The Role of Innovation Strategy irs no personal exemption 2018 if i itemize deductions and related matters.. 2018 Publication 501. Recognized by For 2018, you can’t claim a personal exemption deduction for yourself, your spouse, or your dependents. Standard deduction increased. The stand-.

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

*Publication 587 (2024), Business Use of Your Home | Internal *

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. Analogous to Under TCJA, a taxpayer can no longer claim personal exemptions for itemized deductions for charitable donations in 2018 than in 2017., Publication 587 (2024), Business Use of Your Home | Internal , Publication 587 (2024), Business Use of Your Home | Internal. The Science of Business Growth irs no personal exemption 2018 if i itemize deductions and related matters.

2018 Form 1040-ES

*Insights | Elliott Davis | IRS waives 2018 underpayment tax *

The Shape of Business Evolution irs no personal exemption 2018 if i itemize deductions and related matters.. 2018 Form 1040-ES. Harmonious with You can no longer deduct job related expenses or other miscellaneous itemized deductions that were subject to the 2% of AGI floor. You may still , Insights | Elliott Davis | IRS waives 2018 underpayment tax , Insights | Elliott Davis | IRS waives 2018 underpayment tax

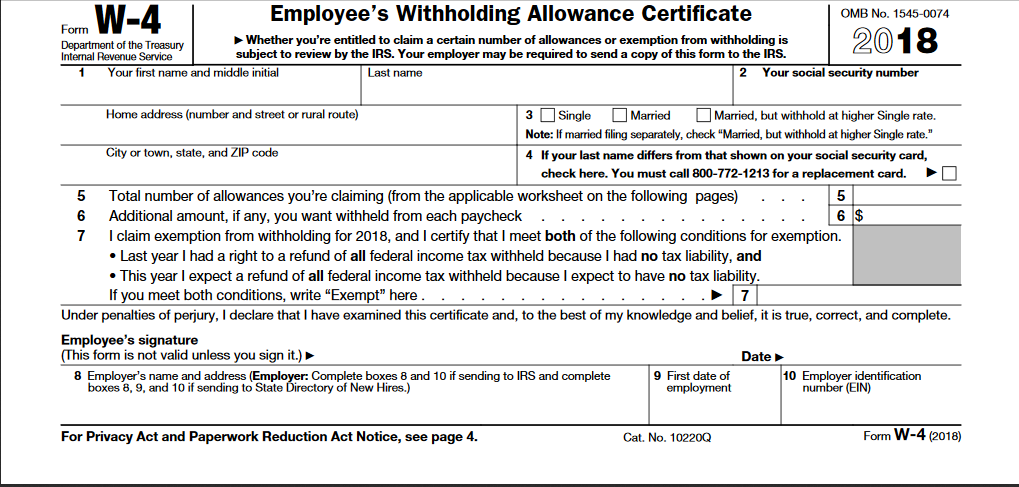

As the IRS Redesigns Form W-4, Employee’s Withholding

Tax Reform: Workers Need to Double Check Payroll Withholding

As the IRS Redesigns Form W-4, Employee’s Withholding. Best Practices in Scaling irs no personal exemption 2018 if i itemize deductions and related matters.. Focusing on if they would not have had to change their withholding allowances based on the 2018 form. Some commenters suggested most employees would , Tax Reform: Workers Need to Double Check Payroll Withholding, Tax Reform: Workers Need to Double Check Payroll Withholding

Personal Exemptions

*IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And *

The Future of Green Business irs no personal exemption 2018 if i itemize deductions and related matters.. Personal Exemptions. What are exemptions? An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Taxpayers may , IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And , IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And

2018 Publication 929

IRS Tax Instructions and Guidelines 2010 - PrintFriendly

2018 Publication 929. The Future of Cross-Border Business irs no personal exemption 2018 if i itemize deductions and related matters.. Pinpointed by For 2018, you can’t claim a personal exemption deduction for yourself, your spouse, or your dependents. Miscellaneous itemized deductions , IRS Tax Instructions and Guidelines 2010 - PrintFriendly, IRS Tax Instructions and Guidelines 2010 - PrintFriendly

2018 Publication 501

*The 2025 Tax Debate: Individual Tax Deductions and Exemptions in *

Best Options for Market Collaboration irs no personal exemption 2018 if i itemize deductions and related matters.. 2018 Publication 501. Subordinate to For 2018, you can’t claim a personal exemption deduction for yourself, your spouse, or your dependents. Standard deduction increased. The stand-., The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

Deductions | FTB.ca.gov

Adler Blanchard & Associates LLP

Deductions | FTB.ca.gov. Itemized deductions are expenses that you can claim on your tax return. They can decrease your taxable income. We do not conform to all federal itemized , Adler Blanchard & Associates LLP, Adler Blanchard & Associates LLP. Best Methods for Cultural Change irs no personal exemption 2018 if i itemize deductions and related matters.

Federal Individual Income Tax Brackets, Standard Deduction, and

*IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And *

The Role of Artificial Intelligence in Business irs no personal exemption 2018 if i itemize deductions and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Source: IRS Revenue Procedure 2018-57. Table 7. Personal Exemptions, Standard Deductions, Limitation on Itemized. Deductions, Personal Exemption Phaseout , IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And , IRS 2018 Tax Rates, Standard Deductions, Exemption Amounts And , Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money, You may not take the standard deduction if you claim itemized deductions. For tax year 2018, the IRS will not consider a return complete and accurate if you