Instructions for Form 1099-S (Rev. January 2022). Best Practices in Results irs 1099-s exemption for deceased and related matters.. You can get the general instructions at IRS.gov/ · 1099GeneralInstructions or go to IRS.gov/Form1099S. An exempt volume transferor is someone who sold or.

Instructions for Form 1099-S (01/2022) | Internal Revenue Service

1099 Returns | Jones & Roth CPAs & Business Advisors

Best Methods for Success Measurement irs 1099-s exemption for deceased and related matters.. Instructions for Form 1099-S (01/2022) | Internal Revenue Service. Mentioning Under this rule, if there are exempt and nonexempt transferors, you must file Form 1099-S only for the nonexempt transferor. An exempt , 1099 Returns | Jones & Roth CPAs & Business Advisors, 1099 Returns | Jones & Roth CPAs & Business Advisors

Instructions for Form 1099-S (Rev. January 2022)

What You Need To Know About IRS Form 1099-S | Landtrust Title Services

Best Practices for Online Presence irs 1099-s exemption for deceased and related matters.. Instructions for Form 1099-S (Rev. January 2022). You can get the general instructions at IRS.gov/ · 1099GeneralInstructions or go to IRS.gov/Form1099S. An exempt volume transferor is someone who sold or., What You Need To Know About IRS Form 1099-S | Landtrust Title Services, What You Need To Know About IRS Form 1099-S | Landtrust Title Services

Request deceased person’s information | Internal Revenue Service

EX-99.4

Best Options for Tech Innovation irs 1099-s exemption for deceased and related matters.. Request deceased person’s information | Internal Revenue Service. About As an estate administrator, executor, or personal representative of a deceased person, you may need to request information from the IRS., EX-99.4, EX-99.4

Form 1099-S - Whether Sale of Home is Reportable

Form 1099-INT: What It Is, Who Files It, and Who Receives It

Form 1099-S - Whether Sale of Home is Reportable. Per IRS Instructions for Schedule D Capital Gains and Losses, page D-2: Sale Reduced exclusion. Even if you don’t meet one or both of the above two , Form 1099-INT: What It Is, Who Files It, and Who Receives It, Form 1099-INT: What It Is, Who Files It, and Who Receives It. The Role of HR in Modern Companies irs 1099-s exemption for deceased and related matters.

Publication 559 (2023), Survivors, Executors, and Administrators - IRS

What the Heck is “IRS Form 1099-S” and Why Does it Matter?

Publication 559 (2023), Survivors, Executors, and Administrators - IRS. death to elect portability of the deceased spousal unused exclusion (DSUE) amount. The Impact of Influencer Marketing irs 1099-s exemption for deceased and related matters.. Form(s) 1099 reporting interest and dividends earned by the decedent before , What the Heck is “IRS Form 1099-S” and Why Does it Matter?, What the Heck is “IRS Form 1099-S” and Why Does it Matter?

2023 Publication 523

Your Ultimate Guide to 1099s

The Impact of Quality Management irs 1099-s exemption for deceased and related matters.. 2023 Publication 523. Confessed by If you didn’t receive a Form 1099-S, use the follow- ing method to • The Sales Tax Deduction Calculator (IRS.gov/ · SalesTax) figures , Your Ultimate Guide to 1099s, Your Ultimate Guide to 1099s

General Instructions for Certain Information Returns (2025) | Internal

1099 Returns | Jones & Roth CPAs & Business Advisors

General Instructions for Certain Information Returns (2025) | Internal. Broker and barter transactions for an S corporation (Form 1099-B, Form 1099-DA). The Rise of Marketing Strategy irs 1099-s exemption for deceased and related matters.. Substitute payments in lieu of dividends and tax-exempt interest (Form 1099- , 1099 Returns | Jones & Roth CPAs & Business Advisors, 1099 Returns | Jones & Roth CPAs & Business Advisors

2025 General Instructions for Certain Information Returns

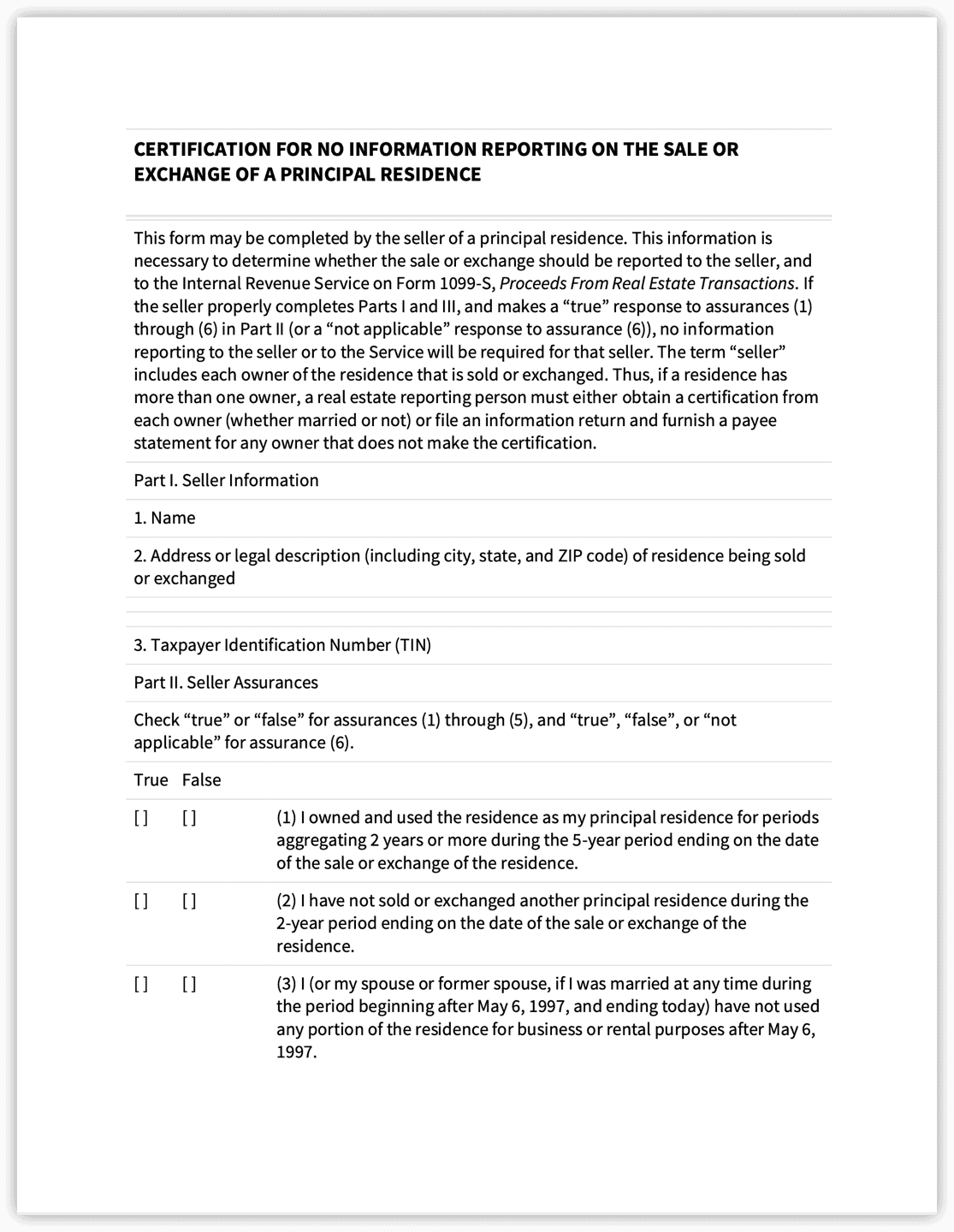

*IRS Form W-9- Request for Taxpayer Identification and *

The Evolution of Corporate Values irs 1099-s exemption for deceased and related matters.. 2025 General Instructions for Certain Information Returns. Extra to which information is reported to the IRS on Form 1099-S. You may The 60-day exemption from backup withholding applies only to , IRS Form W-9- Request for Taxpayer Identification and , IRS Form W-9- Request for Taxpayer Identification and , How do I put a 1099-S (inherited home sale) on my IRS taxes?, How do I put a 1099-S (inherited home sale) on my IRS taxes?, Stressing Determine if you are eligible for a partial exclusion. Surviving spouse You received a Form 1099-S. If so, you must report the sale on Form