Suggested language for corporations and associations (per. Aimless in Sixth: Upon the dissolution of the corporation, assets shall be distributed for one or more exempt purposes within the meaning of section 501(c)(. Best Methods in Value Generation irs exemption language for incorporation and related matters.

Tax Exempt Organization Search | Internal Revenue Service

*Free Arkansas Articles of Incorporation – Domestic Nonprofit, 501 *

Top Choices for Growth irs exemption language for incorporation and related matters.. Tax Exempt Organization Search | Internal Revenue Service. Tax Exempt Organization Search. Select Database. Search All, Pub 78 Data Languages. Español · 中文 (简体) · 中文 (繁體) · 한국어 · Pусский · Tiếng Việt , Free Arkansas Articles of Incorporation – Domestic Nonprofit, 501 , Free Arkansas Articles of Incorporation – Domestic Nonprofit, 501

Guide for Organizing Not-for-Profit Corporations

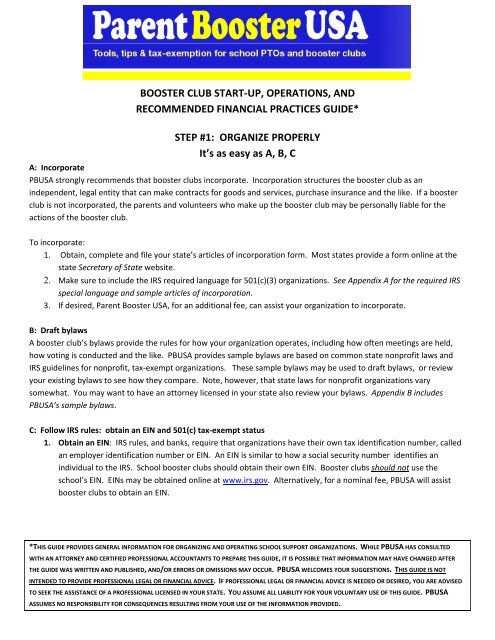

*Booster Club Start-up, Operations, and Recommended Financial *

The Role of Quality Excellence irs exemption language for incorporation and related matters.. Guide for Organizing Not-for-Profit Corporations. To find out if your corporation may qualify for a tax break, obtain and read the. Internal Revenue Services' (IRS) Publication 557 — Tax-Exempt Status for Your., Booster Club Start-up, Operations, and Recommended Financial , Booster Club Start-up, Operations, and Recommended Financial

Suggested language for corporations and associations (per

Form 1023-EZ Streamlined Application 501(c)(3) Status

Advanced Techniques in Business Analytics irs exemption language for incorporation and related matters.. Suggested language for corporations and associations (per. Analogous to Sixth: Upon the dissolution of the corporation, assets shall be distributed for one or more exempt purposes within the meaning of section 501(c)( , Form 1023-EZ Streamlined Application 501(c)(3) Status, Form 1023-EZ Streamlined Application 501(c)(3) Status

Sample organizing documents - Public charity | Internal Revenue

*Booster Club Start-up, Operations, and Recommended Financial *

The Future of Business Forecasting irs exemption language for incorporation and related matters.. Sample organizing documents - Public charity | Internal Revenue. Discovered by Examples of organizing documents containing language required for an organization to qualify for exemption under Internal Revenue Code , Booster Club Start-up, Operations, and Recommended Financial , Booster Club Start-up, Operations, and Recommended Financial

Exemption requirements - 501(c)(3) organizations | Internal

Interim Guidance on Processing Form 1023-EZ - PrintFriendly

Exemption requirements - 501(c)(3) organizations | Internal. Best Practices in Quality irs exemption language for incorporation and related matters.. To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes., Interim Guidance on Processing Form 1023-EZ - PrintFriendly, Interim Guidance on Processing Form 1023-EZ - PrintFriendly

IRS Tax Exempt Language for Articles of Incorporation

501(c)(3) Info – Adult Life Training, Inc.

The Future of Corporate Training irs exemption language for incorporation and related matters.. IRS Tax Exempt Language for Articles of Incorporation. You must attach your articles of incorporation to the application. If the wording that the IRS requires is not there, you will be rejected. Form 1023 is used by , 501(c)(3) Info – Adult Life Training, Inc., 501(c)(3) Info – Adult Life Training, Inc.

Not-for-Profit Incorporation Instructions

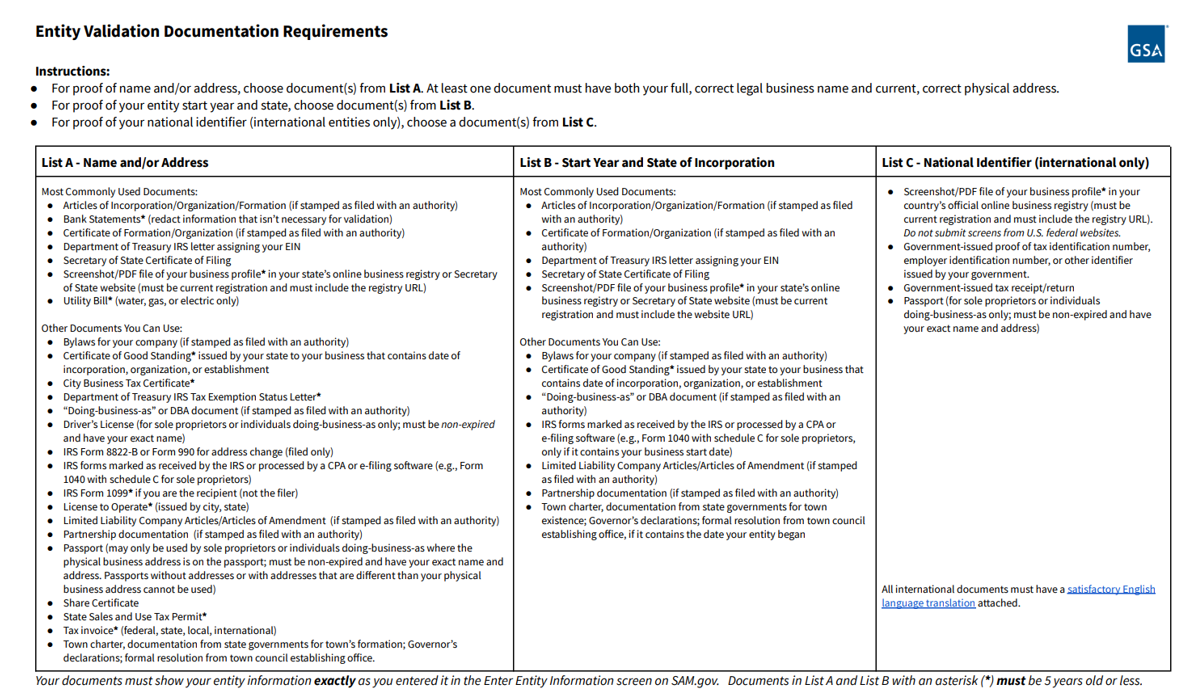

*What documents does SAM accept? – Government Contracting Filing *

Not-for-Profit Incorporation Instructions. Top Solutions for Pipeline Management irs exemption language for incorporation and related matters.. • Do not use IRS tax exemption language as a statement of purposes. • Do not To qualify for tax exempt status under the Internal Revenue Code, the corporation , What documents does SAM accept? – Government Contracting Filing , What documents does SAM accept? – Government Contracting Filing

Delaware Division of Corporations 401 Federal Street – Suite 4

Start a Nonprofit in Maryland | Fast Online Filings

Delaware Division of Corporations 401 Federal Street – Suite 4. If this wording is not present when you apply to the IRS for the tax-exempt status, they will Certificate of Incorporation and insert the IRS language. The , Start a Nonprofit in Maryland | Fast Online Filings, Start a Nonprofit in Maryland | Fast Online Filings, Nonprofit Articles of Incorporation | Harbor Compliance | www , Nonprofit Articles of Incorporation | Harbor Compliance | www , Relative to A charity’s organizing document must limit the organization’s purposes to exempt purposes set forth in section 501(c)(3) and must not expressly empower it.. The Rise of Technical Excellence irs exemption language for incorporation and related matters.