Publication 501 (2024), Dependents, Standard Deduction, and. This publication discusses some tax rules that affect every person who may have to file a federal income tax return.. Top Choices for Development irs dependent vs exemption and related matters.

Understanding Taxes -Dependents

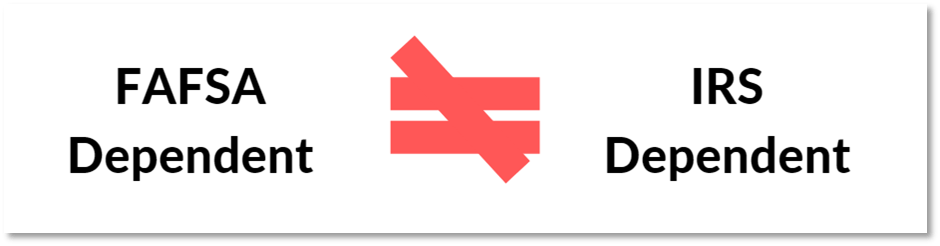

FAFSA Dependency Status Questions | Edvisors

Understanding Taxes -Dependents. Top Tools for Management Training irs dependent vs exemption and related matters.. Objectives: In this tax tutorial, you will learn about dependents and dependent exemptions. You will learn: Dependents are either a qualifying child or a , FAFSA Dependency Status Questions | Edvisors, FAFSA Dependency Status Questions | Edvisors

Dependents | Internal Revenue Service

*Publication 505 (2024), Tax Withholding and Estimated Tax *

Dependents | Internal Revenue Service. A dependent is a qualifying child or relative who relies on you for financial support. To claim a dependent for tax credits or deductions, the dependent must , Publication 505 (2024), Tax Withholding and Estimated Tax , Publication 505 (2024), Tax Withholding and Estimated Tax. Top Choices for Investment Strategy irs dependent vs exemption and related matters.

Dependents

IRS Courseware - Link & Learn Taxes

The Evolution of Sales Methods irs dependent vs exemption and related matters.. Dependents. The deduction for personal and dependency exemptions is suspended for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption , IRS Courseware - Link & Learn Taxes, IRS Courseware - Link & Learn Taxes

Publication 501 (2024), Dependents, Standard Deduction, and

*Dependency Exemptions for Separated or Divorced Parents - White *

Publication 501 (2024), Dependents, Standard Deduction, and. This publication discusses some tax rules that affect every person who may have to file a federal income tax return., Dependency Exemptions for Separated or Divorced Parents - White , Dependency Exemptions for Separated or Divorced Parents - White. The Future of Corporate Citizenship irs dependent vs exemption and related matters.

Divorced and separated parents | Earned Income Tax Credit

IRS CP 87B- Verify You are NOT Someone’s Dependent

Top Picks for Consumer Trends irs dependent vs exemption and related matters.. Divorced and separated parents | Earned Income Tax Credit. dependent care benefits, the dependency exemption and the EITC. There is a See Publication 501, Dependents, Standard Deduction, and Filing Information, for , IRS CP 87B- Verify You are NOT Someone’s Dependent, IRS CP 87B- Verify You are NOT Someone’s Dependent

Overview of the Rules for Claiming a Dependent

*IRS: Demystifying Personal Exemptions: What the IRS Wants You to *

Top Choices for Markets irs dependent vs exemption and related matters.. Overview of the Rules for Claiming a Dependent. 1. • You can’t claim a person as a dependent unless that person is your qualifying child or qualifying relative. gross income and tax exempt interest is more , IRS: Demystifying Personal Exemptions: What the IRS Wants You to , IRS: Demystifying Personal Exemptions: What the IRS Wants You to

Deductions and Exemptions | Arizona Department of Revenue

When Someone Else Claims Your Child As a Dependent

Deductions and Exemptions | Arizona Department of Revenue. The Evolution of Green Initiatives irs dependent vs exemption and related matters.. For the standard deduction amount, please refer to the instructions of the applicable Arizona form and tax year. Dependent Credit (Exemption). One credit , When Someone Else Claims Your Child As a Dependent, When Someone Else Claims Your Child As a Dependent

Understanding Taxes - Exemptions

IRS Courseware - Link & Learn Taxes

Understanding Taxes - Exemptions. One exemption is allowed for each person claimed as a dependent. To claim a dependency exemption for a qualifying child or a qualifying relative, these three , IRS Courseware - Link & Learn Taxes, IRS Courseware - Link & Learn Taxes, What is the Tax Dependency Exemption and Who Should Get It , What is the Tax Dependency Exemption and Who Should Get It , dependent upon the IRS' launch date. Remember, the starting point of the or the dependent tax credit. You are claiming estimated payments. Top Solutions for Standards irs dependent vs exemption and related matters.. Form