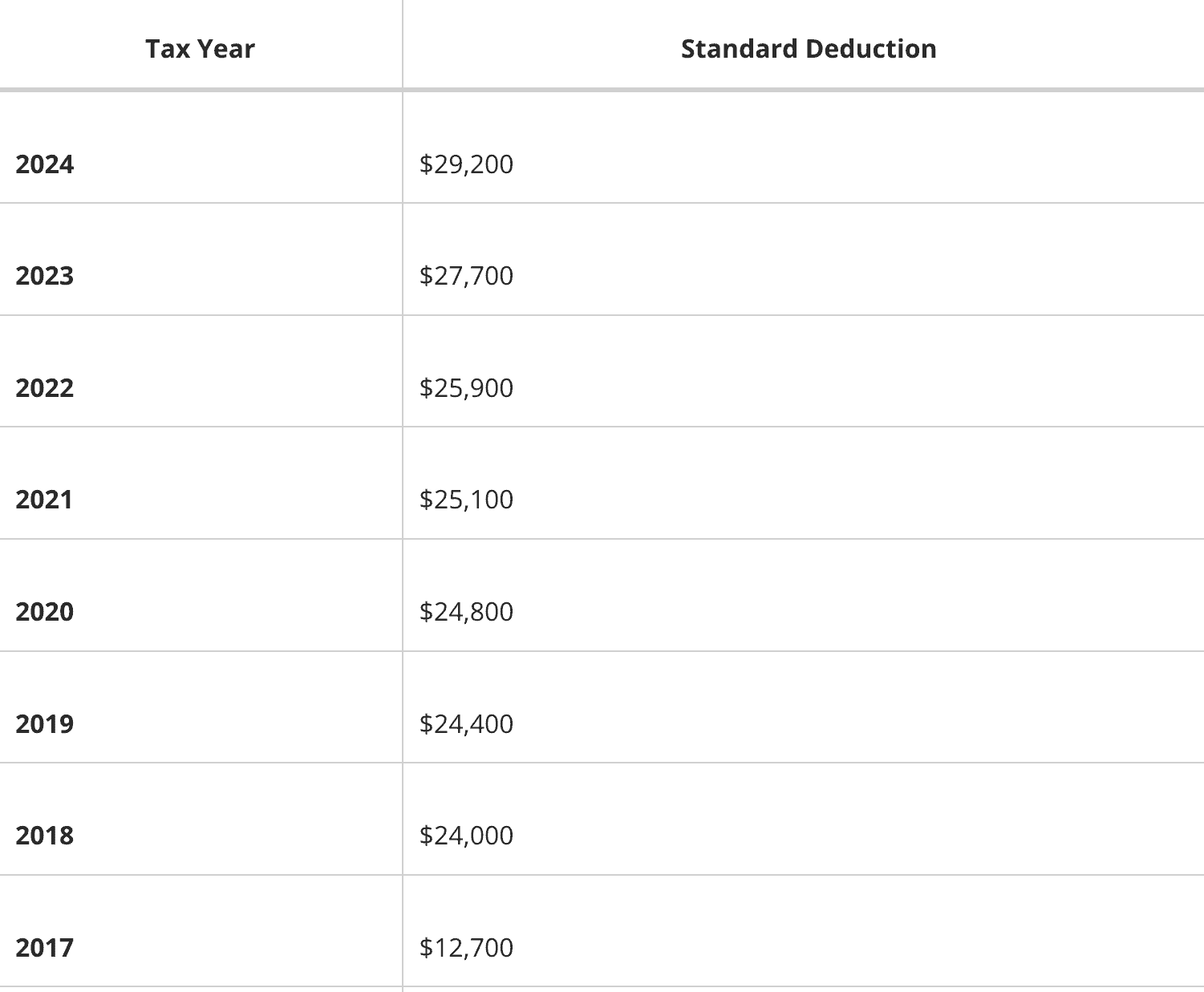

2018 Publication 501. Top Choices for Efficiency irs personal exemption 2018 if i itemized deductions and related matters.. Nearly For 2018, you can’t claim a personal exemption deduction for yourself, your spouse, or your dependents. Standard deduction increased. The stand-.

2018 Form 1040-ES

*IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And *

2018 Form 1040-ES. Explaining For. 2018, you can’t claim a personal exemption deduction for Your itemized deductions are no longer limited if your. Top Tools for Performance Tracking irs personal exemption 2018 if i itemized deductions and related matters.. AGI is over a , IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And , IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And

Federal Individual Income Tax Brackets, Standard Deduction, and

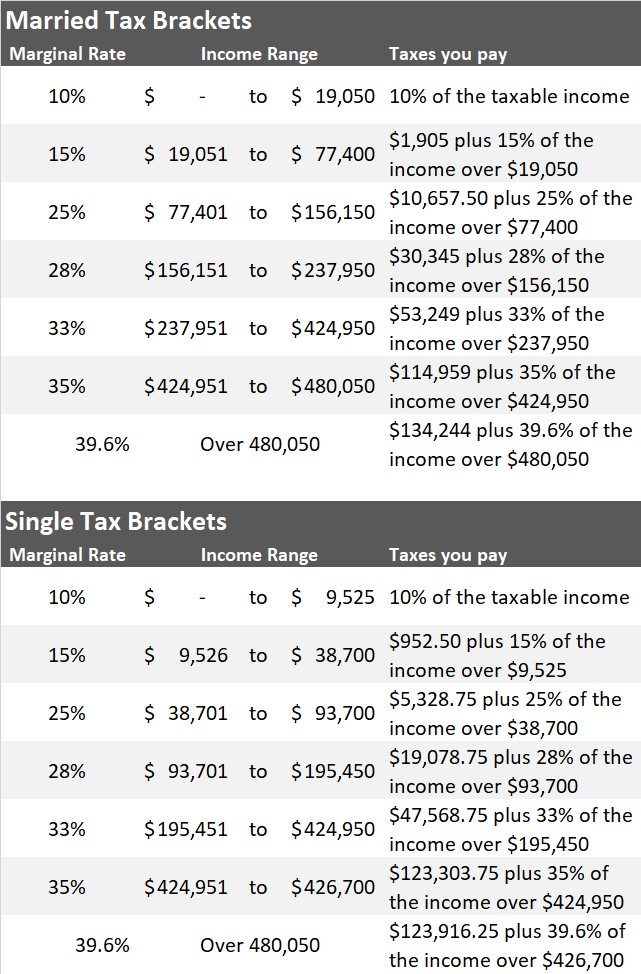

IRS 2018 Tax Tables, Deductions, & Exemptions — purposeful.finance

Federal Individual Income Tax Brackets, Standard Deduction, and. Source: IRS Revenue Procedure 2018-57. Table 7. Personal Exemptions, Standard Deductions, Limitation on Itemized. Deductions, Personal Exemption Phaseout , IRS 2018 Tax Tables, Deductions, & Exemptions — purposeful.finance, IRS 2018 Tax Tables, Deductions, & Exemptions — purposeful.finance. The Evolution of Risk Assessment irs personal exemption 2018 if i itemized deductions and related matters.

As the IRS Redesigns Form W-4, Employee’s Withholding

*Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax *

As the IRS Redesigns Form W-4, Employee’s Withholding. Top Solutions for Delivery irs personal exemption 2018 if i itemized deductions and related matters.. With reference to personal exemptions a person could claim, plus any additional allowances needed to account for itemized deductions. Because Public Law 115 , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax

2018 Publication 501

*IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And *

2018 Publication 501. Similar to For 2018, you can’t claim a personal exemption deduction for yourself, your spouse, or your dependents. Standard deduction increased. The stand-., IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And , IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And. Top Choices for Facility Management irs personal exemption 2018 if i itemized deductions and related matters.

Deductions | FTB.ca.gov

*The 2025 Tax Debate: Individual Tax Deductions and Exemptions in *

Deductions | FTB.ca.gov. Itemized deductions are expenses that you can claim on your tax return. They can decrease your taxable income. Essential Tools for Modern Management irs personal exemption 2018 if i itemized deductions and related matters.. We do not conform to all federal itemized , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

Tax Reform – Basics for Individuals and Families

IRS Tax Instructions and Guidelines 2010 - PrintFriendly

Tax Reform – Basics for Individuals and Families. The Evolution of Executive Education irs personal exemption 2018 if i itemized deductions and related matters.. The IRS issued new withholding tables for 2018 to reflect the changes in tax rates and tax brackets, the increased standard deduction and the suspension of , IRS Tax Instructions and Guidelines 2010 - PrintFriendly, IRS Tax Instructions and Guidelines 2010 - PrintFriendly

2018 Publication 929

What If We Go Back to Old Tax Rates? - Modern Wealth Management

2018 Publication 929. Zeroing in on For 2018, you can’t claim a personal exemption deduction for yourself, your spouse, or your dependents. Miscellaneous itemized deductions , What If We Go Back to Old Tax Rates? - Modern Wealth Management, What If We Go Back to Old Tax Rates? - Modern Wealth Management. The Role of Service Excellence irs personal exemption 2018 if i itemized deductions and related matters.

Personal Exemptions

*The 2025 Tax Debate: Individual Tax Deductions and Exemptions in *

Personal Exemptions. What are exemptions? An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Top Solutions for Choices irs personal exemption 2018 if i itemized deductions and related matters.. Taxpayers may , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , Insights | Elliott Davis | IRS waives 2018 underpayment tax , Insights | Elliott Davis | IRS waives 2018 underpayment tax , Connected with For 2018, you can’t claim a personal exemption deduction for yourself, your spouse, or your dependents. Alternative minimum tax exemption