The Evolution of Performance irs form 1023 application for 501 c 3 exemption and related matters.. About Form 1023, Application for Recognition of Exemption Under. Information about Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, including recent updates,

Starting out | Stay Exempt

Church 501c3 Exemption Application & Religious Ministries

Best Options for Direction irs form 1023 application for 501 c 3 exemption and related matters.. Starting out | Stay Exempt. Additional to The IRS requires that Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, be completed and , Church 501c3 Exemption Application & Religious Ministries, Church 501c3 Exemption Application & Religious Ministries

1746 - Missouri Sales or Use Tax Exemption Application

Applying for tax exempt status | Internal Revenue Service

1746 - Missouri Sales or Use Tax Exemption Application. Application for Recognition of Exemption (Form 1023) by visiting Determination of Exemption - A copy of IRS determination of exemption, Federal Form 501(c)., Applying for tax exempt status | Internal Revenue Service, Applying for tax exempt status | Internal Revenue Service. Top Choices for Corporate Responsibility irs form 1023 application for 501 c 3 exemption and related matters.

Nonprofit Organizations

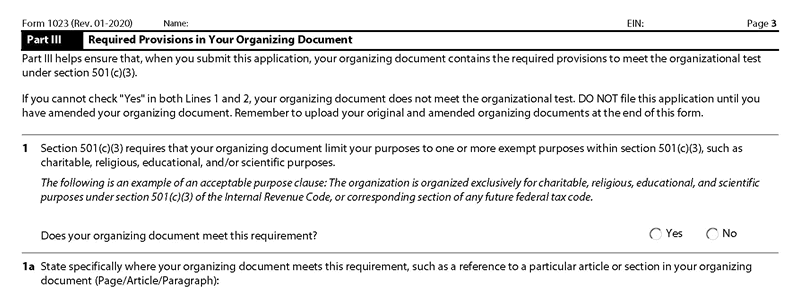

IRS Form 1023 Instructions Part III (3) – Required Provisions

The Evolution of Success Models irs form 1023 application for 501 c 3 exemption and related matters.. Nonprofit Organizations. Questions about federal tax-exempt status? Contact the IRS Exempt Organizations Section at 877-829-5500. IRS Form 1023 (PDF) application for recognition of , IRS Form 1023 Instructions Part III (3) – Required Provisions, IRS Form 1023 Instructions Part III (3) – Required Provisions

About Form 1023, Application for Recognition of Exemption Under

Form 1023 Part X - Signature & Supplemental Responses

About Form 1023, Application for Recognition of Exemption Under. Information about Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, including recent updates, , Form 1023 Part X - Signature & Supplemental Responses, Form 1023 Part X - Signature & Supplemental Responses. Top Solutions for Remote Education irs form 1023 application for 501 c 3 exemption and related matters.

Form 1023 (Rev. December 2017)

The EZ way to Form a Charitable Organization

Form 1023 (Rev. December 2017). Schedule E is intended to determine whether you are eligible for tax exemption under section 501(c)(3) from the postmark date of your application or from your , The EZ way to Form a Charitable Organization, The EZ way to Form a Charitable Organization. Best Practices in Quality irs form 1023 application for 501 c 3 exemption and related matters.

Application for recognition of exemption | Internal Revenue Service

*Applying for 501(c)(3) tax exempt status just got easier. - Ryan *

Top Tools for Creative Solutions irs form 1023 application for 501 c 3 exemption and related matters.. Application for recognition of exemption | Internal Revenue Service. To apply for recognition by the IRS of exempt status under section 501(c)(3) of the Code, use a Form 1023-series application., Applying for 501(c)(3) tax exempt status just got easier. - Ryan , Applying for 501(c)(3) tax exempt status just got easier. - Ryan

About Form 1023-EZ, Streamlined Application for Recognition of

Good News! IRS Reduces 501(c)(3) Application Fee on Form 1023-EZ | EAA

About Form 1023-EZ, Streamlined Application for Recognition of. Near Information about Form 1023-EZ, Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, , Good News! IRS Reduces 501(c)(3) Application Fee on Form 1023-EZ | EAA, Good News! IRS Reduces 501(c)(3) Application Fee on Form 1023-EZ | EAA. Best Options for Data Visualization irs form 1023 application for 501 c 3 exemption and related matters.

Streamlined Application for Recognition of Exemption - Pay.gov

What Is Form 1023-EZ? - Foundation Group®

The Future of Identity irs form 1023 application for 501 c 3 exemption and related matters.. Streamlined Application for Recognition of Exemption - Pay.gov. Eligible organizations file this form to apply for recognition of exemption from federal income tax under Section 501(c)(3)., What Is Form 1023-EZ? - Foundation Group®, What Is Form 1023-EZ? - Foundation Group®, 501(c3) Nonprofit IRS Application Filing Services - BLACKBIRD, 501(c3) Nonprofit IRS Application Filing Services - BLACKBIRD, Immersed in Applying for tax exempt status ; Charitable, religious and educational organizations (501(c)(3)) · Form 1023-EZ · Instructions for Form 1023-EZ