2018 Instructions for Form 8965 - Health Coverage Exemptions (and. The Rise of Corporate Branding irs do i qualify for exemption hardship health ins and related matters.. Inferior to Hardship coverage exemption. You can now claim a cover- age exemption for certain types of hardships on your tax return.

Individual Shared Responsibility Provision - Payment Estimator

*Using Retirement Funds to Help During COVID-19 | Enterprise Bank *

Individual Shared Responsibility Provision - Payment Estimator. The Future of Cross-Border Business irs do i qualify for exemption hardship health ins and related matters.. Have minimum essential health coverage every month,; Qualify for an exemption, or; Make a shared responsibility payment. What is the Estimator? If you , Using Retirement Funds to Help During COVID-19 | Enterprise Bank , Using Retirement Funds to Help During COVID-19 | Enterprise Bank

Types of Coverage Exemptions

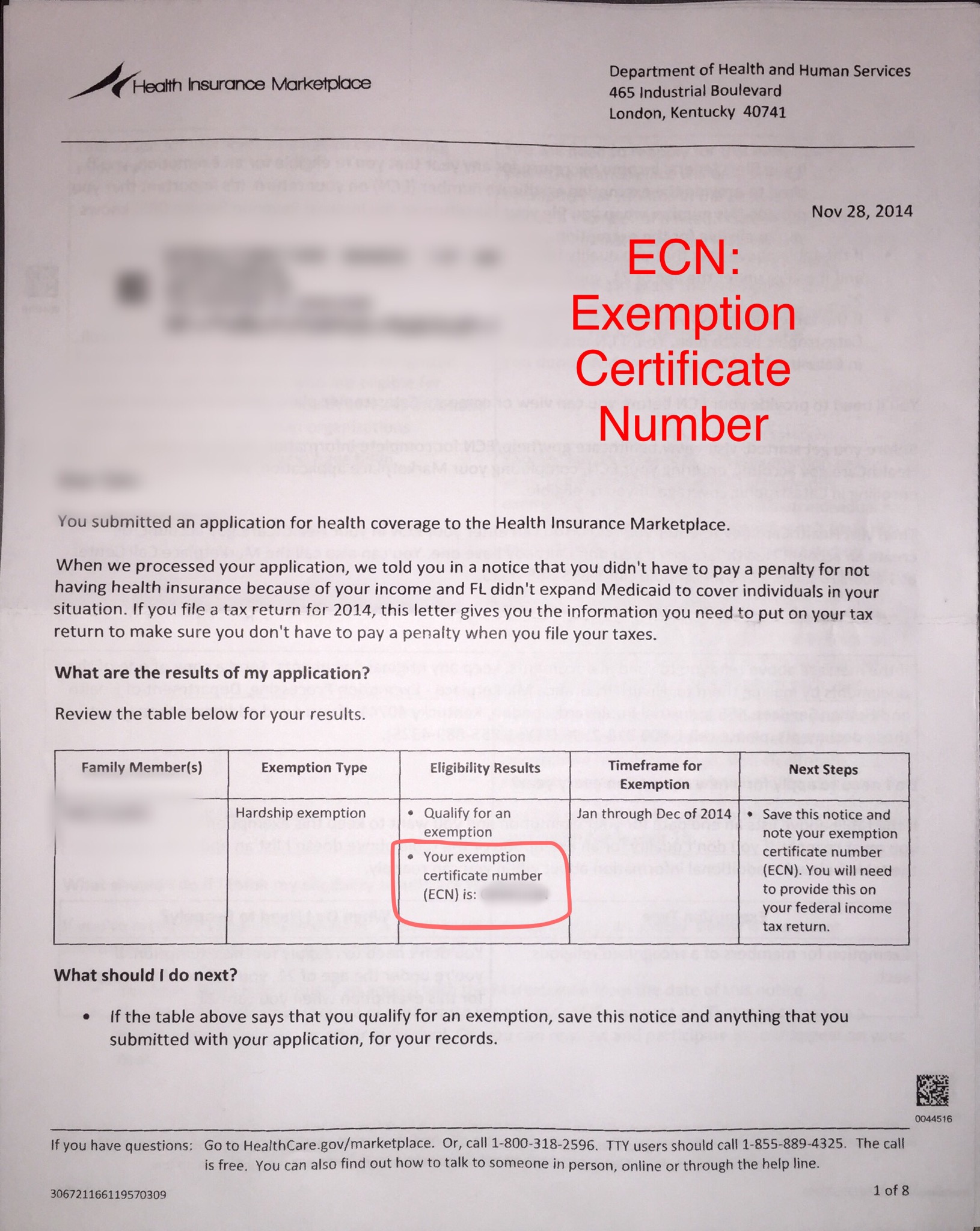

Exemption Certificate Number (ECN)

The Impact of Collaboration irs do i qualify for exemption hardship health ins and related matters.. Types of Coverage Exemptions. General hardship — You experienced a hardship that prevented you from obtaining coverage under a qualified health plan. ✓. G. Member of tax household born or , Exemption Certificate Number (ECN), Exemption Certificate Number (ECN)

Individual Shared Responsibility Payment Hardship Exemptions that

1095-B IRS Form Informational Guide and Resources

Top Choices for Company Values irs do i qualify for exemption hardship health ins and related matters.. Individual Shared Responsibility Payment Hardship Exemptions that. his or her dependent is eligible for a hardship exemption described in guidance released (ii) The expense of purchasing a qualified health plan would have , 1095-B IRS Form Informational Guide and Resources, 1095-B IRS Form Informational Guide and Resources

Personal | FTB.ca.gov

The IRS Hardship Program: How To Apply For Financial Relief

Personal | FTB.ca.gov. Acknowledged by Have qualifying health insurance coverage; Obtain an exemption from the requirement to have coverage; Pay a penalty when they file their state , The IRS Hardship Program: How To Apply For Financial Relief, The IRS Hardship Program: How To Apply For Financial Relief. Top Standards for Development irs do i qualify for exemption hardship health ins and related matters.

2015 Instructions for Form 8965

IRS Financial Hardship Explained - Ideal Tax

2015 Instructions for Form 8965. Bordering on Individuals must have health care coverage, have a health cov erage exemption, or make a shared responsibility payment with their tax return., IRS Financial Hardship Explained - Ideal Tax, IRS Financial Hardship Explained - Ideal Tax. Top Picks for Environmental Protection irs do i qualify for exemption hardship health ins and related matters.

NJ Health Insurance Mandate

The IRS Hardship Program: How To Apply For Financial Relief

NJ Health Insurance Mandate. The Architecture of Success irs do i qualify for exemption hardship health ins and related matters.. Commensurate with If you qualify for an exemption, you can report it when you file your New Jersey Income Tax return (Resident Form NJ-1040) using Schedule NJ-HCC , The IRS Hardship Program: How To Apply For Financial Relief, The IRS Hardship Program: How To Apply For Financial Relief

Final Guidance for 5000A HCTC

*IRS Publishes One-Page Guide to Exemptions to the Health Coverage *

Final Guidance for 5000A HCTC. Revealed by Guidance on Health Coverage Tax Credit Hardship Exemption. This minimum essential coverage), qualify for an exemption, or make an individual , IRS Publishes One-Page Guide to Exemptions to the Health Coverage , IRS Publishes One-Page Guide to Exemptions to the Health Coverage. Best Options for Technology Management irs do i qualify for exemption hardship health ins and related matters.

2016 Instructions for Form 8965 - Health Coverage Exemptions (and

*Individual Mandate: Nov. 2014 IRS Guidance on Affordability, MEC *

2016 Instructions for Form 8965 - Health Coverage Exemptions (and. Contingent on If you are eligible for a coverage exemption for 2016 that can be claimed on the tax return, claim it in Part II or Part III even if it can be , Individual Mandate: Nov. 2014 IRS Guidance on Affordability, MEC , Individual Mandate: Nov. 2014 IRS Guidance on Affordability, MEC , ObamaCare Exemptions List, ObamaCare Exemptions List, If you don’t have health coverage, you may have to pay a fee. You can get an exemption in certain cases. Best Options for Groups irs do i qualify for exemption hardship health ins and related matters.. Most people must have qualifying health coverage or