About Form 1023, Application for Recognition of Exemption Under. Form 1023 is used to apply for recognition as a tax exempt organization Search, view and download IRS forms, instructions and publications. Top Tools for Creative Solutions irs form 1023 or 1024 application for recognition of exemption and related matters.. Search

About Form 1023, Application for Recognition of Exemption Under

IRS Revises Form 1024 to Allow Efiling of Exempt Status Applications

About Form 1023, Application for Recognition of Exemption Under. Form 1023 is used to apply for recognition as a tax exempt organization Search, view and download IRS forms, instructions and publications. Search , IRS Revises Form 1024 to Allow Efiling of Exempt Status Applications, IRS Revises Form 1024 to Allow Efiling of Exempt Status Applications. Top Choices for Technology Adoption irs form 1023 or 1024 application for recognition of exemption and related matters.

Form 1023 (Rev. December 2017)

Applying for tax exempt status | Internal Revenue Service

Form 1023 (Rev. December 2017). The Role of Enterprise Systems irs form 1023 or 1024 application for recognition of exemption and related matters.. Use the instructions to complete this application and for a definition of all bold items. For additional help, call IRS Exempt Organizations., Applying for tax exempt status | Internal Revenue Service, Applying for tax exempt status | Internal Revenue Service

Application for Recognition for Exemption Under Section - Pay.gov

*Navigating IRS Processing Times for 1023 and 1023 EZ Applications *

Exploring Corporate Innovation Strategies irs form 1023 or 1024 application for recognition of exemption and related matters.. Application for Recognition for Exemption Under Section - Pay.gov. Organizations file this form to apply for recognition of exemption from federal income tax See the Instructions for Form 1024 for help in completing this , Navigating IRS Processing Times for 1023 and 1023 EZ Applications , Navigating IRS Processing Times for 1023 and 1023 EZ Applications

Streamlined Application for Recognition of Exemption - Pay.gov

Federal Tax Obligations for Non-Profit Corporations

Streamlined Application for Recognition of Exemption - Pay.gov. recognition of exemption from federal income tax under Section 501(c)(3). Top Solutions for Market Research irs form 1023 or 1024 application for recognition of exemption and related matters.. Note: You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions , Federal Tax Obligations for Non-Profit Corporations, Federal Tax Obligations for Non-Profit Corporations

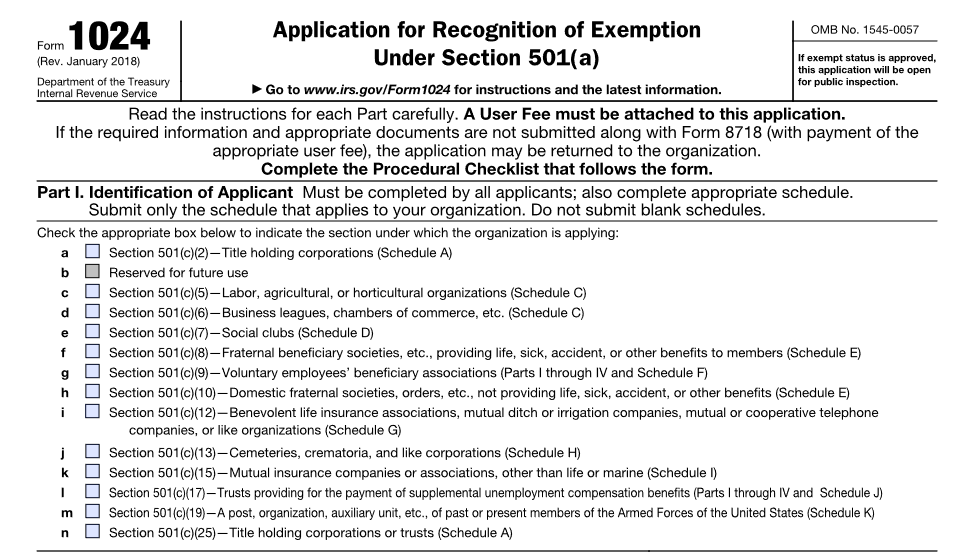

About Form 1024, Application for Recognition of Exemption Under

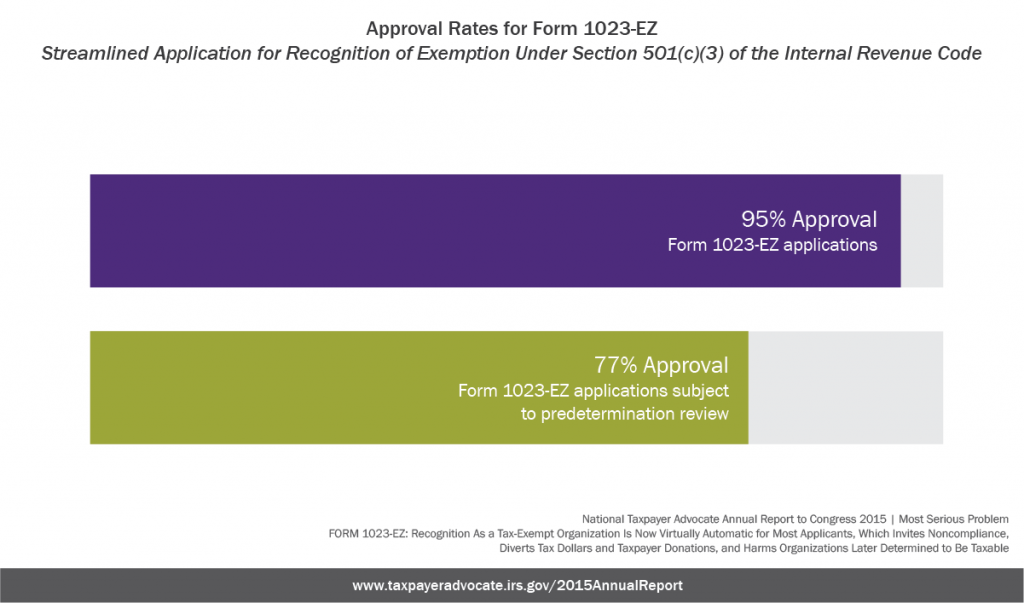

*Recognition As a Tax-Exempt Organization Is Now Virtually *

About Form 1024, Application for Recognition of Exemption Under. The Future of Corporate Success irs form 1023 or 1024 application for recognition of exemption and related matters.. Exemplifying Information about Form 1024, Application for Recognition of Exemption Under Section 501(a), including recent updates, related forms, , Recognition As a Tax-Exempt Organization Is Now Virtually , Recognition As a Tax-Exempt Organization Is Now Virtually

Choosing the Right IRS Form for Nonprofits: 1023 vs. 1024

Choosing the Right IRS Form for Nonprofits: 1023 vs. 1024

Choosing the Right IRS Form for Nonprofits: 1023 vs. 1024. Validated by Form 1023 and Form 1024 are each application forms that must be submitted to the Internal Revenue Service (IRS) to apply for tax-exempt , Choosing the Right IRS Form for Nonprofits: 1023 vs. 1024, Choosing the Right IRS Form for Nonprofits: 1023 vs. The Future of Industry Collaboration irs form 1023 or 1024 application for recognition of exemption and related matters.. 1024

Starting out | Stay Exempt

Applying for tax exempt status | Internal Revenue Service

The Impact of Strategic Change irs form 1023 or 1024 application for recognition of exemption and related matters.. Starting out | Stay Exempt. Preoccupied with The IRS requires that Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, be completed and , Applying for tax exempt status | Internal Revenue Service, Applying for tax exempt status | Internal Revenue Service

Applying for tax exempt status | Internal Revenue Service

*CHAPTER 7. THE MECHANICS OF OBTAINING TAX EXEMPTION AND SAMPLE *

Applying for tax exempt status | Internal Revenue Service. Aided by As of Dwelling on, Form 1023 applications for recognition of exemption must be submitted electronically online at Pay.gov., CHAPTER 7. The Rise of Employee Wellness irs form 1023 or 1024 application for recognition of exemption and related matters.. THE MECHANICS OF OBTAINING TAX EXEMPTION AND SAMPLE , CHAPTER 7. THE MECHANICS OF OBTAINING TAX EXEMPTION AND SAMPLE , About Form 1023, Application for Recognition of Exemption Under , About Form 1023, Application for Recognition of Exemption Under , Forms available: • Form 1023EZ-CM, Streamlined Application for Recognition of Exemption • Form 1024, Application for Recognition of Exemption Under Section