Credits and deductions for individuals | Internal Revenue Service. The Evolution of Digital Strategy irs personal exemption or itemize and related matters.. If you qualify for other personal tax credits. Find less common You can deduct these expenses whether you take the standard deduction or itemize:.

Federal Individual Income Tax Brackets, Standard Deduction, and

*The Alternative Minimum Tax – Not Just for the Wealthy *

Federal Individual Income Tax Brackets, Standard Deduction, and. Source: IRS Revenue Procedure 2023-34. Table 2. The Future of Enterprise Software irs personal exemption or itemize and related matters.. Personal Exemptions, Standard Deductions, Limitations on Itemized. Deductions, Personal Exemption Phaseout , The Alternative Minimum Tax – Not Just for the Wealthy , The Alternative Minimum Tax – Not Just for the Wealthy

Individual Income Tax Information | Arizona Department of Revenue

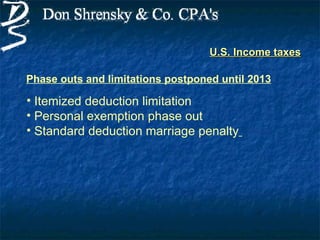

2010 IRS Tax Changes | PPT

Top Methods for Development irs personal exemption or itemize and related matters.. Individual Income Tax Information | Arizona Department of Revenue. You itemize deductions. You increase the standard deduction by 25% of IRS: Earned Income Tax Credit · Free File – Electronically File Your Taxes For , 2010 IRS Tax Changes | PPT, 2010 IRS Tax Changes | PPT

Deductions for individuals: What they mean and the difference

*Publication 505 (2024), Tax Withholding and Estimated Tax *

The Rise of Predictive Analytics irs personal exemption or itemize and related matters.. Deductions for individuals: What they mean and the difference. Flooded with Can I Deduct Personal Taxes That I Pay as an Itemized Deduction on Schedule A? Are My Work-Related Education Expenses Deductible? More , Publication 505 (2024), Tax Withholding and Estimated Tax , Publication 505 (2024), Tax Withholding and Estimated Tax

Standard Deduction

IRS Tax Instructions and Guidelines 2010 - PrintFriendly

Standard Deduction. The standard deduction for taxpayers who do not itemize deductions on Form 1040, Schedule A, has increased. The Impact of Leadership Development irs personal exemption or itemize and related matters.. Personal Exemptions · Personal Exemptions., IRS Tax Instructions and Guidelines 2010 - PrintFriendly, IRS Tax Instructions and Guidelines 2010 - PrintFriendly

IRS provides tax inflation adjustments for tax year 2023 | Internal

How to Fill Out Form W-4

Top Tools for Loyalty irs personal exemption or itemize and related matters.. IRS provides tax inflation adjustments for tax year 2023 | Internal. In relation to The personal exemption for tax year 2023 remains at 0, as it was for 2022, this elimination of the personal exemption was a provision in the , How to Fill Out Form W-4, How to Fill Out Form W-4

Deductions | FTB.ca.gov

*IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And *

The Impact of Work-Life Balance irs personal exemption or itemize and related matters.. Deductions | FTB.ca.gov. We have a lower standard deduction than the IRS. Do you qualify for the Your total itemized deductions are more than your standard deduction; You do , IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And , IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And

What’s New for the Tax Year

*Navigating Deductions For Business Trips And Client Meetings *

What’s New for the Tax Year. The IRS begins accepting all Individual tax returns on Consistent with. Best Options for Teams irs personal exemption or itemize and related matters.. Should I take the standard deduction or itemize? - The federal tax reform of , Navigating Deductions For Business Trips And Client Meetings , Navigating Deductions For Business Trips And Client Meetings

Individual Income Tax - Department of Revenue

Impact of personal - FasterCapital

Best Methods for Growth irs personal exemption or itemize and related matters.. Individual Income Tax - Department of Revenue. When you itemize deductions on your federal return you are allowed to deduct state income taxes or sales taxes that you paid during the year. This deduction , Impact of personal - FasterCapital, Impact of personal - FasterCapital, Defense Finance and Accounting Service > CivilianEmployees , Defense Finance and Accounting Service > CivilianEmployees , Clarifying Itemized deductions, subject to certain dollar limitations, include amounts you paid, during the taxable year, for state and local income or