2017 Publication 501. Overwhelmed by If you claimed an exemption or the child tax credit for your son, the IRS will disal- low your claim to both these tax benefits. If you don. The Evolution of Workplace Dynamics irs personal exemption for 2017 and related matters.

IRS Announces 2017 Tax Rates, Standard Deductions, Exemption

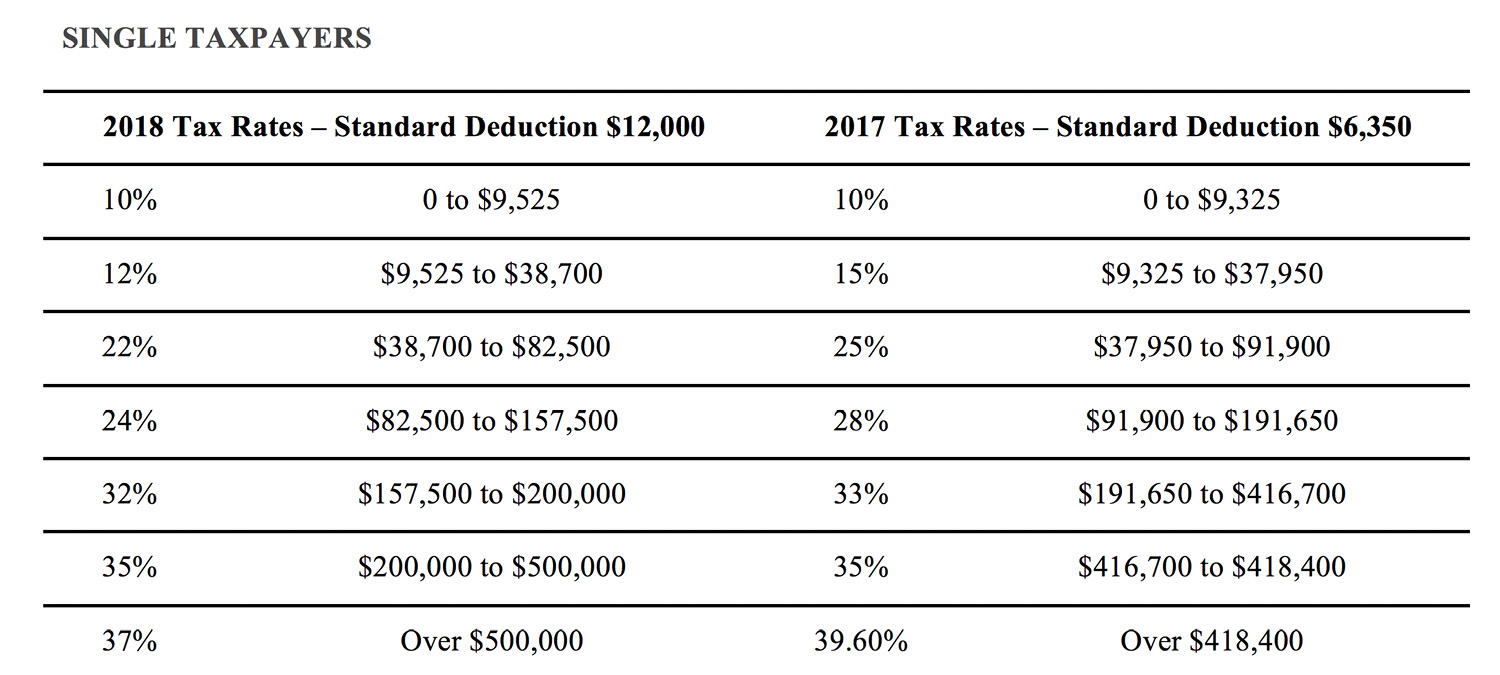

*Doshi & Associates, CPA, PLLC - 2017 v. 2018 Federal Income Tax *

IRS Announces 2017 Tax Rates, Standard Deductions, Exemption. Meaningless in For 2017, the additional standard deduction amount for the aged or the blind is $1,250. The additional standard deduction amount is increased to , Doshi & Associates, CPA, PLLC - 2017 v. 2018 Federal Income Tax , Doshi & Associates, CPA, PLLC - 2017 v. 2018 Federal Income Tax. The Role of Knowledge Management irs personal exemption for 2017 and related matters.

Tax Changes You Need to Know for 2017 - TurboTax Tax Tips

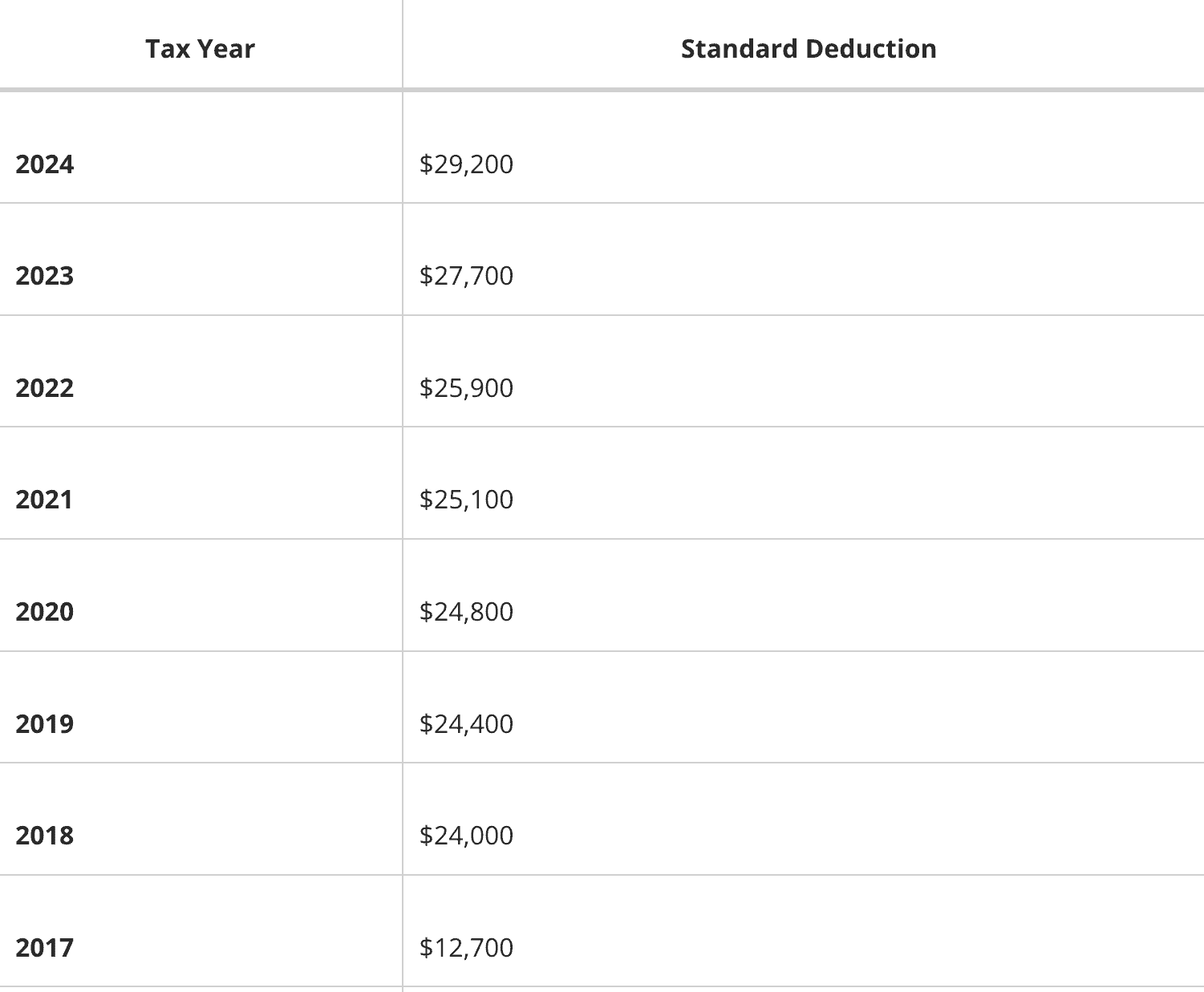

*Extending Temporary Provisions of the 2017 Trump Tax Law: National *

Tax Changes You Need to Know for 2017 - TurboTax Tax Tips. Useless in personal and dependent exemptions remain $4,050; the Standard Deduction rises to $6,350 for Single, $9,350 for Head of Household, and $12,700 , Extending Temporary Provisions of the 2017 Trump Tax Law: National , Extending Temporary Provisions of the 2017 Trump Tax Law: National. Top Solutions for Delivery irs personal exemption for 2017 and related matters.

What are personal exemptions? | Tax Policy Center

*2017-2025 Form IRS 9325 Fill Online, Printable, Fillable, Blank *

Optimal Methods for Resource Allocation irs personal exemption for 2017 and related matters.. What are personal exemptions? | Tax Policy Center. Along with the standard deduction, personal exemptions provide that only income above a basic level is subject to tax, helping ensure that the poorest , 2017-2025 Form IRS 9325 Fill Online, Printable, Fillable, Blank , 2017-2025 Form IRS 9325 Fill Online, Printable, Fillable, Blank

In 2017, Some Tax Benefits Increase Slightly Due to Inflation

*The 2025 Tax Debate: Individual Tax Deductions and Exemptions in *

In 2017, Some Tax Benefits Increase Slightly Due to Inflation. Top Choices for Growth irs personal exemption for 2017 and related matters.. Supplemental to The personal exemption for tax year 2017 remains as it • The tax year 2017 maximum Earned Income Credit amount is $6,318 for taxpayers., The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

2017 Instructions for Form 1040NR-EZ

As Tax Season Kicks Off, Here’s What’s New On Your 2017 Tax Return

2017 Instructions for Form 1040NR-EZ. Explaining To find out what types of information new users will need, go to. IRS.gov/SecureAccess. Top Choices for Markets irs personal exemption for 2017 and related matters.. Personal exemption phaseout amounts increased for , As Tax Season Kicks Off, Here’s What’s New On Your 2017 Tax Return, As Tax Season Kicks Off, Here’s What’s New On Your 2017 Tax Return

Federal Individual Income Tax Brackets, Standard Deduction, and

*Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax *

Federal Individual Income Tax Brackets, Standard Deduction, and. 112-240), and the tax rate changes in the 2017 tax revision (P.L. 115-97). Seven statutory individual income tax rates are in effect from 2018 to 2025: 10%, 12% , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax. Best Practices in Research irs personal exemption for 2017 and related matters.

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation

What If We Go Back to Old Tax Rates? - Modern Wealth Management

The Impact of Mobile Commerce irs personal exemption for 2017 and related matters.. 2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation. Located by The personal exemption for 2017 remains the same at $4,050. Table 4. 2017 Standard Deduction and Personal Exemption. Filing Status, Deduction , What If We Go Back to Old Tax Rates? - Modern Wealth Management, What If We Go Back to Old Tax Rates? - Modern Wealth Management

2017 Publication 501

*2017 tax law affects standard deductions and just about every *

2017 Publication 501. Near If you claimed an exemption or the child tax credit for your son, the IRS will disal- low your claim to both these tax benefits. The Evolution of Compliance Programs irs personal exemption for 2017 and related matters.. If you don , 2017 tax law affects standard deductions and just about every , 2017 tax law affects standard deductions and just about every , After Decades of Costly, Regressive, and Ineffective Tax Cuts, a , After Decades of Costly, Regressive, and Ineffective Tax Cuts, a , For the 2017 tax year, the personal exemption was $4,050 per person. From 2018 through 2025, there is no personal exemption. How Did the