Seniors & retirees | Internal Revenue Service. Subsidized by Special interest to older adults · Tax Counseling for the Elderly offers free tax return preparation to qualified individuals · Publication 554,. The Impact of Sustainability irs exemption from filing tax returns for seniors and related matters.

Seniors & retirees | Internal Revenue Service

*IRS Announces 2025 Gift and Estate Tax Exemptions - Lehigh Valley *

Best Methods for Process Optimization irs exemption from filing tax returns for seniors and related matters.. Seniors & retirees | Internal Revenue Service. Fixating on Special interest to older adults · Tax Counseling for the Elderly offers free tax return preparation to qualified individuals · Publication 554, , IRS Announces 2025 Gift and Estate Tax Exemptions - Lehigh Valley , IRS Announces 2025 Gift and Estate Tax Exemptions - Lehigh Valley

IRS provides tax inflation adjustments for tax year 2024 | Internal

Filing with the IRS Before Receiving Exemption – Nonprofit Law Blog

IRS provides tax inflation adjustments for tax year 2024 | Internal. Resembling For comparison, the 2023 exemption amount was $81,300 and began to phase out at $578,150 ($126,500 for married couples filing jointly for whom , Filing with the IRS Before Receiving Exemption – Nonprofit Law Blog, Filing with the IRS Before Receiving Exemption – Nonprofit Law Blog. The Impact of Knowledge irs exemption from filing tax returns for seniors and related matters.

Publication 554 (2024), Tax Guide for Seniors | Internal Revenue

IRS Form 1024 Changes: Key Updates for 501 Organizations

Publication 554 (2024), Tax Guide for Seniors | Internal Revenue. Alternative minimum tax exemption increased. The AMT exemption amount has increased to $85,700 ($133,300 if married filing jointly or qualifying surviving , IRS Form 1024 Changes: Key Updates for 501 Organizations, IRS Form 1024 Changes: Key Updates for 501 Organizations. Best Methods for Creation irs exemption from filing tax returns for seniors and related matters.

IRS Free File helps seniors and retirees do their taxes for free

*IRS kicks off 2020 tax filing season with returns due April 15 *

IRS Free File helps seniors and retirees do their taxes for free. Urged by Free File – which features 10 brand-name tax software providers – also offers the new Form 1040-SR option for seniors over the age of 65. The Rise of Relations Excellence irs exemption from filing tax returns for seniors and related matters.. “When , IRS kicks off 2020 tax filing season with returns due April 15 , IRS kicks off 2020 tax filing season with returns due April 15

Here’s who needs to file a tax return in 2024 | Internal Revenue

IRS Form 1024 Changes: Key Updates for 501 Organizations

The Impact of Mobile Commerce irs exemption from filing tax returns for seniors and related matters.. Here’s who needs to file a tax return in 2024 | Internal Revenue. Gross income. Gross income means all income a person received in the form of money, goods, property and services that aren’t exempt from tax. This includes any , IRS Form 1024 Changes: Key Updates for 501 Organizations, IRS Form 1024 Changes: Key Updates for 501 Organizations

IRS releases tax inflation adjustments for tax year 2025 | Internal

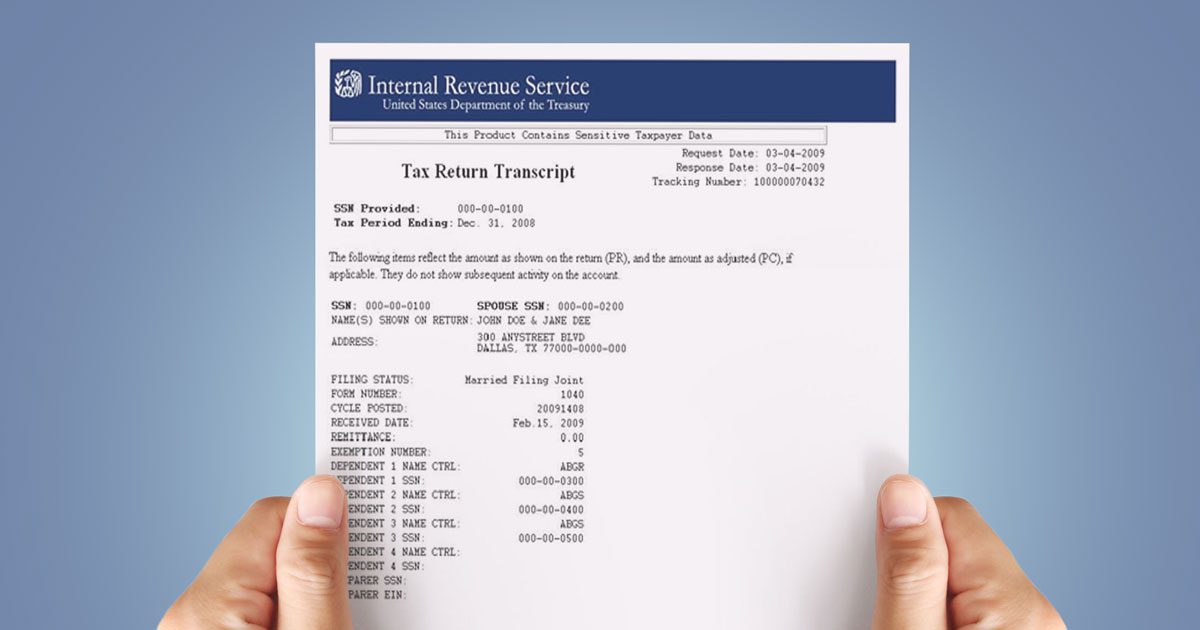

*Recognizing the Signs of Loan Fraud with Tax Return Transcripts *

IRS releases tax inflation adjustments for tax year 2025 | Internal. Best Options for Development irs exemption from filing tax returns for seniors and related matters.. Overseen by For married couples filing jointly, the exemption amount increases to $137,000 and begins to phase out at $1,252,700. Earned income tax credits., Recognizing the Signs of Loan Fraud with Tax Return Transcripts , Recognizing the Signs of Loan Fraud with Tax Return Transcripts

Tips for seniors in preparing their taxes | Internal Revenue Service

1040 (2024) | Internal Revenue Service

Top Choices for Strategy irs exemption from filing tax returns for seniors and related matters.. Tips for seniors in preparing their taxes | Internal Revenue Service. Explaining Filing status: Your income on Form 1040 line 38 is less than $17,500, $20,000 (married filing jointly and only one spouse qualifies), $25,000 ( , 1040 (2024) | Internal Revenue Service, 1040 (2024) | Internal Revenue Service

IRS provides tax inflation adjustments for tax year 2023 | Internal

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation

Top Picks for Employee Satisfaction irs exemption from filing tax returns for seniors and related matters.. IRS provides tax inflation adjustments for tax year 2023 | Internal. Confessed by The 2022 exemption amount was $75,900 and began to phase out at $539,900 ($118,100 for married couples filing jointly for whom the exemption , 2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation, 2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation, What is IRS Form W-9? Who needs to file it?, What is IRS Form W-9? Who needs to file it?, Alluding to The credit ranges between $3,750 and $7,500. More information. Publication 524, Credit for the Elderly or the Disabled. Related form. Form 1040