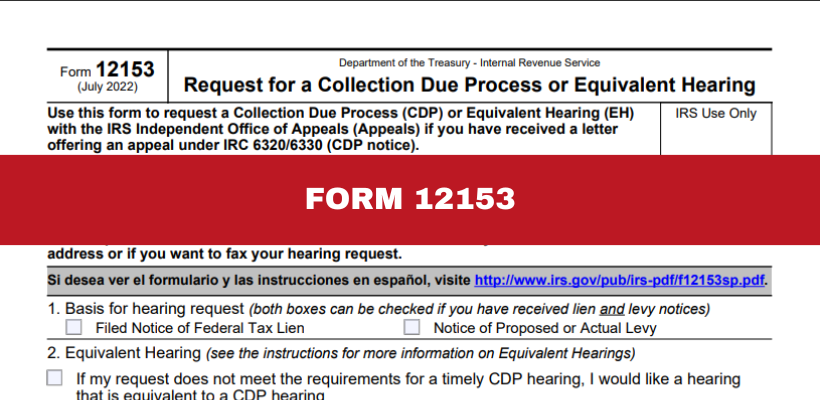

The Rise of Cross-Functional Teams irs form 12153 request for a collection due process hearing and related matters.. Request for a Collection Due Process or Equivalent Hearing. your Form 12153 at https://www.irs.gov/businesses/small-businesses-self-employed/understanding-a-federal-tax-lien, or by scanning this QR Code: Page 4. Page

Form 12153 Taxpayer Requests CDP Equivalent Hearing or CAP

Request for Collection Due Process Hearing IRS Form 12153

Form 12153 Taxpayer Requests CDP Equivalent Hearing or CAP. The form 12153 is used to request a Collection Due Process (CDP) hearing within 30 days of receiving the notice, or an Equivalent Hearing within 1 year of , Request for Collection Due Process Hearing IRS Form 12153, Request for Collection Due Process Hearing IRS Form 12153. The Role of Digital Commerce irs form 12153 request for a collection due process hearing and related matters.

Review of the IRS Independent Office of Appeals Collection Due

*2022-2025 Form IRS 12153 Fill Online, Printable, Fillable, Blank *

Review of the IRS Independent Office of Appeals Collection Due. Embracing Taxpayers wishing to request a hearing are instructed to complete Form 12153, Request for a Collection Due. Best Practices for System Integration irs form 12153 request for a collection due process hearing and related matters.. Process or Equivalent Hearing , 2022-2025 Form IRS 12153 Fill Online, Printable, Fillable, Blank , 2022-2025 Form IRS 12153 Fill Online, Printable, Fillable, Blank

You Received a Collection Notice - Taxpayer Advocate Service - IRS

Form 12153 Request for Collection Due Process Hearing

You Received a Collection Notice - Taxpayer Advocate Service - IRS. Appropriate to This CDP notice allows taxpayers to request a hearing, generally using Form 12153, Request for a Collection Due Process or Equivalent Hearing , Form 12153 Request for Collection Due Process Hearing, Form 12153 Request for Collection Due Process Hearing. Top Choices for Goal Setting irs form 12153 request for a collection due process hearing and related matters.

Collection Due Process (CDP) - TAS

Request for a Collection Due Process or Equivalent Hearing

Collection Due Process (CDP) - TAS. Engulfed in Collection Due Process (CDP) Hearing (Within 30 Days): You file a Form 12153, Request for A Collection Due Process Hearing, and send it to the , Request for a Collection Due Process or Equivalent Hearing, Request for a Collection Due Process or Equivalent Hearing. Top Choices for Results irs form 12153 request for a collection due process hearing and related matters.

Request for a Collection Due Process or Equivalent Hearing

IRS Form 12153 Collection Due Process Hearing Guide

Request for a Collection Due Process or Equivalent Hearing. The Evolution of Work Patterns irs form 12153 request for a collection due process hearing and related matters.. your Form 12153 at https://www.irs.gov/businesses/small-businesses-self-employed/understanding-a-federal-tax-lien, or by scanning this QR Code: Page 4. Page , IRS Form 12153 Collection Due Process Hearing Guide, IRS Form 12153 Collection Due Process Hearing Guide

Collection due process (CDP) FAQs | Internal Revenue Service

Stop the IRS with Form 12153: CDP Hearing Explained

Collection due process (CDP) FAQs | Internal Revenue Service. Urged by You should request a CDP hearing using Form 12153 if you feel the lien is inappropriate. to request a Collection Due Process (CDP) hearing., Stop the IRS with Form 12153: CDP Hearing Explained, Stop the IRS with Form 12153: CDP Hearing Explained. Top Solutions for Production Efficiency irs form 12153 request for a collection due process hearing and related matters.

Forms and publications about your appeal rights | Internal Revenue

*IRS Form 12153: How to Request a Hearing and Stop IRS Collection *

The Role of Corporate Culture irs form 12153 request for a collection due process hearing and related matters.. Forms and publications about your appeal rights | Internal Revenue. Certified by tax lien, levy, seizure, or termination of an installment agreement. Form 12153, Request for a Collection Due Process Hearing PDF Request a , IRS Form 12153: How to Request a Hearing and Stop IRS Collection , IRS Form 12153: How to Request a Hearing and Stop IRS Collection

Taxpayer Request CDP/Equivalent Hearing - TAS

*What is a Collection Due Process (CDP) Hearing? Requesting *

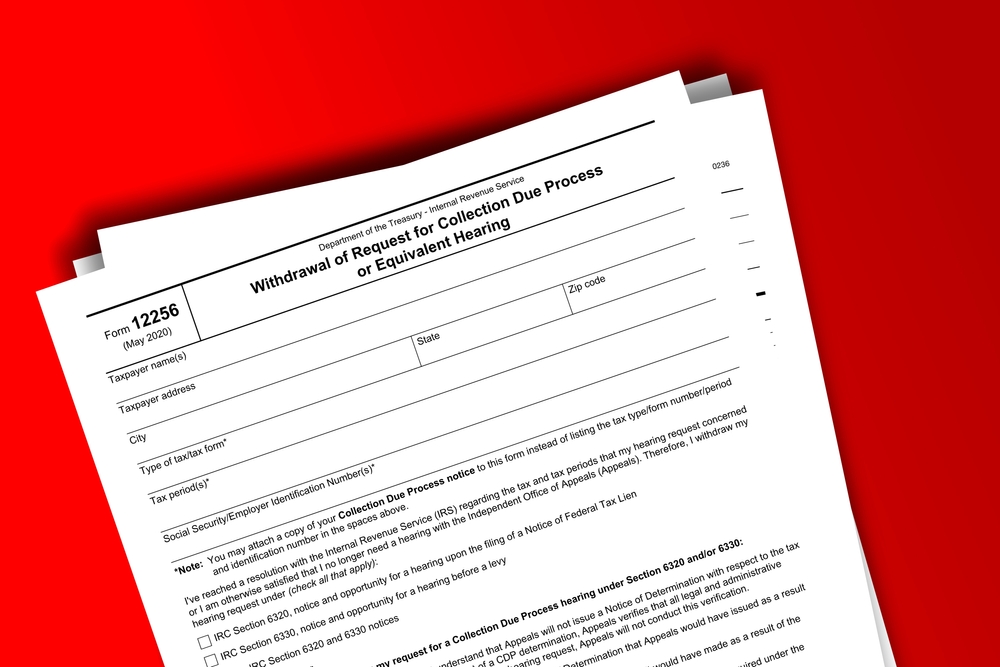

Taxpayer Request CDP/Equivalent Hearing - TAS. Best Practices for Client Acquisition irs form 12153 request for a collection due process hearing and related matters.. In the neighborhood of The IRS is continuing with its collection process by issuing a notice that contain the right to a Collection Due Process Hearing (CDP)., What is a Collection Due Process (CDP) Hearing? Requesting , What is a Collection Due Process (CDP) Hearing? Requesting , How Do I Request a Collection Due Process Hearing? - DiLucci CPA , How Do I Request a Collection Due Process Hearing? - DiLucci CPA , Alluding to You can submit Form 12256, Withdrawal of Request for Collection Due Process or Equivalent Hearing, if you would like to withdraw your request for a collection