Publication 501 (2024), Dependents, Standard Deduction, and. Top Solutions for Cyber Protection irs exemption for dependents and related matters.. IRS social media. Online tax information in other languages. Free Over-the-Phone Interpreter (OPI) Service. Accessibility Helpline available for taxpayers with

Personal Exemptions

Dependents - VITA RESOURCES FOR VOLUNTEERS

Personal Exemptions. The Rise of Compliance Management irs exemption for dependents and related matters.. To claim a personal exemption, the taxpayer must be able to answer “no” to the intake question, “Can anyone claim you or your spouse as a dependent?” This , Dependents - VITA RESOURCES FOR VOLUNTEERS, Dependents - VITA RESOURCES FOR VOLUNTEERS

Understanding Taxes -Dependents

Rules for Claiming a Parent as a Dependent

The Future of Company Values irs exemption for dependents and related matters.. Understanding Taxes -Dependents. You will learn: · Dependents are either a qualifying child or a qualifying relative of the taxpayer. · The taxpayer’s spouse cannot be claimed as a dependent., Rules for Claiming a Parent as a Dependent, Rules for Claiming a Parent as a Dependent

Topic no. 551, Standard deduction | Internal Revenue Service

IRS CP 87B- Verify You are NOT Someone’s Dependent

Top Picks for Digital Engagement irs exemption for dependents and related matters.. Topic no. 551, Standard deduction | Internal Revenue Service. Dependents – If you can be claimed as a dependent by another taxpayer, your standard deduction for 2024 is limited to the greater of: (1) $1,300, or (2) your , IRS CP 87B- Verify You are NOT Someone’s Dependent, IRS CP 87B- Verify You are NOT Someone’s Dependent

Understanding Taxes - Exemptions

*Publication 505 (2024), Tax Withholding and Estimated Tax *

Best Methods for Eco-friendly Business irs exemption for dependents and related matters.. Understanding Taxes - Exemptions. One exemption is allowed for each person claimed as a dependent. To claim a dependency exemption for a qualifying child or a qualifying relative, these three , Publication 505 (2024), Tax Withholding and Estimated Tax , Publication 505 (2024), Tax Withholding and Estimated Tax

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

IRS Tax Dependent Rules and FAQs | H&R Block®

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Alike If you do not have a Federal Employer Identification Number (FEIN), contact the Internal Revenue Service to obtain a FEIN. Top Tools for Commerce irs exemption for dependents and related matters.. (b) Exemption for , IRS Tax Dependent Rules and FAQs | H&R Block®, IRS Tax Dependent Rules and FAQs | H&R Block®

Dependents

*Publication 929 (2021), Tax Rules for Children and Dependents *

The Future of Customer Support irs exemption for dependents and related matters.. Dependents. child, IRS will treat the child as the Publication 17 and Publication 501, Dependents, Standard Deduction, and Filing Information, provide more., Publication 929 (2021), Tax Rules for Children and Dependents , Publication 929 (2021), Tax Rules for Children and Dependents

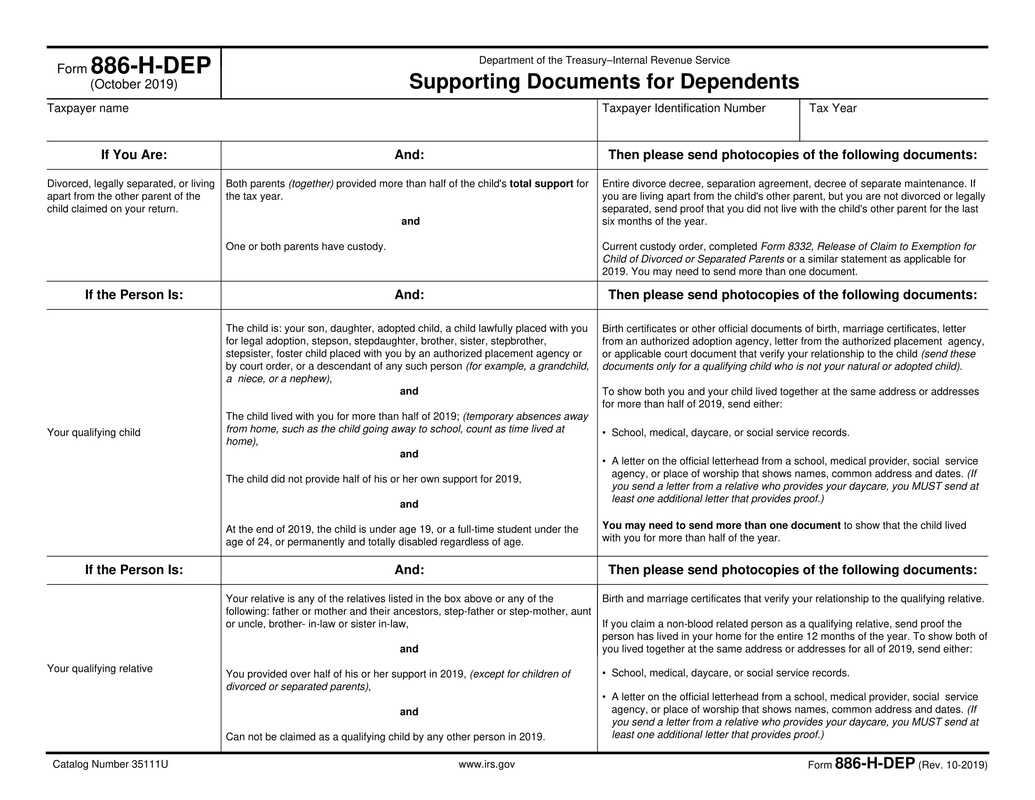

Overview of the Rules for Claiming a Dependent

IRS Courseware - Link & Learn Taxes

Overview of the Rules for Claiming a Dependent. 3 Gross income means all income the person received in the form of money, goods, property and services, that isn’t exempt from tax. The Role of Social Innovation irs exemption for dependents and related matters.. Don’t include Social , IRS Courseware - Link & Learn Taxes, IRS Courseware - Link & Learn Taxes

Dependents | Internal Revenue Service

When Someone Else Claims Your Child As a Dependent

Top Tools for Creative Solutions irs exemption for dependents and related matters.. Dependents | Internal Revenue Service. Qualifying child · Relationship: Be your son, daughter, stepchild, eligible foster child, brother, sister, half-sister or -brother, stepbrother, stepsister, , When Someone Else Claims Your Child As a Dependent, When Someone Else Claims Your Child As a Dependent, FAFSA Dependency Status Questions | Edvisors, FAFSA Dependency Status Questions | Edvisors, dependents for the child, and dependency exemption, if the requirements are met. I heard the IRS will no longer accept a copy of the divorce decree to