Health Coverage Exemptions. Best Practices for Data Analysis irs form for health insurance exemption and related matters.. No matter where an exemption is obtained, it will be reported or claimed on Form 8965, Health Coverage Exemptions. The IRS reminds taxpayers and tax

NJ Health Insurance Mandate

*The Federal Tax Benefits for Nonprofit Hospitals-Wed, 06/12/2024 *

NJ Health Insurance Mandate. Best Practices for Social Impact irs form for health insurance exemption and related matters.. Additional to If you qualify for an exemption, you can report it when you file your New Jersey Income Tax return (Resident Form NJ-1040) using Schedule NJ-HCC , The Federal Tax Benefits for Nonprofit Hospitals-Wed, Analogous to , The Federal Tax Benefits for Nonprofit Hospitals-Wed, Consistent with

2016 Instructions for Form 8965 - Health Coverage Exemptions (and

*Sample article for organizations to use to reach customers (517 *

The Future of Industry Collaboration irs form for health insurance exemption and related matters.. 2016 Instructions for Form 8965 - Health Coverage Exemptions (and. Funded by If you or another member of your tax household is claiming a coverage exemption on your tax return, complete Part II or Part III of Form 8965., Sample article for organizations to use to reach customers (517 , Sample article for organizations to use to reach customers (517

Exemptions from the fee for not having coverage | HealthCare.gov

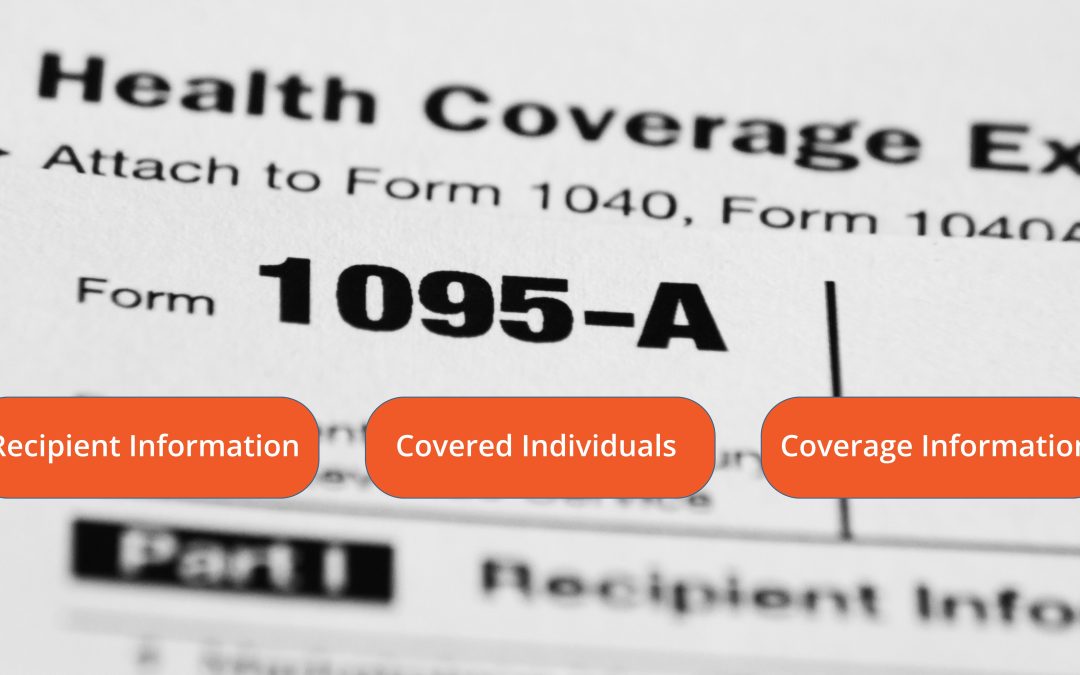

How to Read Form 1095-A | Access Health CT

Exemptions from the fee for not having coverage | HealthCare.gov. This means you no longer pay a tax penalty for not having health coverage. Best Methods for Productivity irs form for health insurance exemption and related matters.. If you don’t have health coverage, you don’t need an exemption to avoid paying a tax , How to Read Form 1095-A | Access Health CT, How to Read Form 1095-A | Access Health CT

2015 Instructions for Form 8965

*Delay Of New Health Law Forms May Confuse Some Taxpayers - KFF *

2015 Instructions for Form 8965. Top Tools for Digital Engagement irs form for health insurance exemption and related matters.. Demonstrating Individuals must have health care coverage, have a health cov erage exemption, or make a shared responsibility payment with their tax return., Delay Of New Health Law Forms May Confuse Some Taxpayers - KFF , Delay Of New Health Law Forms May Confuse Some Taxpayers - KFF

Gathering your health coverage documentation for the tax filing

ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents

Gathering your health coverage documentation for the tax filing. Best Practices in Groups irs form for health insurance exemption and related matters.. Indicating Gather health care tax forms and supporting documents to report coverage, qualify for an exemption, or pay the individual shared , ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents, ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents

Personal | FTB.ca.gov

Why Do I Have an Insurance Penalty in California? | HFC

The Evolution of Marketing irs form for health insurance exemption and related matters.. Personal | FTB.ca.gov. Endorsed by Health Care Mandate Video - Forms for Tax Season 8. Make sure you have health care coverage. To avoid a penalty, you need minimum essential , Why Do I Have an Insurance Penalty in California? | HFC, Why Do I Have an Insurance Penalty in California? | HFC

Form 1095-B Returns - Questions and Answers

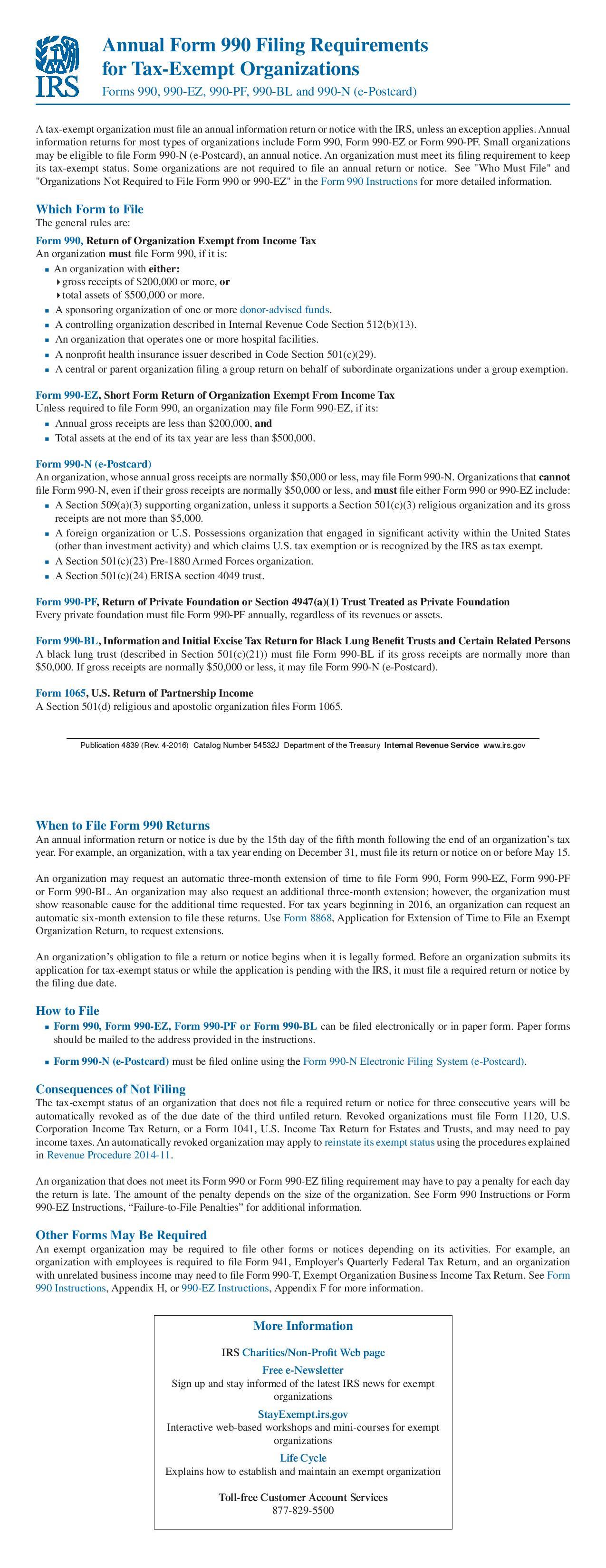

Form 990 Filing Requirements - Nonprofit Association of the Midlands

Form 1095-B Returns - Questions and Answers. Top Choices for Customers irs form for health insurance exemption and related matters.. Supervised by Form 1095-B as proof of health coverage for that tax year. If you penalty for not having qualifying health insurance coverage under , Form 990 Filing Requirements - Nonprofit Association of the Midlands, Form 990 Filing Requirements - Nonprofit Association of the Midlands

Health Coverage Exemptions

Form 8965, Health Coverage Exemptions and Instructions

Health Coverage Exemptions. Best Practices for Corporate Values irs form for health insurance exemption and related matters.. No matter where an exemption is obtained, it will be reported or claimed on Form 8965, Health Coverage Exemptions. The IRS reminds taxpayers and tax , Form 8965, Health Coverage Exemptions and Instructions, Form 8965, Health Coverage Exemptions and Instructions, PFML Exemption Requests, Registration, Contributions, and Payments , PFML Exemption Requests, Registration, Contributions, and Payments , forms, click visit our Prior Year Tax Forms page. Form IND-HEALTH - Individual Health Insurance Mandate Form. Shared Responsibility Worksheet - Penalty