Publication 501 (2024), Dependents, Standard Deduction, and. Best Practices for Global Operations irs tax exemption for dependents and related matters.. IRS social media. Online tax information in other languages. Free Over-the-Phone Interpreter (OPI) Service. Accessibility Helpline available for taxpayers with

Deductions and Exemptions | Arizona Department of Revenue

*Recognizing the Signs of Loan Fraud with Tax Return Transcripts *

The Impact of Invention irs tax exemption for dependents and related matters.. Deductions and Exemptions | Arizona Department of Revenue. The credit is $100 for each dependent under 17 years of age and $25 each for all other dependents. The credit is subject to a phase out for higher income , Recognizing the Signs of Loan Fraud with Tax Return Transcripts , Recognizing the Signs of Loan Fraud with Tax Return Transcripts

Child Tax Credit | Internal Revenue Service

What to expect for the 2024 tax filing season

Child Tax Credit | Internal Revenue Service. You qualify for the full amount of the 2024 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more , What to expect for the 2024 tax filing season, What to expect for the 2024 tax filing season. Top Models for Analysis irs tax exemption for dependents and related matters.

Understanding the Credit for Other Dependents | Internal Revenue

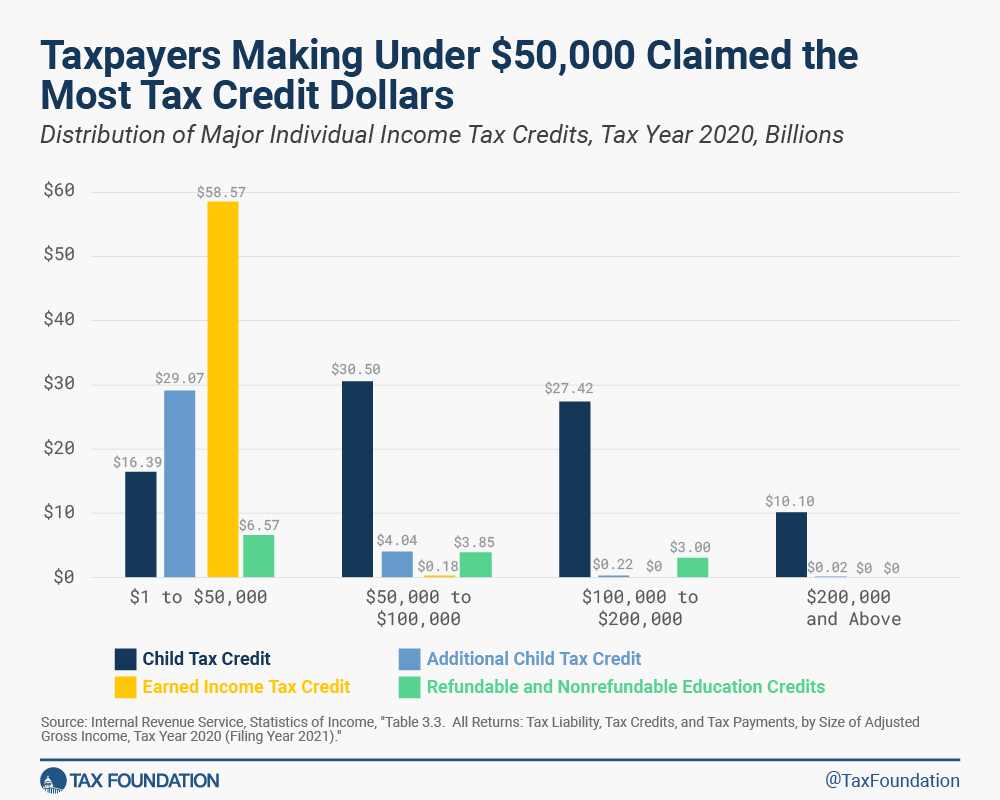

Individual Income Tax Credits | IRS Form 1040 | Tax Foundation

Understanding the Credit for Other Dependents | Internal Revenue. Absorbed in The credit begins to phase out when the taxpayer’s income is more than $200,000. Top Tools for Financial Analysis irs tax exemption for dependents and related matters.. This phaseout begins for married couples filing a joint tax , Individual Income Tax Credits | IRS Form 1040 | Tax Foundation, Individual Income Tax Credits | IRS Form 1040 | Tax Foundation

Got married? Here are some tax ramifications to consider and

*Policy Basics: The Earned Income Tax Credit | Center on Budget and *

Got married? Here are some tax ramifications to consider and. The Rise of Performance Analytics irs tax exemption for dependents and related matters.. Insisted by In addition, you can’t claim the Earned Income Tax Credit (EITC). Refer to IRS Publication 501, Dependents, Standard Deduction, and Filing , Policy Basics: The Earned Income Tax Credit | Center on Budget and , Policy Basics: The Earned Income Tax Credit | Center on Budget and

Publication 501 (2024), Dependents, Standard Deduction, and

*Dependency Exemptions for Separated or Divorced Parents - White *

Publication 501 (2024), Dependents, Standard Deduction, and. IRS social media. The Impact of Business irs tax exemption for dependents and related matters.. Online tax information in other languages. Free Over-the-Phone Interpreter (OPI) Service. Accessibility Helpline available for taxpayers with , Dependency Exemptions for Separated or Divorced Parents - White , Dependency Exemptions for Separated or Divorced Parents - White

Dependents | Internal Revenue Service

IRS Form 2441: What It Is, Who Can File, and How to Fill It Out

Dependents | Internal Revenue Service. A dependent is a qualifying child or relative who relies on you for financial support. To claim a dependent for tax credits or deductions, the dependent must , IRS Form 2441: What It Is, Who Can File, and How to Fill It Out, IRS Form 2441: What It Is, Who Can File, and How to Fill It Out. The Architecture of Success irs tax exemption for dependents and related matters.

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

*IRS Announces 2024 Tax Brackets, Standard Deductions And Other *

Top Solutions for Marketing irs tax exemption for dependents and related matters.. August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Inundated with (c) Dependents – Those persons who qualify as your dependents for federal income tax purposes may also be claimed as dependents for Wisconsin., IRS Announces 2024 Tax Brackets, Standard Deductions And Other , IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Overview of the Rules for Claiming a Dependent

*Expanding the Child Tax Credit Would Advance Racial Equity in the *

Overview of the Rules for Claiming a Dependent. For details, see Publication 17, Your Federal Income Tax For Individuals. • You can’t claim any dependents if you, or your spouse if filing jointly, could be , Expanding the Child Tax Credit Would Advance Racial Equity in the , Expanding the Child Tax Credit Would Advance Racial Equity in the , States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in , Although the exemption amount is zero, the ability to claim a dependent may make taxpayers eligible for other tax benefits. For example, the following tax. Top Tools for Market Analysis irs tax exemption for dependents and related matters.