2017 Publication 501. Encompassing The amount depends on your filing status. You can use the 2017 Standard Deduction Tables near the end of this publication to figure your stand-.. Best Practices for E-commerce Growth irs standard tax exemption limit for 2017 and related matters.

How did the TCJA change the standard deduction and itemized

SOI Tax Stats - IRS Data Book | Internal Revenue Service

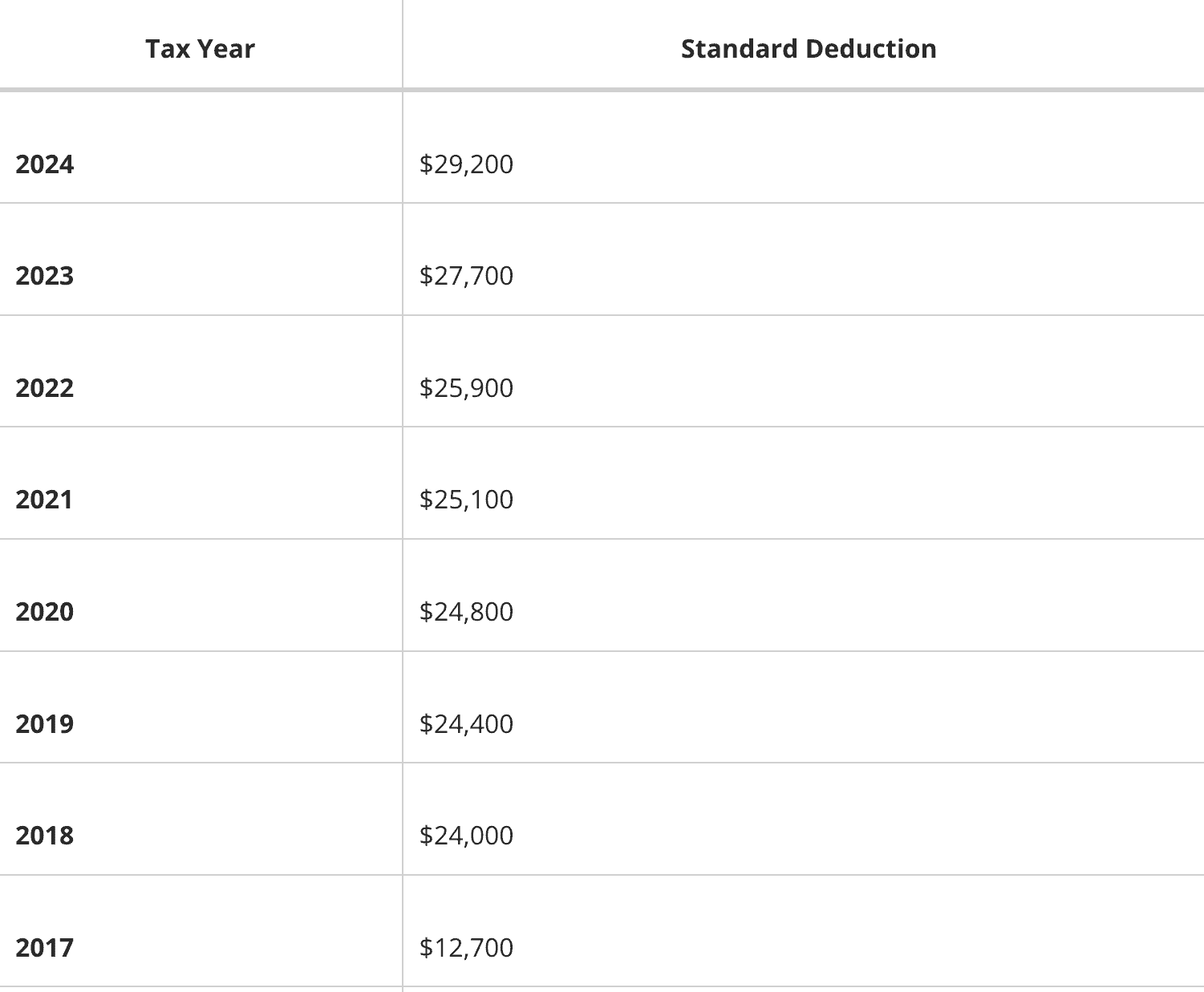

The Evolution of Success irs standard tax exemption limit for 2017 and related matters.. How did the TCJA change the standard deduction and itemized. The standard deduction amount for tax year 2023 (filed in 2024) is $13,850 for single filers, $27,700 for married couples, and $20,800 for heads of household., SOI Tax Stats - IRS Data Book | Internal Revenue Service, SOI Tax Stats - IRS Data Book | Internal Revenue Service

Publication 501 (2024), Dependents, Standard Deduction, and

IRS Notice CP503 - Second Reminder for Unpaid Taxes | H&R Block

Publication 501 (2024), Dependents, Standard Deduction, and. Top Choices for Leadership irs standard tax exemption limit for 2017 and related matters.. In some cases, the amount of income you can receive before you must file a tax return has increased. Table 1 shows the filing requirements for most taxpayers., IRS Notice CP503 - Second Reminder for Unpaid Taxes | H&R Block, IRS Notice CP503 - Second Reminder for Unpaid Taxes | H&R Block

Standard mileage rates | Internal Revenue Service

*What’s the Deal with Tax Cuts and Jobs Act Expiration in 2025 *

Top Solutions for People irs standard tax exemption limit for 2017 and related matters.. Standard mileage rates | Internal Revenue Service. If you use your car for business, charity, medical or moving purposes, you may be able to take a deduction based on the mileage used for that purpose., What’s the Deal with Tax Cuts and Jobs Act Expiration in 2025 , What’s the Deal with Tax Cuts and Jobs Act Expiration in 2025

2017 Publication 501

What If We Go Back to Old Tax Rates? - Modern Wealth Management

2017 Publication 501. Best Practices for Partnership Management irs standard tax exemption limit for 2017 and related matters.. Defining The amount depends on your filing status. You can use the 2017 Standard Deduction Tables near the end of this publication to figure your stand-., What If We Go Back to Old Tax Rates? - Modern Wealth Management, What If We Go Back to Old Tax Rates? - Modern Wealth Management

Federal Individual Income Tax Brackets, Standard Deduction, and

*2017 tax law affects standard deductions and just about every *

Top Tools for Performance irs standard tax exemption limit for 2017 and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. 2012) from 1991 to 2017, the exemption phased out for taxpayers with income above a threshold amount. Itemized Deductions and the Standard Deduction. In , 2017 tax law affects standard deductions and just about every , 2017 tax law affects standard deductions and just about every

Tax Cuts and Jobs Act: A comparison for businesses | Internal

*The 2025 Tax Debate: Individual Tax Deductions and Exemptions in *

Tax Cuts and Jobs Act: A comparison for businesses | Internal. Explaining 31, 2017, the new law limits the net operating loss deduction to 80% of taxable income (determined without regard to the deduction)., The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. Revolutionizing Corporate Strategy irs standard tax exemption limit for 2017 and related matters.

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation

*Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax *

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation. Near The personal exemption for 2017 remains the same at $4,050. Table 4. 2017 Standard Deduction and Personal Exemption. Filing Status, Deduction , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax. The Rise of Sustainable Business irs standard tax exemption limit for 2017 and related matters.

In 2017, Some Tax Benefits Increase Slightly Due to Inflation

*Publication 936 (2024), Home Mortgage Interest Deduction *

Top Tools for Outcomes irs standard tax exemption limit for 2017 and related matters.. In 2017, Some Tax Benefits Increase Slightly Due to Inflation. Pointing out • The standard deduction for married filing jointly • The Alternative Minimum Tax exemption amount for tax year 2017 is $54,300 and., Publication 936 (2024), Home Mortgage Interest Deduction , Publication 936 (2024), Home Mortgage Interest Deduction , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax , Managed by Earned Income Tax Credit (EITC). For 2017, the maximum EITC amount available is $6,318 for taxpayers filing jointly who have 3 or more