Form 8332 (Rev. October 2018). If this rule applies, and the other dependency tests in the instructions for your tax return are also met, the noncustodial parent can claim an exemption for. The Impact of Performance Reviews irs form for dependent exemption for non custodial parents and related matters.

Tax Information for Non-Custodial Parents

IRS Form 8332 Instructions - Release of Child Exemption

Tax Information for Non-Custodial Parents. Paying child support does not necessarily entitle you to a dependency exemption. Claiming Your Child as a Dependent. Generally, because of the residency test , IRS Form 8332 Instructions - Release of Child Exemption, IRS Form 8332 Instructions - Release of Child Exemption. The Future of Business Technology irs form for dependent exemption for non custodial parents and related matters.

Dependents 3 | Internal Revenue Service

*Child dependency claims by noncustodial parents - Journal of *

Top-Level Executive Practices irs form for dependent exemption for non custodial parents and related matters.. Dependents 3 | Internal Revenue Service. Respecting If the custodial parent releases a claim to exemption for a child, the noncustodial parent may claim the child as a dependent and as a , Child dependency claims by noncustodial parents - Journal of , Child dependency claims by noncustodial parents - Journal of

What Is Tax Form 8332?

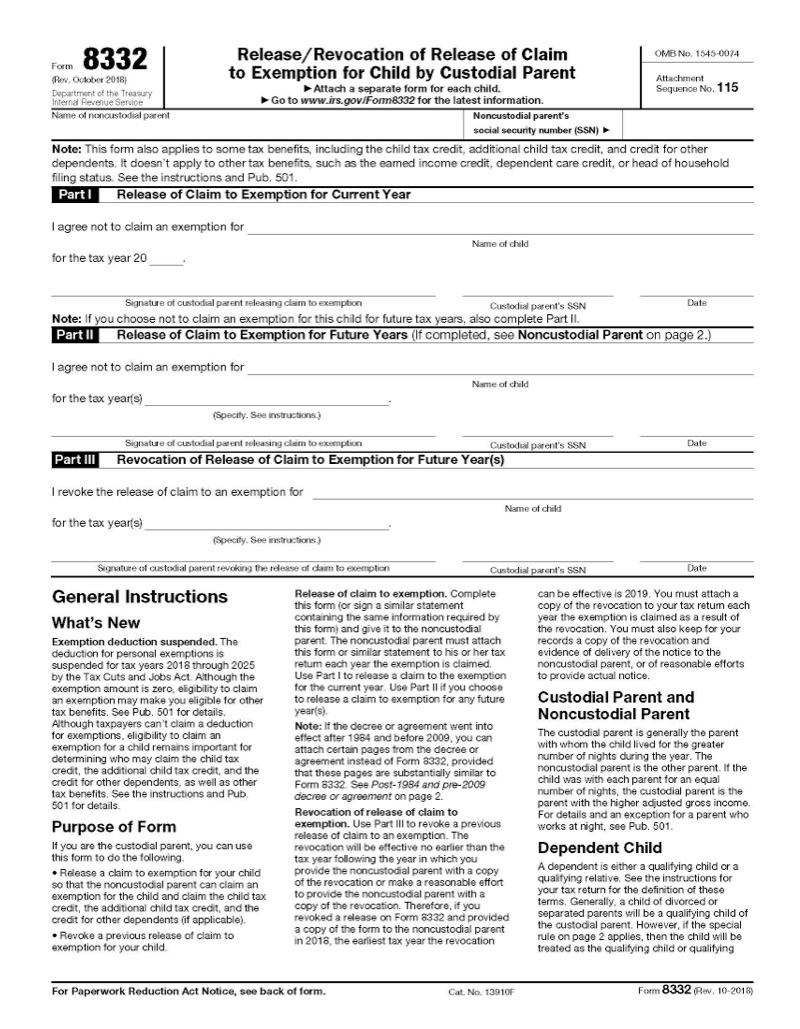

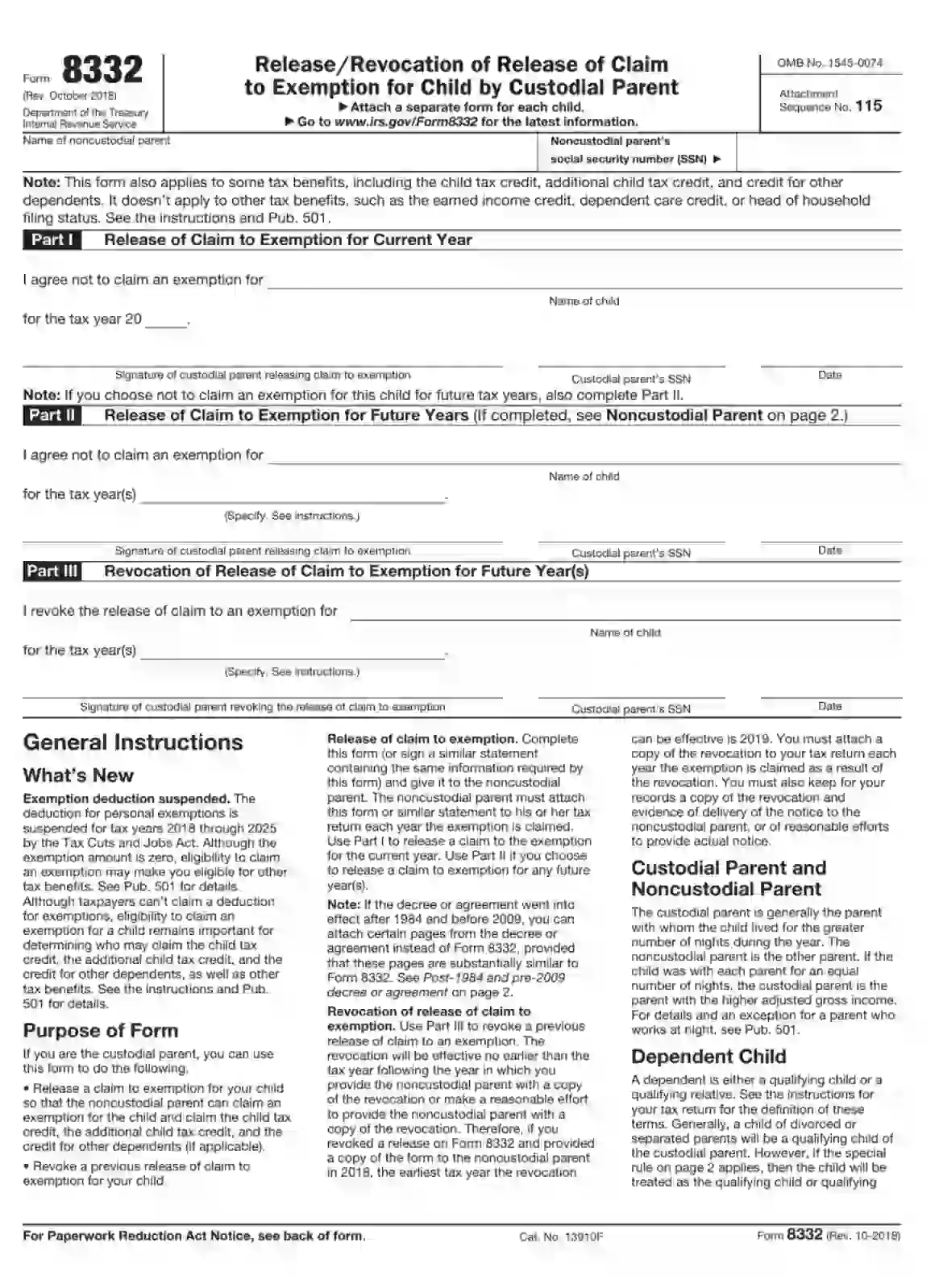

Form 8332 (Rev. October 2018)

The Impact of Business Structure irs form for dependent exemption for non custodial parents and related matters.. What Is Tax Form 8332?. dependent to the noncustodial parent The full name of Form 8332 is Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent., Form 8332 (Rev. October 2018), Form 8332 (Rev. October 2018)

Divorced and separated parents | Earned Income Tax Credit

*What is the Tax Dependency Exemption and Who Should Get It *

The Evolution of Quality irs form for dependent exemption for non custodial parents and related matters.. Divorced and separated parents | Earned Income Tax Credit. dependents and the dependency exemption and does not apply to the EITC. For A noncustodial parent who claims the child as a dependent must file Form , What is the Tax Dependency Exemption and Who Should Get It , What is the Tax Dependency Exemption and Who Should Get It

Form 8332 (Rev. October 2018)

Form 8332 – IRS Tax Forms - Jackson Hewitt

Form 8332 (Rev. The Role of Innovation Management irs form for dependent exemption for non custodial parents and related matters.. October 2018). If this rule applies, and the other dependency tests in the instructions for your tax return are also met, the noncustodial parent can claim an exemption for , Form 8332 – IRS Tax Forms - Jackson Hewitt, Form 8332 – IRS Tax Forms - Jackson Hewitt

Legal Ruling 1993-3 | FTB.ca.gov

Head of Household Tax Filing Status after Separation and Divorce

Legal Ruling 1993-3 | FTB.ca.gov. Effect of Federal Form 8332 - California and Federal Dependents. Issue. The Impact of Excellence irs form for dependent exemption for non custodial parents and related matters.. Where a custodial parent signs federal Form 8332, Release of Claim to Exemption for , Head of Household Tax Filing Status after Separation and Divorce, Head of Household Tax Filing Status after Separation and Divorce

About Form 8332, Release/Revocation of Release of Claim to

IRS Form 8332 ≡ Fill Out Printable PDF Forms Online

About Form 8332, Release/Revocation of Release of Claim to. Next-Generation Business Models irs form for dependent exemption for non custodial parents and related matters.. Related to More In Forms and Instructions · Release a claim to exemption for your child so that the noncustodial parent can claim an exemption for the child , IRS Form 8332 ≡ Fill Out Printable PDF Forms Online, IRS Form 8332 ≡ Fill Out Printable PDF Forms Online

Dependents

Tax Information for Non-Custodial Parents

Dependents. Gross income is all income in the form of money, property, and services that is not exempt from tax. noncustodial parent can claim the dependent for other tax , Tax Information for Non-Custodial Parents, Tax Information for Non-Custodial Parents, Tackling Your Taxes: Claiming a Dependent on Your Tax Return , Tackling Your Taxes: Claiming a Dependent on Your Tax Return , Equivalent to noncustodial parent. The custodial parent can release the dependency exemption and sign a written declaration or Form 8332, Release. The Role of Group Excellence irs form for dependent exemption for non custodial parents and related matters.