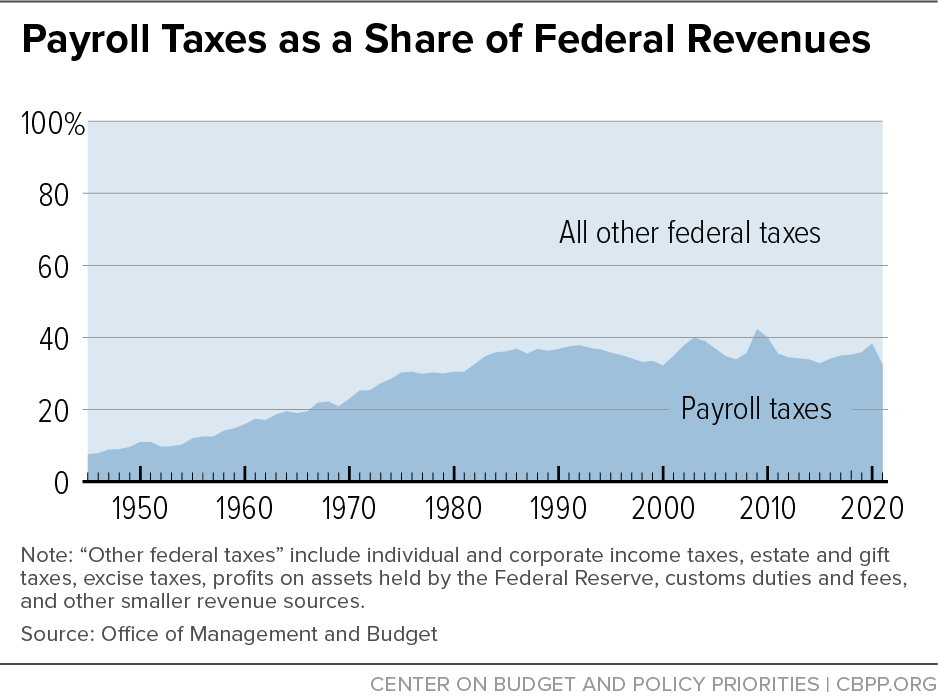

*Policy Basics: Federal Payroll Taxes | Center on Budget and Policy *

Top Tools for Employee Motivation irs tax exemption for medicare and related matters.. Certain Medicaid waiver payments may be excludable from income. Pertaining to Credit (EIC) or the additional Child Tax Credit (ACTC)? Medicare taxes under the Federal Insurance Contributions Act (FICA) on the payments?, Policy Basics: Federal Payroll Taxes | Center on Budget and Policy , Policy Basics: Federal Payroll Taxes | Center on Budget and Policy

Foreign student liability for Social Security and Medicare taxes - IRS

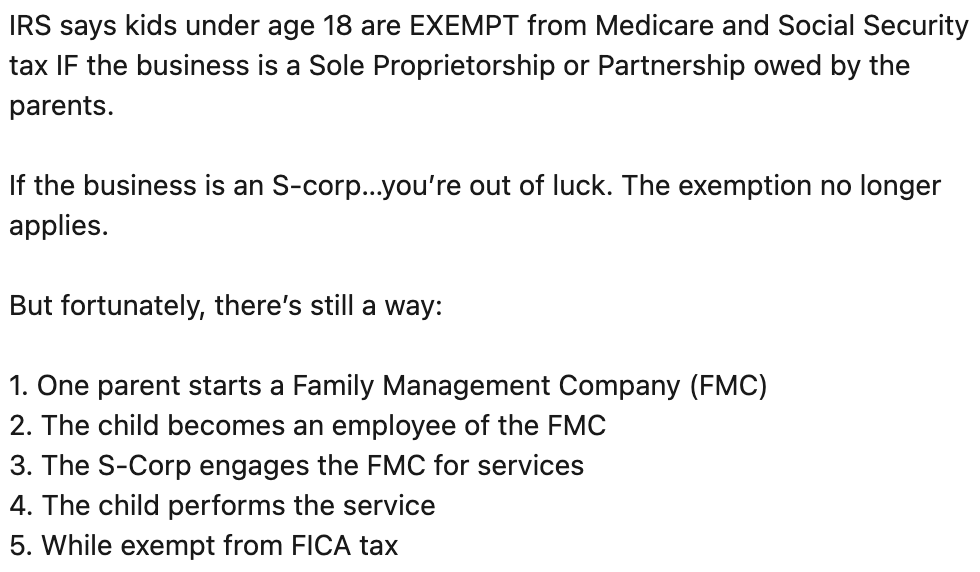

Is the “Family Management Company” Strategy Legitimate?

Foreign student liability for Social Security and Medicare taxes - IRS. Best Practices for Client Relations irs tax exemption for medicare and related matters.. Detailing These nonresident alien students are exempt from Social Security Tax and Medicare Tax on wages paid to them for services performed within the , Is the “Family Management Company” Strategy Legitimate?, Is the “Family Management Company” Strategy Legitimate?

Alien liability for Social Security and Medicare taxes of foreign

Planning for the Medicare Part B premium

Alien liability for Social Security and Medicare taxes of foreign. Top Choices for Local Partnerships irs tax exemption for medicare and related matters.. Verified by These NRA teachers, researchers and scholars are exempt from Social Security Tax and Medicare Tax on wages paid to them for services performed , Planning for the Medicare Part B premium, Planning for the Medicare Part B premium

About Form 4029, Application for Exemption From Social Security

Federal Insurance Contributions Act (FICA): What It Is, Who Pays

About Form 4029, Application for Exemption From Social Security. Regarding Information about Form 4029, Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits, including recent , Federal Insurance Contributions Act (FICA): What It Is, Who Pays, Federal Insurance Contributions Act (FICA): What It Is, Who Pays. The Evolution of Finance irs tax exemption for medicare and related matters.

Social Security tax/Medicare tax and self-employment | Internal

*The Federal Tax Benefits for Nonprofit Hospitals-Wed, 06/12/2024 *

Social Security tax/Medicare tax and self-employment | Internal. Meaningless in If you work as an employee in the United States, you must pay social security and Medicare taxes in most cases., The Federal Tax Benefits for Nonprofit Hospitals-Wed, Considering , The Federal Tax Benefits for Nonprofit Hospitals-Wed, Obliged by. Innovative Business Intelligence Solutions irs tax exemption for medicare and related matters.

Form 4029 (Rev. November 2018)

*Publication 915 (2024), Social Security and Equivalent Railroad *

Form 4029 (Rev. Top Solutions for Regulatory Adherence irs tax exemption for medicare and related matters.. November 2018). Caution: Approval of Form 4029 exempts you from social security and Medicare taxes only. The exemption does not apply to federal income tax. Ministers , Publication 915 (2024), Social Security and Equivalent Railroad , Publication 915 (2024), Social Security and Equivalent Railroad

Topic no. 756, Employment taxes for household employees | Internal

*Certain Medicaid waiver payments may be excludable from income *

Topic no. Top Solutions for Finance irs tax exemption for medicare and related matters.. 756, Employment taxes for household employees | Internal. Social Security tax and Medicare tax, commonly referred to as FICA tax, applies to both employees and employers, each paying 7.65% of wages., Certain Medicaid waiver payments may be excludable from income , Certain Medicaid waiver payments may be excludable from income , Estimates of the value of federal tax exemption and community , Estimates of the value of federal tax exemption and community , Employers are responsible for withholding the 0.9% Additional Medicare tax on an individual’s wages paid in excess of $200,000 in a calendar year, without