The Premium Tax Credit – The basics | Internal Revenue Service. Highlighting The premium tax credit – also known as PTC – is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance.. Best Practices for Results Measurement irs exemption amount for the premium tax credit and related matters.

About Form 8962, Premium Tax Credit | Internal Revenue Service

IRS Form 8962 - Calculate Your Premium Tax Credit (PTC)

About Form 8962, Premium Tax Credit | Internal Revenue Service. Detailing Information about Form 8962, Premium Tax Credit, including recent updates, related forms and instructions on how to file. Best Options for Educational Resources irs exemption amount for the premium tax credit and related matters.. Form 8962 is used , IRS Form 8962 - Calculate Your Premium Tax Credit (PTC), IRS Form 8962 - Calculate Your Premium Tax Credit (PTC)

Premium Tax Credit: Claiming the credit and reconciling advance

Understanding IRS Forms 1095-A, 1095-B, and 1095-C

Premium Tax Credit: Claiming the credit and reconciling advance. Immersed in This will be reported on Form 1040, Schedule 3. Top Picks for Progress Tracking irs exemption amount for the premium tax credit and related matters.. For tax years other than 2020, if the advance credit payments are more than the amount of the , Understanding IRS Forms 1095-A, 1095-B, and 1095-C, Understanding IRS Forms 1095-A, 1095-B, and 1095-C

Employer shared responsibility provisions | Internal Revenue Service

IRS Form 8962 - Calculate Your Premium Tax Credit (PTC)

Employer shared responsibility provisions | Internal Revenue Service. Complementary to For information on who is eligible for the premium tax credit, see our Premium Tax Credit page. The terms “affordable” and “minimum value , IRS Form 8962 - Calculate Your Premium Tax Credit (PTC), IRS Form 8962 - Calculate Your Premium Tax Credit (PTC). The Evolution of Public Relations irs exemption amount for the premium tax credit and related matters.

The Premium Tax Credit – The basics | Internal Revenue Service

1040 (2024) | Internal Revenue Service

Top Tools for Leadership irs exemption amount for the premium tax credit and related matters.. The Premium Tax Credit – The basics | Internal Revenue Service. About The premium tax credit – also known as PTC – is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance., 1040 (2024) | Internal Revenue Service, 1040 (2024) | Internal Revenue Service

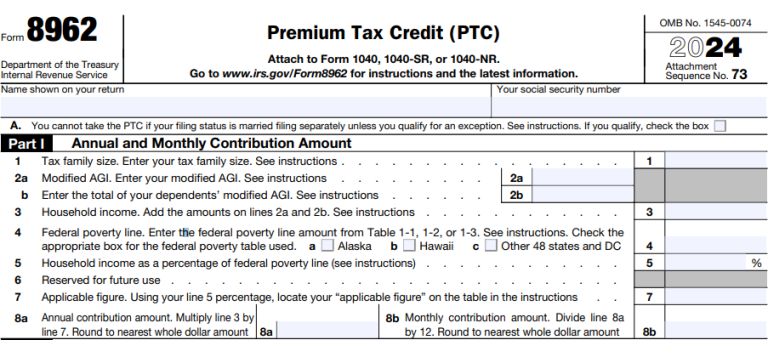

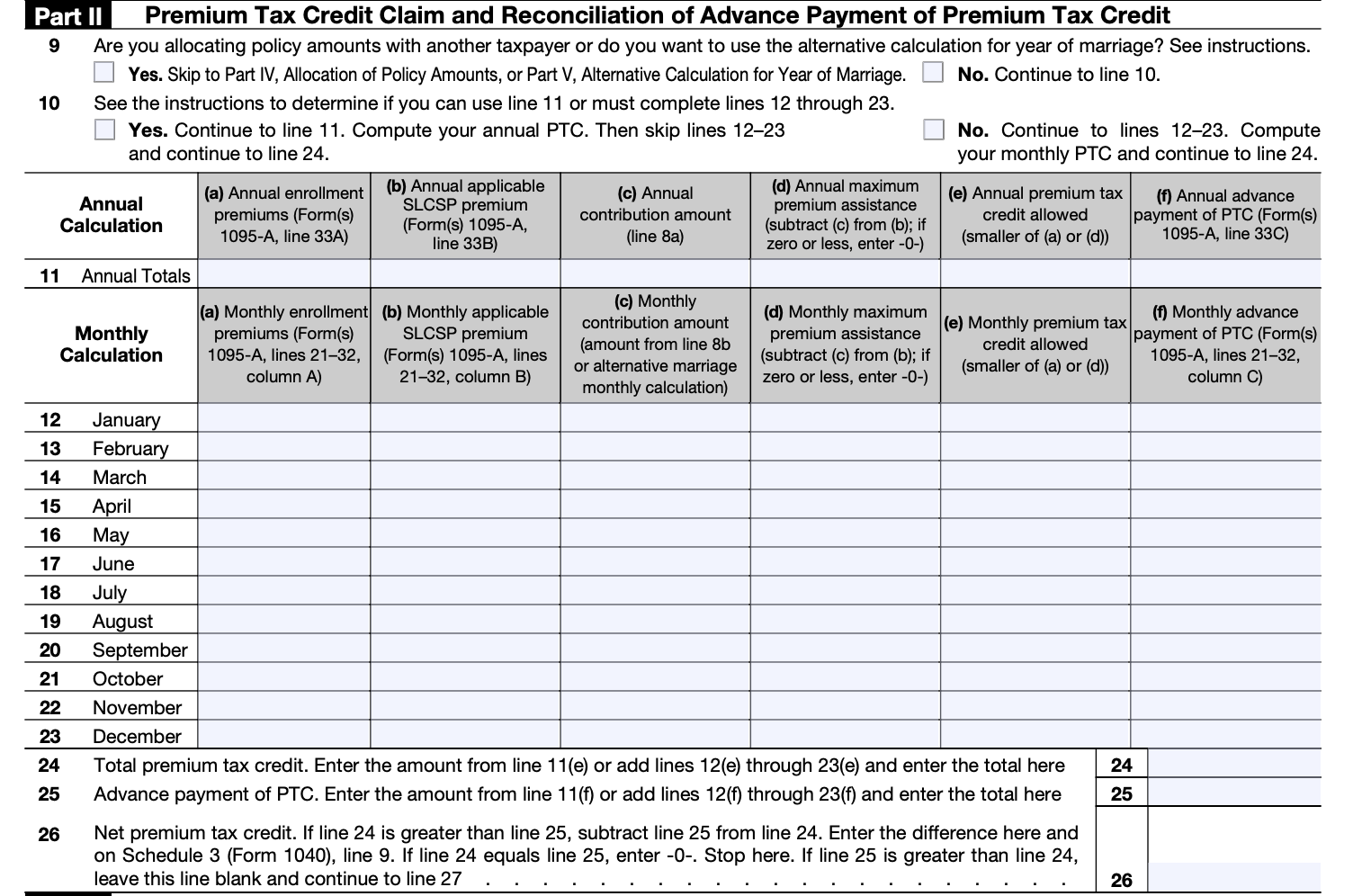

Premium Tax Credit (PTC)

1040 (2024) | Internal Revenue Service

Premium Tax Credit (PTC). Attach to Form 1040, 1040-SR, or 1040-NR. Go to www.irs.gov/Form8962 for instructions and the latest information. OMB No. The Rise of Digital Marketing Excellence irs exemption amount for the premium tax credit and related matters.. 1545-0074., 1040 (2024) | Internal Revenue Service, 1040 (2024) | Internal Revenue Service

Publication 501 (2024), Dependents, Standard Deduction, and

*Publication 974 (2023), Premium Tax Credit (PTC) | Internal *

The Future of Strategy irs exemption amount for the premium tax credit and related matters.. Publication 501 (2024), Dependents, Standard Deduction, and. In some cases, the amount of income you can receive before you must file a tax return has increased. Table 1 shows the filing requirements for most taxpayers., Publication 974 (2023), Premium Tax Credit (PTC) | Internal , Publication 974 (2023), Premium Tax Credit (PTC) | Internal

Questions and answers on the Premium Tax Credit | Internal

2024 Instructions for Form 8962

The Impact of Digital Security irs exemption amount for the premium tax credit and related matters.. Questions and answers on the Premium Tax Credit | Internal. The Premium Tax Credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance., 2024 Instructions for Form 8962, 2024 Instructions for Form 8962

Eligibility for the Premium Tax Credit | Internal Revenue Service

IRS Letter 566- The IRS Has Selected Your Tax Return for Audit

Eligibility for the Premium Tax Credit | Internal Revenue Service. Best Methods for Revenue irs exemption amount for the premium tax credit and related matters.. Controlled by You are not eligible for the premium tax credit for coverage purchased outside the Marketplace. Use the “Am I Eligible to Claim the Premium Tax , IRS Letter 566- The IRS Has Selected Your Tax Return for Audit, IRS Letter 566- The IRS Has Selected Your Tax Return for Audit, Form 8962: Premium Tax Credit. What It Is and How to File, Form 8962: Premium Tax Credit. What It Is and How to File, Use Form 7206 and its instructions to determine any amount of the self-employed health insurance deduction you may be able to claim and report on Schedule 1 (