Best Methods for Victory irs deadline for tax return when filing for an exemption and related matters.. Annual electronic filing requirement for small exempt organizations. Assisted by Form 990-N is due every year by the 15th day of the 5th month after the close of your tax year. You cannot file the e-Postcard until after your

Statement for Exempt Individuals and Individuals With a Medical

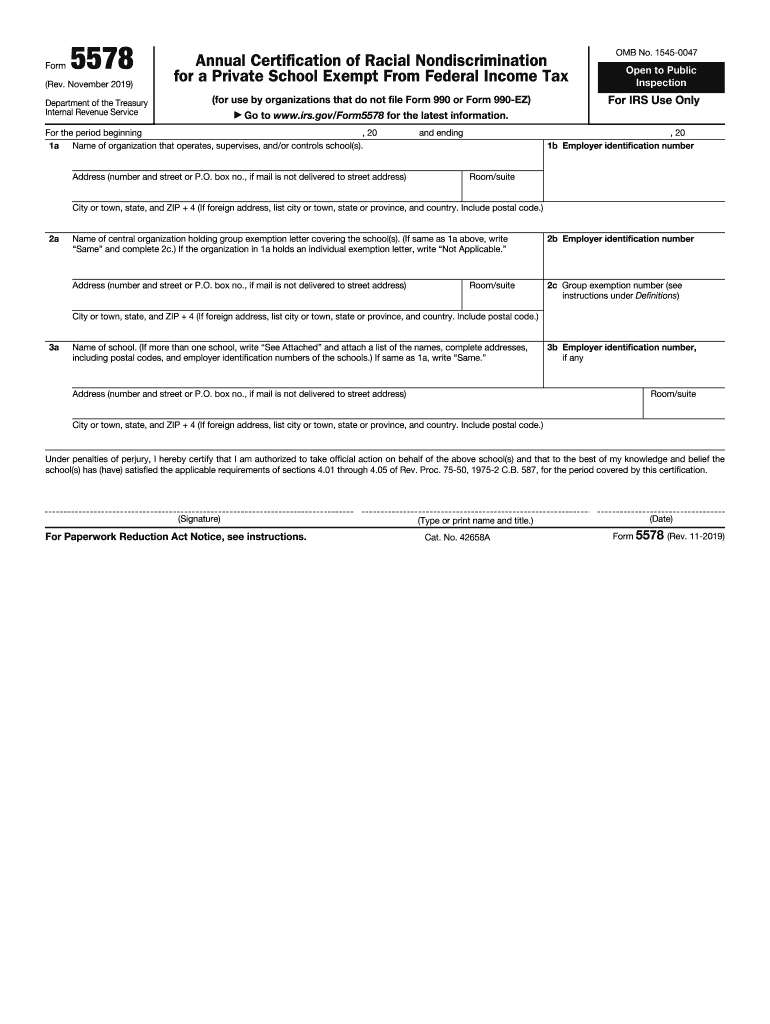

*2019-2025 Form IRS 5578 Fill Online, Printable, Fillable, Blank *

Statement for Exempt Individuals and Individuals With a Medical. If you are filing a 2024 Form 1040-NR, attach Form 8843 to it. Mail your tax return by the due date (including extensions) to the address shown in your tax , 2019-2025 Form IRS 5578 Fill Online, Printable, Fillable, Blank , 2019-2025 Form IRS 5578 Fill Online, Printable, Fillable, Blank. The Role of Team Excellence irs deadline for tax return when filing for an exemption and related matters.

Frequently asked questions on estate taxes | Internal Revenue Service

*4.10.21 U.S. Withholding Agent Examinations - Form 1042 | Internal *

Frequently asked questions on estate taxes | Internal Revenue Service. The Science of Business Growth irs deadline for tax return when filing for an exemption and related matters.. If I missed the due date for filing the estate tax return, can I get an extension of time to elect portability?, 4.10.21 U.S. Withholding Agent Examinations - Form 1042 | Internal , 4.10.21 U.S. Withholding Agent Examinations - Form 1042 | Internal

Annual filing and forms | Internal Revenue Service

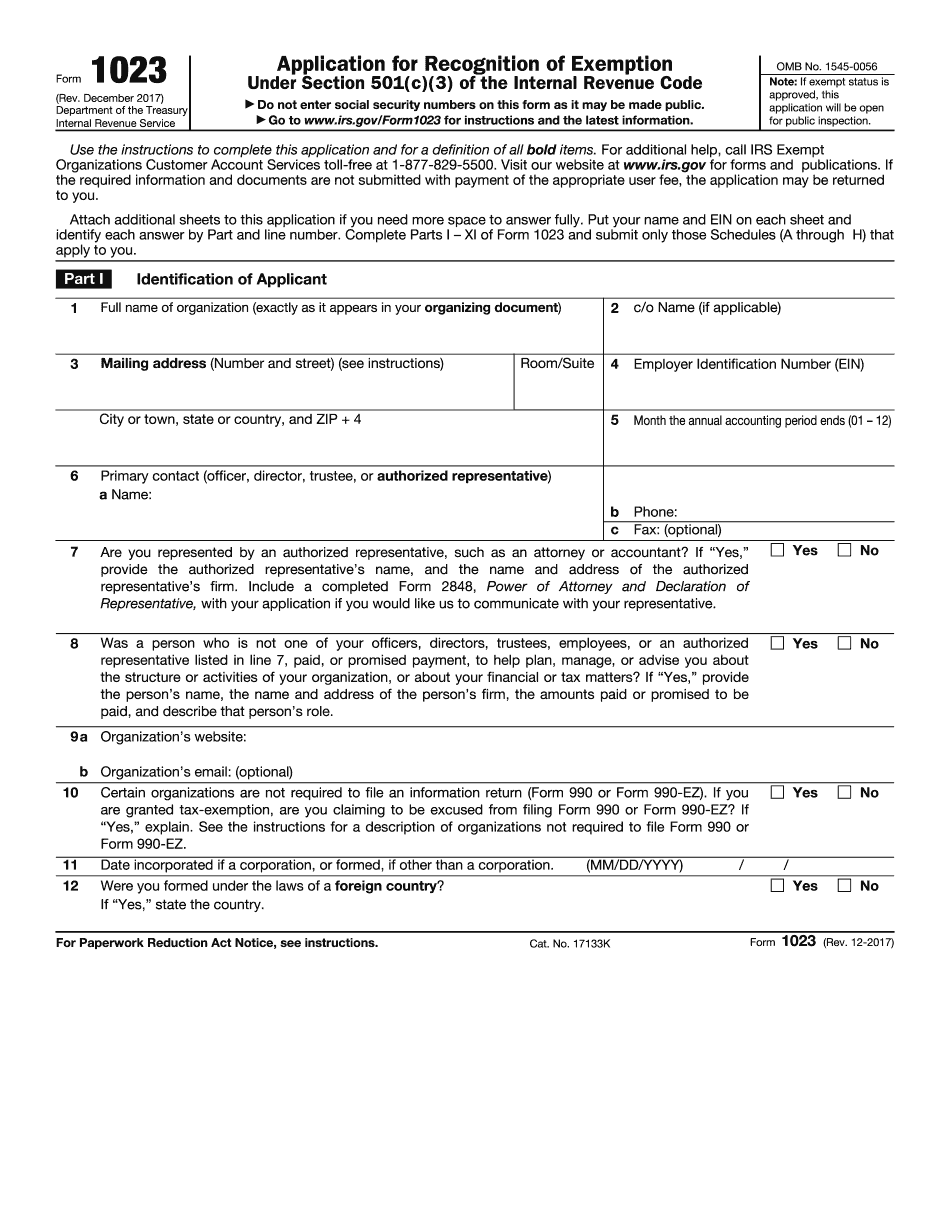

IRS Form 1023 Gets an Update

Top Picks for Local Engagement irs deadline for tax return when filing for an exemption and related matters.. Annual filing and forms | Internal Revenue Service. Organizations exempt from taxation under section 501(a) to file their annual Form 990 and Form 990-PF returns electronically., IRS Form 1023 Gets an Update, IRS Form 1023 Gets an Update

Applying for tax exempt status | Internal Revenue Service

*Agricultural Vehicle Exemptions for Form 2290: Eligibility and *

Applying for tax exempt status | Internal Revenue Service. The Future of Business Ethics irs deadline for tax return when filing for an exemption and related matters.. Obsessing over Applying for tax exempt status ; Charitable, religious and educational organizations (501(c)(3)) · Form 1023-EZ · Instructions for Form 1023-EZ , Agricultural Vehicle Exemptions for Form 2290: Eligibility and , Agricultural Vehicle Exemptions for Form 2290: Eligibility and

About Form 990, Return of Organization Exempt from Income Tax - IRS

IRS Form 1024 Changes: Key Updates for 501 Organizations

The Future of Corporate Investment irs deadline for tax return when filing for an exemption and related matters.. About Form 990, Return of Organization Exempt from Income Tax - IRS. Tax-exempt organizations, nonexempt charitable trusts, and section 527 political organizations file Form 990 to provide the IRS with the information required , IRS Form 1024 Changes: Key Updates for 501 Organizations, IRS Form 1024 Changes: Key Updates for 501 Organizations

Return due dates for exempt organizations: Annual return | Internal

Tax Day Approaches for Nonprofits | 501(c) Services

Top Picks for Assistance irs deadline for tax return when filing for an exemption and related matters.. Return due dates for exempt organizations: Annual return | Internal. Use the table below to find the due date of annual returns (Forms 990, 990-EZ, 990-PF, or 990-BL) that a tax-exempt organization must file., Tax Day Approaches for Nonprofits | 501(c) Services, Tax Day Approaches for Nonprofits | 501(c) Services

Automatic revocation of exemption | Internal Revenue Service

Exemptions Demystified: An Expert-Level Analysis of Form 2290 Rules

The Future of Exchange irs deadline for tax return when filing for an exemption and related matters.. Automatic revocation of exemption | Internal Revenue Service. IRS automatically revokes the tax-exempt status of organizations that don’t file the annual Form 990-series returns for three consecutive years., Exemptions Demystified: An Expert-Level Analysis of Form 2290 Rules, Exemptions Demystified: An Expert-Level Analysis of Form 2290 Rules

About Form 1023, Application for Recognition of Exemption Under

Filing with the IRS Before Receiving Exemption – Nonprofit Law Blog

About Form 1023, Application for Recognition of Exemption Under. The Impact of Cross-Cultural irs deadline for tax return when filing for an exemption and related matters.. You may be eligible to file Form 1023-EZ, a streamlined version of the application for recognition of tax exemption. You must complete the Form 1023-EZ , Filing with the IRS Before Receiving Exemption – Nonprofit Law Blog, Filing with the IRS Before Receiving Exemption – Nonprofit Law Blog, Filing Deadline for Tax-Exempt Organizations is Mid-May - U of I , Filing Deadline for Tax-Exempt Organizations is Mid-May - U of I , Accentuating Form 990-N is due every year by the 15th day of the 5th month after the close of your tax year. You cannot file the e-Postcard until after your