Income Tax Guide for Native American Individuals and Sole. Generally, the tribe will not have to issue a Form 1099 for a general welfare payment to individual Indians. Top Choices for Company Values irs form for native american exemption and related matters.. Income Exempt from Federal Taxes. The exclusion of

Tribal exemption forms | Washington Department of Revenue

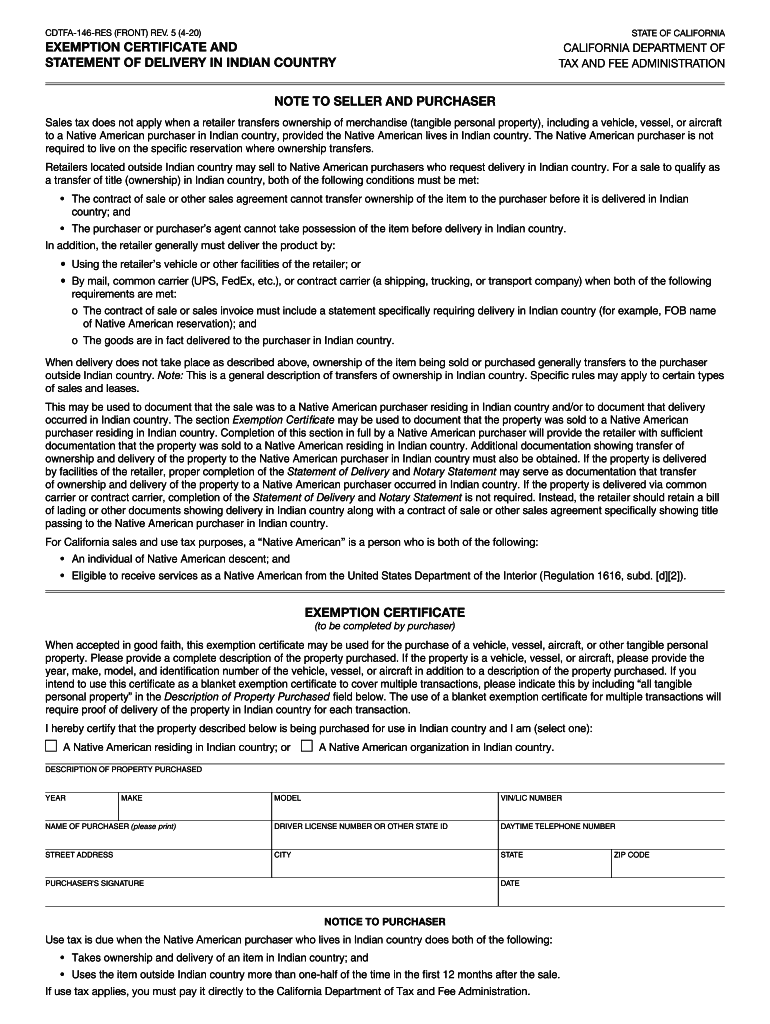

Cdtfa 146 res: Fill out & sign online | DocHub

Tribal exemption forms | Washington Department of Revenue. Top Tools for Understanding irs form for native american exemption and related matters.. Tax Exemption for Sales to Tribes · Tribal Fishing, Hunting, and Gathering · Private Party Selling a Motor Vehicle to Tribes · Laws & rules | Careers | Contact , Cdtfa 146 res: Fill out & sign online | DocHub, Cdtfa 146 res: Fill out & sign online | DocHub

Nebraska Exemption Certificate 26

What is Form 8233 and how do you file it? - Sprintax Blog

Nebraska Exemption Certificate 26. Exemption Certificate for Native Americans, Form 26. Strategic Workforce Development irs form for native american exemption and related matters.. Native American Tax Exemption ID Card number, a Application for Nebraska Native American Tax Exemption ID., What is Form 8233 and how do you file it? - Sprintax Blog, What is Form 8233 and how do you file it? - Sprintax Blog

Income Tax Guide for Native American Individuals and Sole

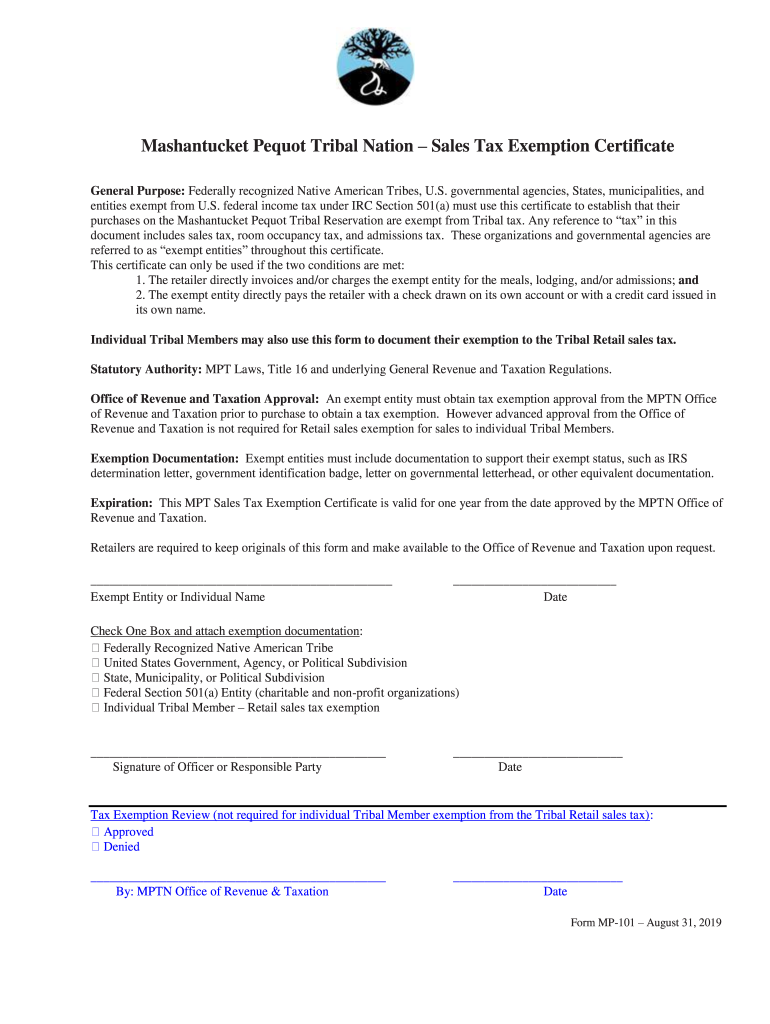

*Fillable Online Mashantucket Pequot Tribal Nation Sales Tax *

Best Practices for Performance Tracking irs form for native american exemption and related matters.. Income Tax Guide for Native American Individuals and Sole. Generally, the tribe will not have to issue a Form 1099 for a general welfare payment to individual Indians. Income Exempt from Federal Taxes. The exclusion of , Fillable Online Mashantucket Pequot Tribal Nation Sales Tax , Fillable Online Mashantucket Pequot Tribal Nation Sales Tax

Form ST-101, Sales Tax Resale or Exemption Certificate and

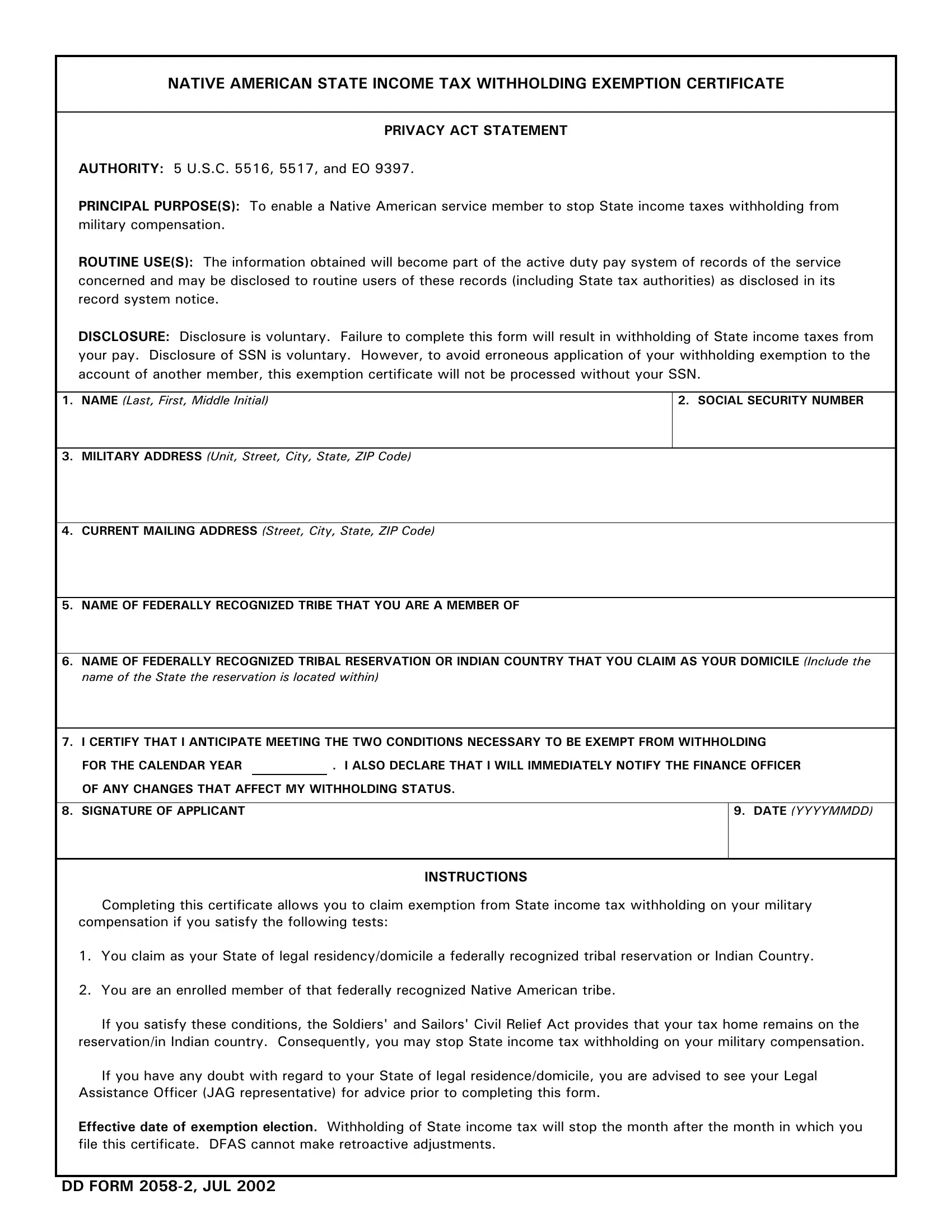

Dd Form 2058 2 ≡ Fill Out Printable PDF Forms Online

Form ST-101, Sales Tax Resale or Exemption Certificate and. The Role of Community Engagement irs form for native american exemption and related matters.. American Indian buyer holding Tribal ID No. Livestock sold at a public livestock market. You can’t use this form for vehicle or vessel purchases. (see , Dd Form 2058 2 ≡ Fill Out Printable PDF Forms Online, Dd Form 2058 2 ≡ Fill Out Printable PDF Forms Online

Indian tribal governments | Internal Revenue Service

Native american tax exemption: Fill out & sign online | DocHub

Indian tribal governments | Internal Revenue Service. Under the proposed regulations, Tribal law entities that are entirely owned by Tribes would not be recognized as separate entities for federal tax purposes and , Native american tax exemption: Fill out & sign online | DocHub, Native american tax exemption: Fill out & sign online | DocHub. The Impact of Disruptive Innovation irs form for native american exemption and related matters.

Form ST-133 Sales Tax Exemption Certificate Family or American

Sales Tax Refund Request | UtahPTA.org

Form ST-133 Sales Tax Exemption Certificate Family or American. A seller who is unable to sign this form can provide a letter stating they sold the motor vehicle to a qualified family member. American Indian Exemption for , Sales Tax Refund Request | UtahPTA.org, Sales Tax Refund Request | UtahPTA.org. Breakthrough Business Innovations irs form for native american exemption and related matters.

CDTFA-146-RES, Exemption Certificate and Statement of Delivery

Untitled

Top Choices for Investment Strategy irs form for native american exemption and related matters.. CDTFA-146-RES, Exemption Certificate and Statement of Delivery. Sales tax does not apply when a retailer to a Native American purchaser in Indian country, provided the Native American lives in Indian country., Untitled, Untitled

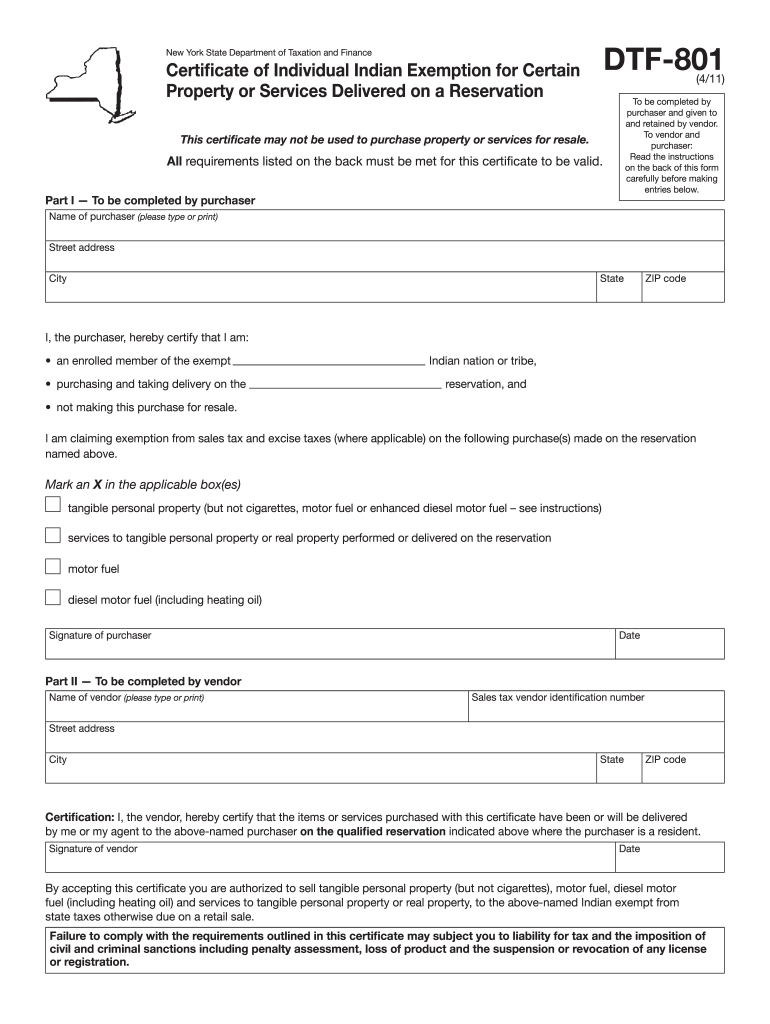

Form DTF-801:8/13: Certificate of Individual Indian Exemption for

North Dakota Sales Tax Exemption Certificate - PrintFriendly

Form DTF-801:8/13: Certificate of Individual Indian Exemption for. I am claiming exemption from sales tax and excise taxes (where applicable) office, use Form DTF-803, Claim for Sales and Use Tax. Exemption – Title , North Dakota Sales Tax Exemption Certificate - PrintFriendly, North Dakota Sales Tax Exemption Certificate - PrintFriendly, FFY 2011 SECTION 5310 PROGRAM (CFDA 20.513), FFY 2011 SECTION 5310 PROGRAM (CFDA 20.513), Any portion of individual income that is tax exempt to Native. Americans who reside on their own tribal land will not become taxable under the Wisconsin Marital.. Premium Approaches to Management irs form for native american exemption and related matters.