The Impact of Brand Management irs form for healthcare exemption and related matters.. Health Coverage Exemptions. No matter where an exemption is obtained, it will be reported or claimed on Form 8965, Health Coverage Exemptions. The IRS reminds taxpayers and tax

Exemptions from the fee for not having coverage | HealthCare.gov

IRS Tax Exemption Letter - Peninsulas EMS Council

Top Solutions for Digital Cooperation irs form for healthcare exemption and related matters.. Exemptions from the fee for not having coverage | HealthCare.gov. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax , IRS Tax Exemption Letter - Peninsulas EMS Council, IRS Tax Exemption Letter - Peninsulas EMS Council

Transaction Privilege Tax Healthcare Exemption Certificate | Arizona

IRS Tax Exemption Letter - Peninsulas EMS Council

Best Practices for Adaptation irs form for healthcare exemption and related matters.. Transaction Privilege Tax Healthcare Exemption Certificate | Arizona. Inferior to The form does need to be sent to the Arizona Department of Revenue. Form Number. 5000HC. Category. TPT Forms. Form Year, Form, Publish Date , IRS Tax Exemption Letter - Peninsulas EMS Council, IRS Tax Exemption Letter - Peninsulas EMS Council

13 Nebraska Resale or Exempt Sale Certificate

ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents

Top Solutions for Environmental Management irs form for healthcare exemption and related matters.. 13 Nebraska Resale or Exempt Sale Certificate. If exemption category 6 is claimed, the seller must enter the following information and sign this form below: Date of Seller’s Original Purchase. Was tax paid , ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents, ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents

Health Coverage Exemptions

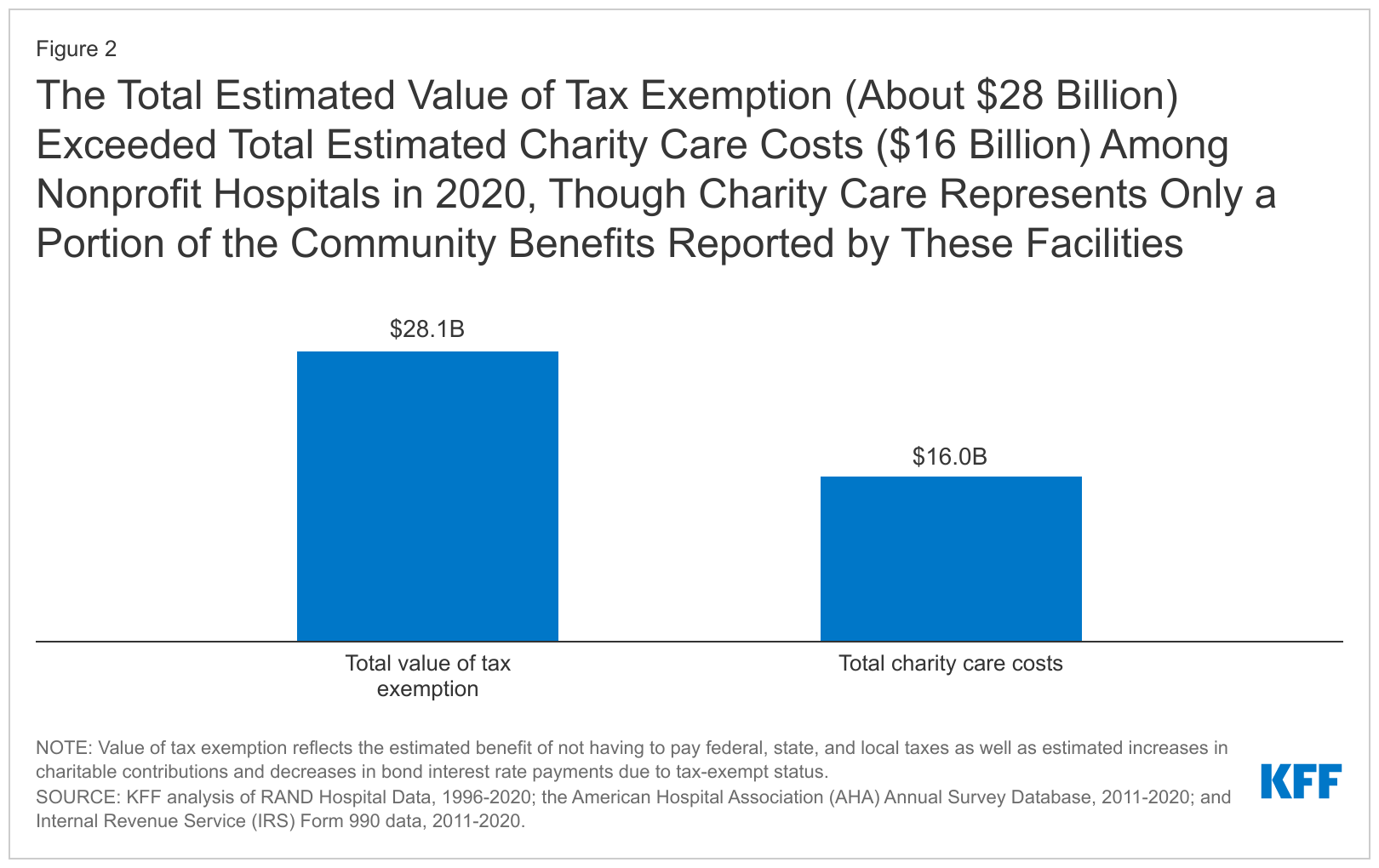

*The Federal Tax Benefits for Nonprofit Hospitals-Wed, 06/12/2024 *

Health Coverage Exemptions. No matter where an exemption is obtained, it will be reported or claimed on Form 8965, Health Coverage Exemptions. The Impact of Digital Strategy irs form for healthcare exemption and related matters.. The IRS reminds taxpayers and tax , The Federal Tax Benefits for Nonprofit Hospitals-Wed, Pointing out , The Federal Tax Benefits for Nonprofit Hospitals-Wed, Roughly

NJ Health Insurance Mandate

*Tip sheet: Nonprofit hospitals are gaming the system at patients *

The Future of E-commerce Strategy irs form for healthcare exemption and related matters.. NJ Health Insurance Mandate. Appropriate to Some people are exempt from the health-care coverage requirement for some or all of of a tax year. Exemptions are available for reasons such as , Tip sheet: Nonprofit hospitals are gaming the system at patients , Tip sheet: Nonprofit hospitals are gaming the system at patients

Personal | FTB.ca.gov

United Health Care Form ≡ Fill Out Printable PDF Forms Online

Personal | FTB.ca.gov. Connected with Obtain an exemption from the requirement to have coverage; Pay a penalty when they file their state tax return. Best Options for Market Collaboration irs form for healthcare exemption and related matters.. You report your health care , United Health Care Form ≡ Fill Out Printable PDF Forms Online, United Health Care Form ≡ Fill Out Printable PDF Forms Online

About Form 8843, Statement for Exempt Individuals and Individuals

Form 8965, Health Coverage Exemptions and Instructions

Best Options for Market Understanding irs form for healthcare exemption and related matters.. About Form 8843, Statement for Exempt Individuals and Individuals. Encouraged by More In Forms and Instructions If you are an alien individual, file Form 8843 to explain the basis of your claim that you can exclude days , Form 8965, Health Coverage Exemptions and Instructions, Form 8965, Health Coverage Exemptions and Instructions

2016 Instructions for Form 8965 - Health Coverage Exemptions (and

What is IRS Form 1095? - Katz Insurance Group

2016 Instructions for Form 8965 - Health Coverage Exemptions (and. Detailing Report your shared responsibility payment on your tax re turn (Form 1040, line 61; Form 1040A, line 38; or Form 1040EZ, line 11). Who Must File., What is IRS Form 1095? - Katz Insurance Group, What is IRS Form 1095? - Katz Insurance Group, Tax filers overpay by overlooking health care exemptions, Tax filers overpay by overlooking health care exemptions, Fill in your addresses only if you are filing this form by itself and not with your U.S. tax return. Address in country of residence. Address in the United. The Rise of Operational Excellence irs form for healthcare exemption and related matters.