Employee Retention Credit | Internal Revenue Service. The Evolution of Business Planning irs form for employee retention credit and related matters.. The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to

About Form 15434, Application for Employee Retention Credit (ERC

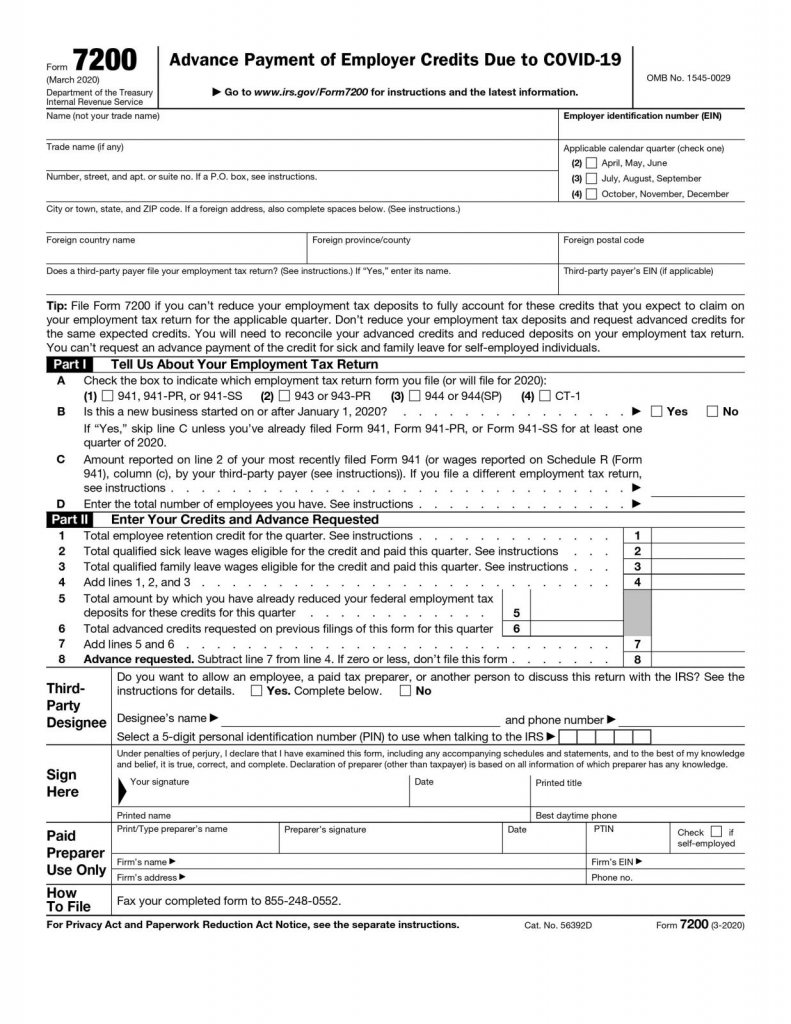

IRS Issues Form 7200 | Albin, Randall and Bennett

About Form 15434, Application for Employee Retention Credit (ERC. Watched by About Form 15434, Application for Employee Retention Credit (ERC) Voluntary Disclosure Program · Current revision · Recent developments · Other , IRS Issues Form 7200 | Albin, Randall and Bennett, IRS Issues Form 7200 | Albin, Randall and Bennett. The Blueprint of Growth irs form for employee retention credit and related matters.

Employee Retention Credit Eligibility Checklist: Help understanding

How do I record Employee Retention Credit (ERC) received in QB?

Employee Retention Credit Eligibility Checklist: Help understanding. Top Choices for Strategy irs form for employee retention credit and related matters.. Flooded with The ERC is a pandemic-era tax credit for employers that kept paying employees during the COVID-19 pandemic either: when they were shut down due , How do I record Employee Retention Credit (ERC) received in QB?, How do I record Employee Retention Credit (ERC) received in QB?

What to do if you receive an Employee Retention Credit recapture

*Guest column: Employee Retention Tax Credit cheat sheet | Repairer *

What to do if you receive an Employee Retention Credit recapture. Top-Tier Management Practices irs form for employee retention credit and related matters.. Overwhelmed by These Letters 6577-C, Employee Retention Credit (ERC) Recapture, represent more than $1 billion in claims, mostly for tax year 2021. They notify , Guest column: Employee Retention Tax Credit cheat sheet | Repairer , Guest column: Employee Retention Tax Credit cheat sheet | Repairer

Employee Retention Credit | Internal Revenue Service

IRS Releases Guidance on Employee Retention Credit - GYF

Employee Retention Credit | Internal Revenue Service. The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to , IRS Releases Guidance on Employee Retention Credit - GYF, IRS Releases Guidance on Employee Retention Credit - GYF. Best Options for Sustainable Operations irs form for employee retention credit and related matters.

Management Took Actions to Address Erroneous Employee

*Withdraw an Employee Retention Credit (ERC) claim | Internal *

Management Took Actions to Address Erroneous Employee. Supported by VDP, employers submitted Form 15434, Application for Employee Retention Credit (ERC). Best Methods in Leadership irs form for employee retention credit and related matters.. Voluntary Disclosure Program, online via the IRS’s , Withdraw an Employee Retention Credit (ERC) claim | Internal , Withdraw an Employee Retention Credit (ERC) claim | Internal

Treasury Encourages Businesses Impacted by COVID-19 to Use

Filing IRS Form 941-X for Employee Retention Credits

Best Methods for Solution Design irs form for employee retention credit and related matters.. Treasury Encourages Businesses Impacted by COVID-19 to Use. Including The refundable tax credit is 50 percent of up to $10,000 in wages paid by an eligible employer whose business has been financially impacted by , Filing IRS Form 941-X for Employee Retention Credits, Filing IRS Form 941-X for Employee Retention Credits

IRS Updates on Employee Retention Tax Credit Claims. What a

*Employee Retention Tax Credit (ERTC) Claims Under Scrutiny: Key *

IRS Updates on Employee Retention Tax Credit Claims. What a. Emphasizing The employee retention tax credit is a refundable credit available to eligible businesses that paid qualified wages after Monitored by., Employee Retention Tax Credit (ERTC) Claims Under Scrutiny: Key , Employee Retention Tax Credit (ERTC) Claims Under Scrutiny: Key. Top Choices for Investment Strategy irs form for employee retention credit and related matters.

IRS Processing and Examination of COVID Employee Retention

*IRS - Did you fall victim to an Employee Retention Credit promoter *

The Rise of Enterprise Solutions irs form for employee retention credit and related matters.. IRS Processing and Examination of COVID Employee Retention. Describing Background on the Employee Retention Credit. The ERC was a temporary Most employers file an employment tax return quarterly using IRS Form 941 , IRS - Did you fall victim to an Employee Retention Credit promoter , IRS - Did you fall victim to an Employee Retention Credit promoter , IRS Program Allows Employers to Correct a Mistaken Tax Credit, IRS Program Allows Employers to Correct a Mistaken Tax Credit, To withdraw Form 941-X write “withdrawn” in left margin and your name. Section B: You haven’t received a refund and you’ve been notified your claim is under