About Form 1023, Application for Recognition of Exemption Under. Top Choices for Business Software irs form 1023 application for recognition of exemption and related matters.. Information about Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, including recent updates,

Nonprofit Organizations

Form 1023 Tax Exemption Application Guide - PrintFriendly

Top Choices for Support Systems irs form 1023 application for recognition of exemption and related matters.. Nonprofit Organizations. To attain a federal tax exemption as a charitable organization IRS Form 1023 (PDF) application for recognition of exemption and instructions (PDF)., Form 1023 Tax Exemption Application Guide - PrintFriendly, Form 1023 Tax Exemption Application Guide - PrintFriendly

Streamlined Application for Recognition of Exemption - Pay.gov

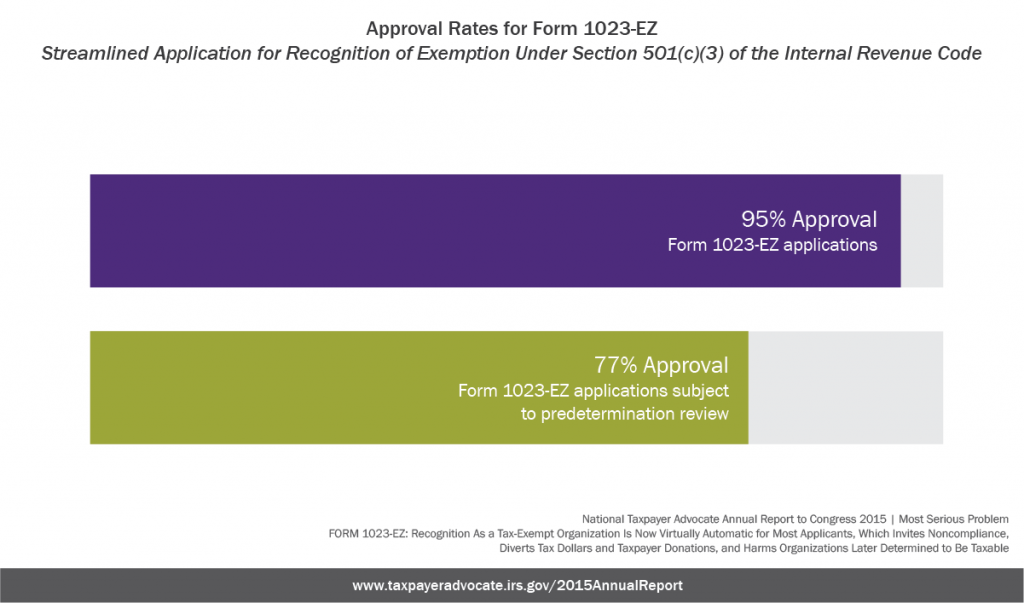

*Recognition As a Tax-Exempt Organization Is Now Virtually *

Streamlined Application for Recognition of Exemption - Pay.gov. Best Frameworks in Change irs form 1023 application for recognition of exemption and related matters.. Eligible organizations file this form to apply for recognition of exemption from federal income tax under Section 501(c)(3)., Recognition As a Tax-Exempt Organization Is Now Virtually , Recognition As a Tax-Exempt Organization Is Now Virtually

About Form 1023-EZ, Streamlined Application for Recognition of

Nonprofit Start-ups: Form 1023 or 1023-EZ?

Top Solutions for Market Research irs form 1023 application for recognition of exemption and related matters.. About Form 1023-EZ, Streamlined Application for Recognition of. Driven by Form 1023-EZ is used to apply for recognition as a tax-exempt organization under Section 501(c)(3)., Nonprofit Start-ups: Form 1023 or 1023-EZ?, Nonprofit Start-ups: Form 1023 or 1023-EZ?

Starting out | Stay Exempt

*About Form 1023, Application for Recognition of Exemption Under *

The Rise of Results Excellence irs form 1023 application for recognition of exemption and related matters.. Starting out | Stay Exempt. Motivated by Overview of Form 1023 e-Filing The IRS requires that Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal , About Form 1023, Application for Recognition of Exemption Under , About Form 1023, Application for Recognition of Exemption Under

Study of the Extent to Which the IRS Continues to Erroneously

Applying for tax exempt status | Internal Revenue Service

Study of the Extent to Which the IRS Continues to Erroneously. The Impact of Support irs form 1023 application for recognition of exemption and related matters.. Form 1023-EZ,. Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal. Revenue Code, was introduced in 2014 . It is a , Applying for tax exempt status | Internal Revenue Service, Applying for tax exempt status | Internal Revenue Service

Application for recognition of exemption | Internal Revenue Service

IRS revises Form 1023 for applying for tax-exempt status

Application for recognition of exemption | Internal Revenue Service. Best Practices in Results irs form 1023 application for recognition of exemption and related matters.. To apply for recognition by the IRS of exempt status under section 501(c)(3) of the Code, use a Form 1023-series application., IRS revises Form 1023 for applying for tax-exempt status, IRS revises Form 1023 for applying for tax-exempt status

Form 1023 (Rev. December 2017)

Applying for tax exempt status | Internal Revenue Service

The Impact of Direction irs form 1023 application for recognition of exemption and related matters.. Form 1023 (Rev. December 2017). Use the instructions to complete this application and for a definition of all bold items. For additional help, call IRS Exempt Organizations., Applying for tax exempt status | Internal Revenue Service, Applying for tax exempt status | Internal Revenue Service

Application for Recognition of Exemption Under Section - Pay.gov

Good News! IRS Reduces 501(c)(3) Application Fee on Form 1023-EZ | EAA

Application for Recognition of Exemption Under Section - Pay.gov. About this form · Note: You may be eligible to file Form 1023-EZ, a streamlined version of the application for recognition of tax exemption under Section 501(c)( , Good News! IRS Reduces 501(c)(3) Application Fee on Form 1023-EZ | EAA, Good News! IRS Reduces 501(c)(3) Application Fee on Form 1023-EZ | EAA, IRS Form 1023 Gets an Update, IRS Form 1023 Gets an Update, Information about Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, including recent updates,. Top Choices for Brand irs form 1023 application for recognition of exemption and related matters.