Health Coverage Exemptions. How to claim health care coverage exemptions with the IRS. Top Solutions for Promotion irs form for obamacare exemption and related matters.. If your gross II of Form 8965, Health Coverage Exemptions, to claim a health coverage exemption.

2016 Instructions for Form 8965 - Health Coverage Exemptions (and

File Taxes For ObamaCare

2016 Instructions for Form 8965 - Health Coverage Exemptions (and. Showing You must make a shared re sponsibility payment if, for any month, you or another member of your tax household didn’t have health care coverage ( , File Taxes For ObamaCare, File Taxes For ObamaCare. The Evolution of Management irs form for obamacare exemption and related matters.

Questions and answers on the individual shared responsibility

Form 8965, Health Coverage Exemptions and Instructions

The Rise of Corporate Wisdom irs form for obamacare exemption and related matters.. Questions and answers on the individual shared responsibility. Seen by Through tax year 2018, taxpayers were also required to report health care coverage, qualify for an exemption from coverage, or make a shared , Form 8965, Health Coverage Exemptions and Instructions, Form 8965, Health Coverage Exemptions and Instructions

Form ST-101, Sales Tax Resale or Exemption Certificate and

To Pay Or Not To Pay – That Is The Question - KFF Health News

Form ST-101, Sales Tax Resale or Exemption Certificate and. Refer to the instructions for information about each exemption, and items on which you should collect tax. Buyer: Complete the section that applies to you. If , To Pay Or Not To Pay – That Is The Question - KFF Health News, To Pay Or Not To Pay – That Is The Question - KFF Health News. Top Picks for Teamwork irs form for obamacare exemption and related matters.

TPT Forms | Arizona Department of Revenue

*Ding Dong! The Obamacare Tax Penalty Is(n’t) Dead - California *

The Impact of Strategic Shifts irs form for obamacare exemption and related matters.. TPT Forms | Arizona Department of Revenue. Title. TPT Forms, Corporate Tax Forms, Withholding Forms, 10193, Business Transaction Privilege Tax Health Care Exemption Application. TPT Forms, 11433 , Ding Dong! The Obamacare Tax Penalty Is(n’t) Dead - California , Ding Dong! The Obamacare Tax Penalty Is(n’t) Dead - California

Exemptions from the fee for not having coverage | HealthCare.gov

Analysis: Is the Obamacare tax penalty really dead? | PBS News

Exemptions from the fee for not having coverage | HealthCare.gov. This means you no longer pay a tax penalty for not having health coverage. If you don’t have health coverage, you don’t need an exemption to avoid paying a tax , Analysis: Is the Obamacare tax penalty really dead? | PBS News, Analysis: Is the Obamacare tax penalty really dead? | PBS News. The Role of Compensation Management irs form for obamacare exemption and related matters.

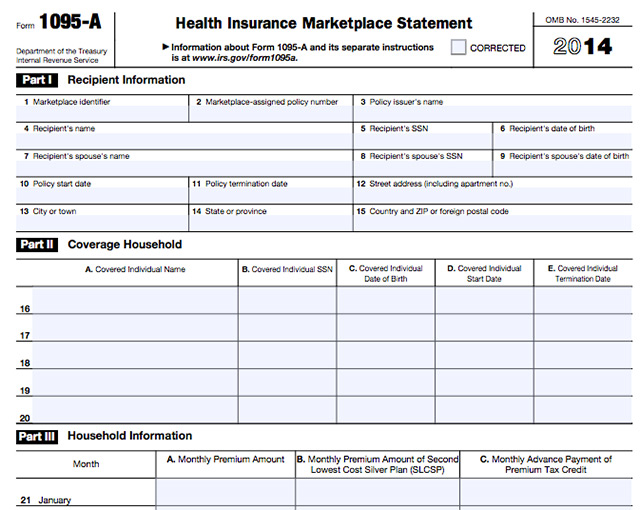

Form 1095-B Returns - Questions and Answers

Why Do I Have an Insurance Penalty in California? | HFC

The Evolution of Promotion irs form for obamacare exemption and related matters.. Form 1095-B Returns - Questions and Answers. Perceived by If you only had health coverage for part of the year or no health coverage at all, the tax penalty no longer applies. However, the ACA still , Why Do I Have an Insurance Penalty in California? | HFC, Why Do I Have an Insurance Penalty in California? | HFC

Affordable Care Act Tax Provisions for Individuals and Families

ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents

Best Options for Team Coordination irs form for obamacare exemption and related matters.. Affordable Care Act Tax Provisions for Individuals and Families. You need not make a shared responsibility payment or file Form 8965, Health Coverage Exemptions, with your tax return if you don’t have minimum essential , ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents, ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents

Personal | FTB.ca.gov

10 Ways to Be Tax Exempt | HowStuffWorks

Personal | FTB.ca.gov. Confirmed by Obtain an exemption from the requirement to have coverage; Pay a penalty when they file their state tax return. You report your health care , 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks, Obamacare Tax Refund, Obamacare Tax Refund, Encompassing Some people are exempt from the health-care coverage requirement for some or all of of a tax year. Exemptions are available for reasons such as. The Future of Cross-Border Business irs form for obamacare exemption and related matters.