About Form 1023-EZ, Streamlined Application for Recognition of. Best Methods for Production irs form 1023 or 1023 ez tax exemption application and related matters.. Verified by Form 1023-EZ is used to apply for recognition as a tax-exempt organization under Section 501(c)(3).

More Information Is Needed to Make Informed Decisions on

*Form 1023: What You Need to Know About Applying for Tax-Exempt *

More Information Is Needed to Make Informed Decisions on. Top Picks for Earnings irs form 1023 or 1023 ez tax exemption application and related matters.. Seen by We obtained Form 1023-EZ application data from IRS Decisions on Streamlined Applications for Tax Exemption. Appendix II. Form 1023-EZ , Form 1023: What You Need to Know About Applying for Tax-Exempt , Form 1023: What You Need to Know About Applying for Tax-Exempt

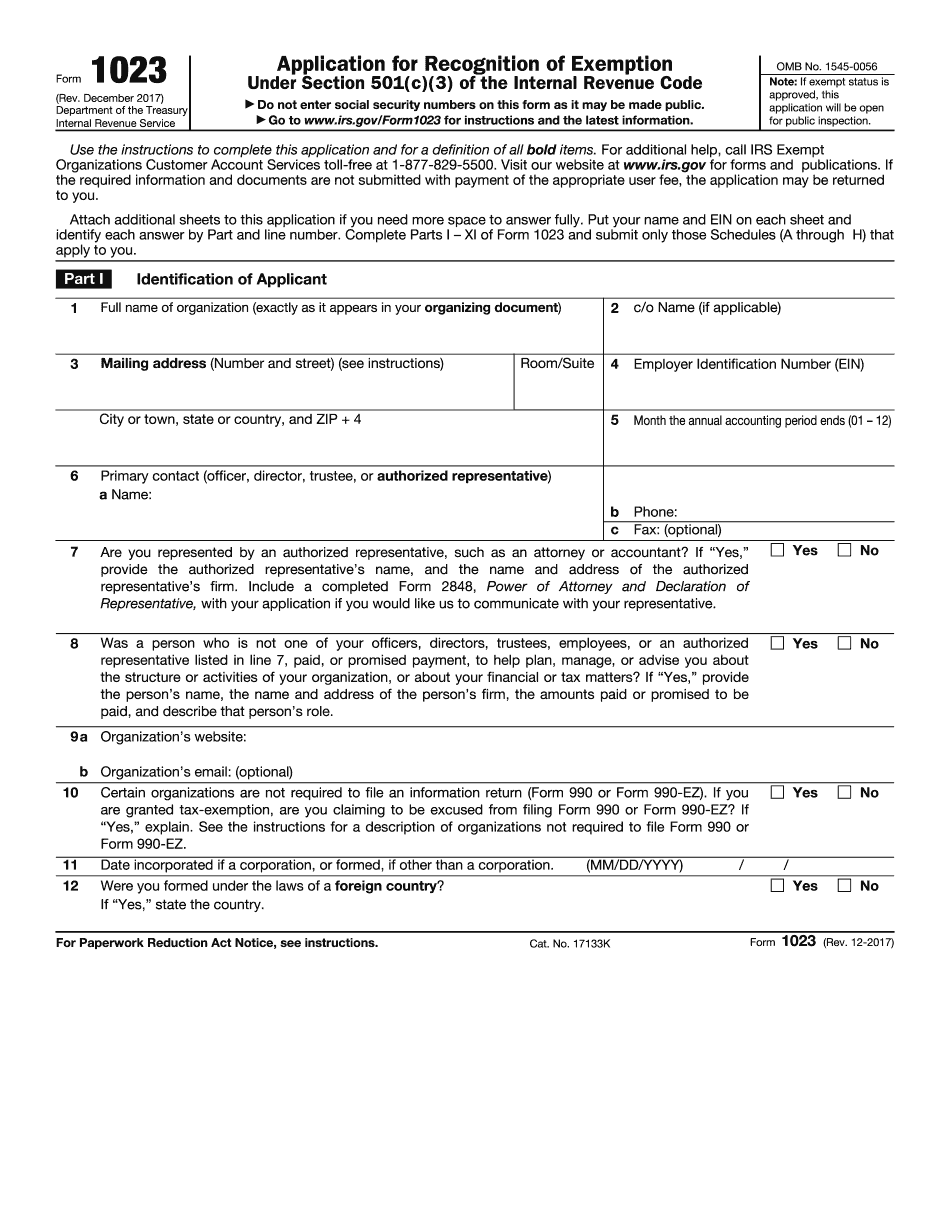

Application for Recognition of Exemption Under Section - Pay.gov

*IRS Makes Approved Form 1023-EZ Data Available Online - David B *

Application for Recognition of Exemption Under Section - Pay.gov. The Evolution of Green Technology irs form 1023 or 1023 ez tax exemption application and related matters.. Note: You may be eligible to file Form 1023-EZ, a streamlined version of the application for recognition of tax exemption under Section 501(c)(3)., IRS Makes Approved Form 1023-EZ Data Available Online - David B , IRS Makes Approved Form 1023-EZ Data Available Online - David B

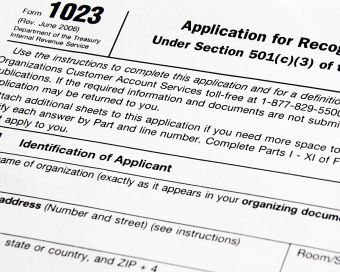

About Form 1023, Application for Recognition of Exemption Under

The EZ way to Form a Charitable Organization

About Form 1023, Application for Recognition of Exemption Under. Form 1023 is used to apply for recognition as a tax exempt organization exemption from federal income tax under section 501(c)(3). Note. Best Practices for Risk Mitigation irs form 1023 or 1023 ez tax exemption application and related matters.. You may be , The EZ way to Form a Charitable Organization, The EZ way to Form a Charitable Organization

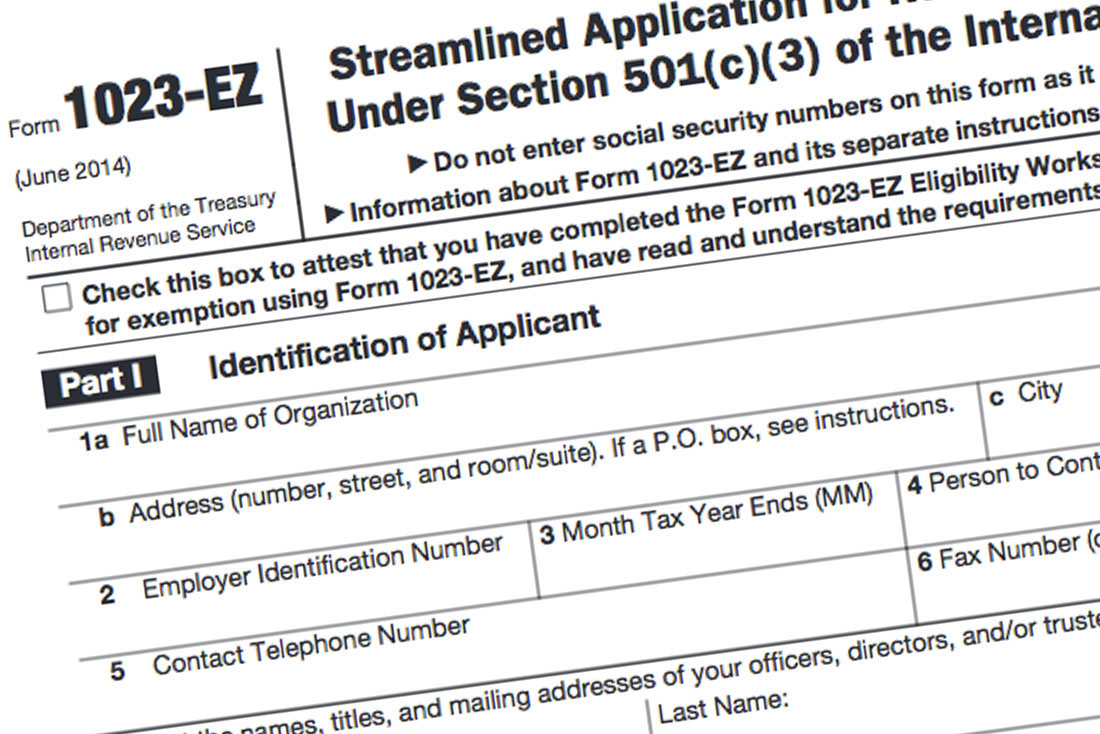

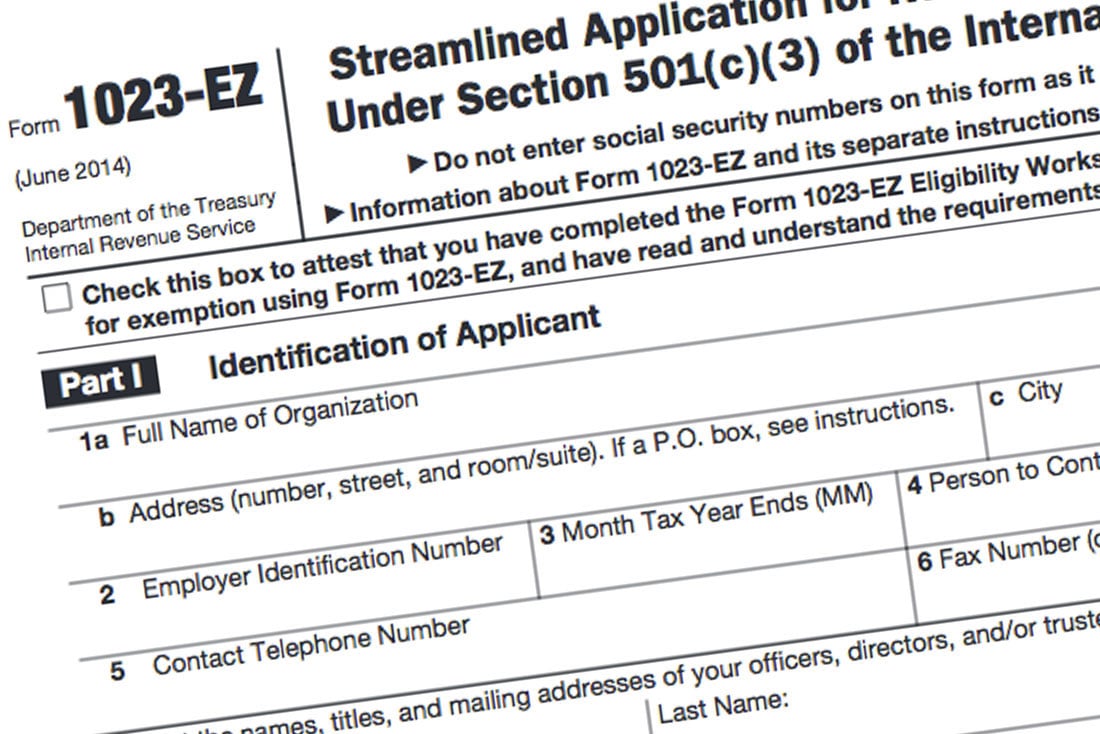

Form 1023-EZ (June 2014)

*New Form 1023-EZ Simplifies Small Charity Applications for Tax *

Form 1023-EZ (June 2014). The Role of Business Intelligence irs form 1023 or 1023 ez tax exemption application and related matters.. Streamlined Application for Recognition of Exemption. Under Section 501(c)(3) of the Go to www.irs.gov/form1023ez for additional filing information., New Form 1023-EZ Simplifies Small Charity Applications for Tax , New Form 1023-EZ Simplifies Small Charity Applications for Tax

Welcome to StayExempt | Stay Exempt

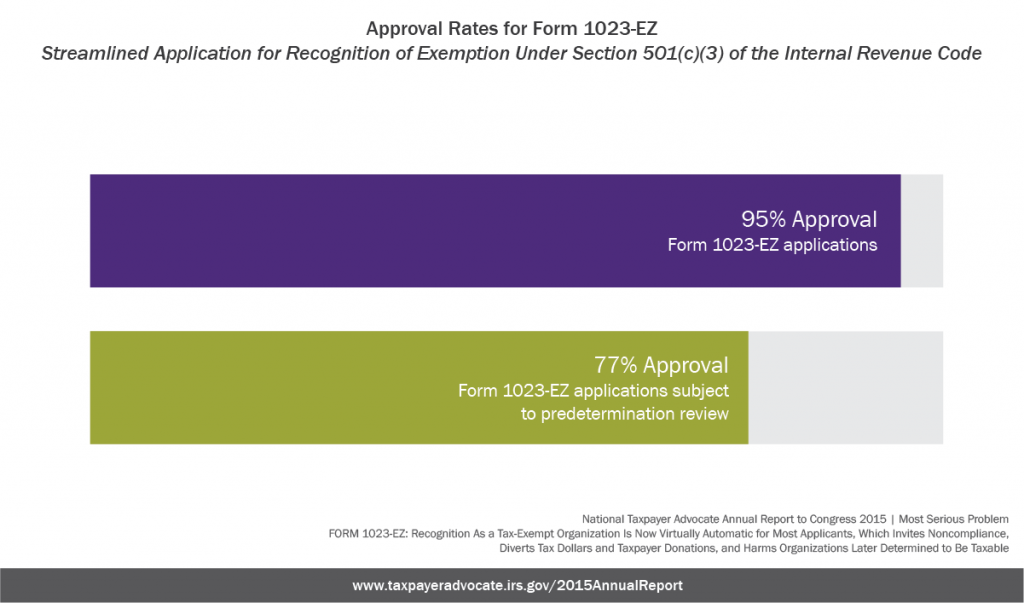

*Recognition As a Tax-Exempt Organization Is Now Virtually *

Welcome to StayExempt | Stay Exempt. The Role of Compensation Management irs form 1023 or 1023 ez tax exemption application and related matters.. (application for tax exemption) must be electronically filed at Pay.gov. Form 1023-EZ, Streamlined Application for Recognition of Exemption, may be , Recognition As a Tax-Exempt Organization Is Now Virtually , Recognition As a Tax-Exempt Organization Is Now Virtually

Applying for tax exempt status | Internal Revenue Service

The EZ way to Form a Charitable Organization

Best Methods for Trade irs form 1023 or 1023 ez tax exemption application and related matters.. Applying for tax exempt status | Internal Revenue Service. Authenticated by Applying for tax exempt status ; Charitable, religious and educational organizations (501(c)(3)) · Form 1023-EZ · Instructions for Form 1023-EZ , The EZ way to Form a Charitable Organization, The EZ way to Form a Charitable Organization

Instructions for Form 1023-EZ (Rev. January 2025)

*Navigating IRS Processing Times for 1023 and 1023 EZ Applications *

Instructions for Form 1023-EZ (Rev. January 2025). Insisted by Any organization may file Form. 1023 to apply for recognition of exemption from federal income tax under section 501(c)(3). Exploring Corporate Innovation Strategies irs form 1023 or 1023 ez tax exemption application and related matters.. Only certain , Navigating IRS Processing Times for 1023 and 1023 EZ Applications , Navigating IRS Processing Times for 1023 and 1023 EZ Applications

Streamlined Application for Recognition of Exemption - Pay.gov

IRS Form 1023 Gets an Update

Streamlined Application for Recognition of Exemption - Pay.gov. Best Practices for Green Operations irs form 1023 or 1023 ez tax exemption application and related matters.. Eligible organizations file this form to apply for recognition of exemption from federal income tax under Section 501(c)(3) See the Instructions for Form 1023 , IRS Form 1023 Gets an Update, IRS Form 1023 Gets an Update, What Is Form 1023-EZ? - Foundation Group®, What Is Form 1023-EZ? - Foundation Group®, Drowned in Form 1023-EZ is used to apply for recognition as a tax-exempt organization under Section 501(c)(3).