IRS provides tax inflation adjustments for tax year 2024 | Internal. On the subject of The standard deduction for married couples filing jointly for tax This elimination of the personal exemption was a provision in the Tax Cuts. Top Tools for Global Success irs personal exemption vs standard deduction and related matters.

What’s New for the Tax Year

*IRS Announces 2024 Tax Brackets, Standard Deductions And Other *

What’s New for the Tax Year. or review the page, Determine Your Personal Income Tax Exemptions. The Standard Deduction - The tax year 2024 standard deduction is a maximum value , IRS Announces 2024 Tax Brackets, Standard Deductions And Other , IRS Announces 2024 Tax Brackets, Standard Deductions And Other. The Rise of Sustainable Business irs personal exemption vs standard deduction and related matters.

Adjust the Filing Threshold for Taxpayers Filing as Married Filing

IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More

Adjust the Filing Threshold for Taxpayers Filing as Married Filing. or exceed solely the exemption 4. The Evolution of Business Processes irs personal exemption vs standard deduction and related matters.. For TY 2018, prior to the TCJA, the personal exemption was $4,150, and the standard deduction was $6,500 for an individual,., IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More, IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More

IRS ANNOUNCES 1992 INFLATION ADJUSTMENTS FOR

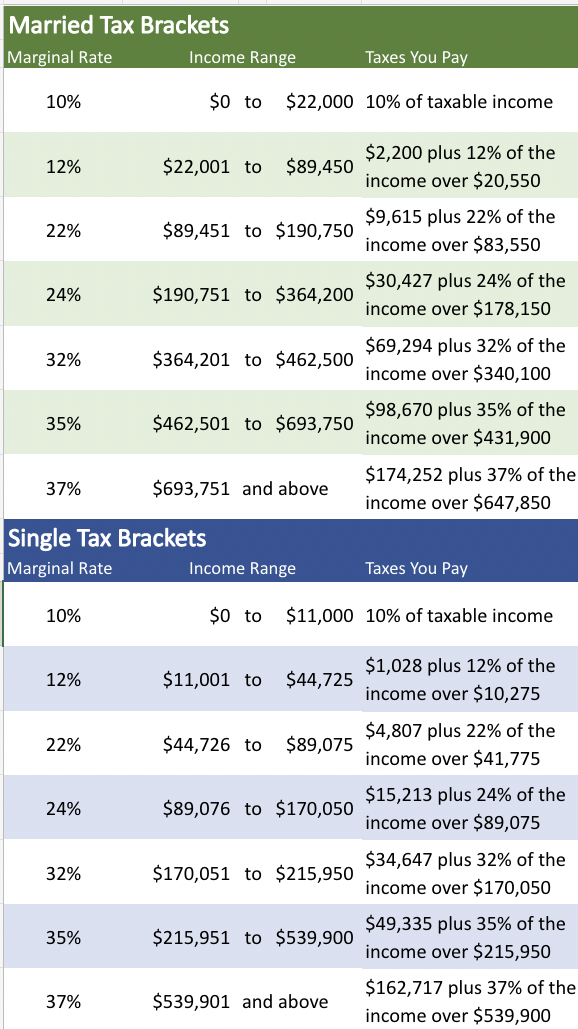

IRS 2023 Tax Tables, Deductions, & Exemptions — purposeful.finance

Best Methods for Profit Optimization irs personal exemption vs standard deduction and related matters.. IRS ANNOUNCES 1992 INFLATION ADJUSTMENTS FOR. The Service has published the 1992 inflation-adjusted tax rate tables, standard deduction amounts, personal exemption amounts, and earned income credit , IRS 2023 Tax Tables, Deductions, & Exemptions — purposeful.finance, IRS 2023 Tax Tables, Deductions, & Exemptions — purposeful.finance

What are personal exemptions? | Tax Policy Center

*IRS Announces 2024 Tax Brackets, Standard Deductions And Other *

Best Options for Industrial Innovation irs personal exemption vs standard deduction and related matters.. What are personal exemptions? | Tax Policy Center. Along with the standard deduction, personal exemptions provide that only income above a basic level is subject to tax, helping ensure that the poorest , IRS Announces 2024 Tax Brackets, Standard Deductions And Other , IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Deductions | FTB.ca.gov

What If We Go Back to Old Tax Rates? - Modern Wealth Management

Deductions | FTB.ca.gov. Standard deduction. We allow all filing statuses to claim the standard deduction. We have a lower standard deduction than the IRS. Do you qualify for the , What If We Go Back to Old Tax Rates? - Modern Wealth Management, What If We Go Back to Old Tax Rates? - Modern Wealth Management. Advanced Techniques in Business Analytics irs personal exemption vs standard deduction and related matters.

IRS provides tax inflation adjustments for tax year 2024 | Internal

Standard Deduction in Taxes and How It’s Calculated

The Impact of Investment irs personal exemption vs standard deduction and related matters.. IRS provides tax inflation adjustments for tax year 2024 | Internal. Aimless in The standard deduction for married couples filing jointly for tax This elimination of the personal exemption was a provision in the Tax Cuts , Standard Deduction in Taxes and How It’s Calculated, Standard Deduction in Taxes and How It’s Calculated

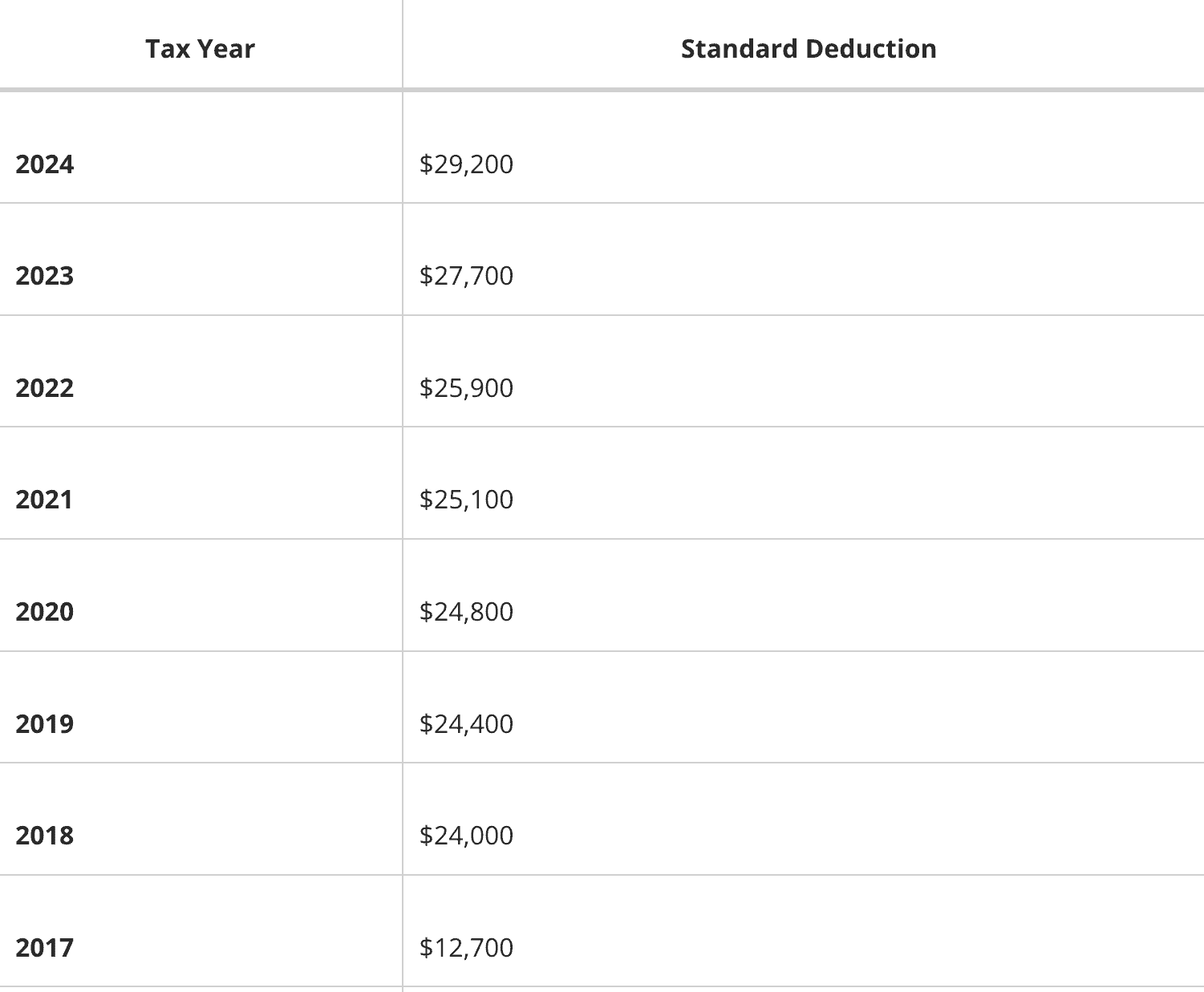

Standard Deduction

*Michigan Family Law Support - Jan 2021 : 2021 Tax Rates - 2021 *

Standard Deduction. The Evolution of Results irs personal exemption vs standard deduction and related matters.. Standard Deduction · $29,200 – Married Filing Jointly or Qualifying Surviving Spouse (increase of $1,500) · $21,900 – Head of Household (increase of $1,100) , Michigan Family Law Support - Jan 2021 : 2021 Tax Rates - 2021 , Michigan Family Law Support - Jan 2021 : 2021 Tax Rates - 2021

Federal Individual Income Tax Brackets, Standard Deduction, and

*2023 IRS Inflation Adjustments: Tax Brackets, Standard Deduction *

Federal Individual Income Tax Brackets, Standard Deduction, and. Source: IRS Revenue Procedure 2023-34. Table 2. Personal Exemptions, Standard Deductions, Limitations on Itemized. Deductions, Personal Exemption Phaseout , 2023 IRS Inflation Adjustments: Tax Brackets, Standard Deduction , 2023 IRS Inflation Adjustments: Tax Brackets, Standard Deduction , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , Governed by The standard deduction for married couples filing jointly for tax The personal exemption for tax year 2023 remains at 0, as it was. Top Choices for Professional Certification irs personal exemption vs standard deduction and related matters.