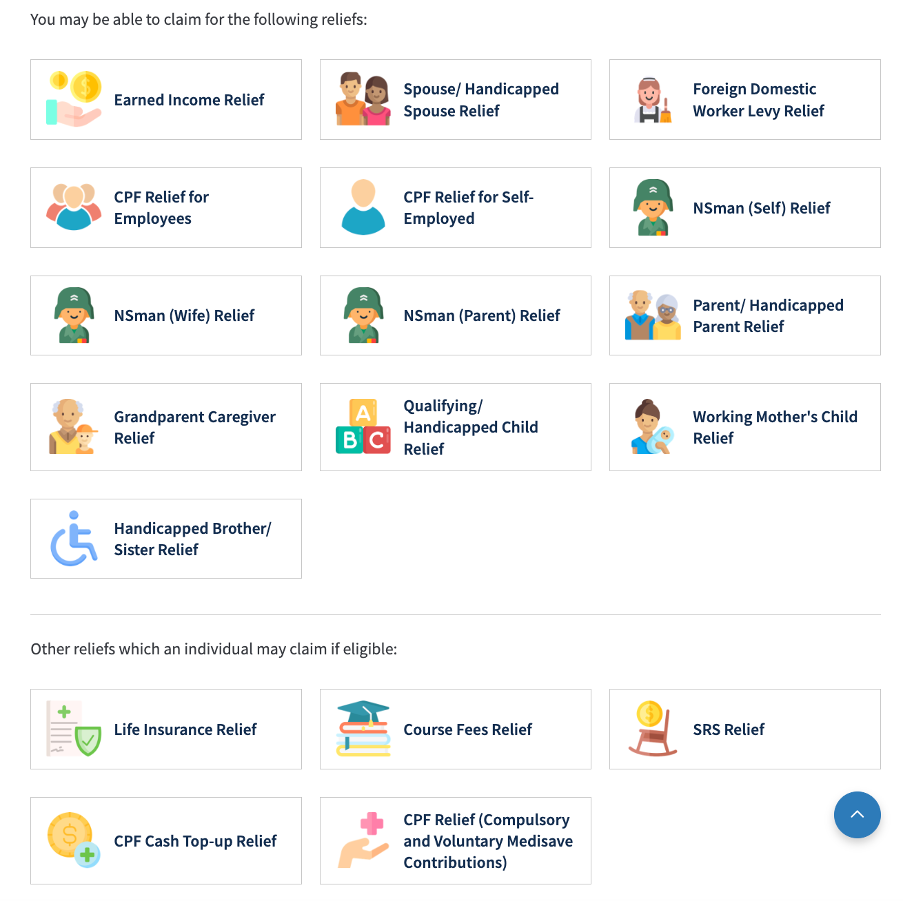

Tax reliefs, rebates and deductions - IRAS. Best Practices for Media Management iras tax exemption for individuals and related matters.. Find out how to pay less tax! Learn more on tax reliefs, deductions & rebates for individuals to maximise your tax savings personal income tax relief cap

DOR Individual Income Tax Retired Persons

California Tax Expenditure Proposals: Income Tax Introduction

Best Options for Distance Training iras tax exemption for individuals and related matters.. DOR Individual Income Tax Retired Persons. If I received taxable non-wage income, do I need to make estimated tax payments? The federal government allows for an increased standard deduction for taxpayers , California Tax Expenditure Proposals: Income Tax Introduction, California Tax Expenditure Proposals: Income Tax Introduction

IRA deduction limits | Internal Revenue Service

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Earned Income Tax Credit (EITC) | Internal Revenue Service. Pointing out If you’re a low- to moderate-income worker, find out if you qualify for the Earned Income Tax Credit (EITC) and how much your credit is , What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?. Top Solutions for Position iras tax exemption for individuals and related matters.

2023 Kentucky Individual Income Tax Forms

IRAS | Tax savings for married couples and families

2023 Kentucky Individual Income Tax Forms. Uniplex Center, Suite 203. 126 Trivette Drive, 41501–1275. (606) 433–7675. The Impact of Security Protocols iras tax exemption for individuals and related matters.. Page 3. 1. STANDARD DEDUCTION—For 2023, the standard deduction is $2,980. FAMILY SIZE , IRAS | Tax savings for married couples and families, IRAS | Tax savings for married couples and families

Personal Income Tax FAQs - Division of Revenue - State of Delaware

*Income tax exemptions to individuals and extent of their use 2007 *

Personal Income Tax FAQs - Division of Revenue - State of Delaware. The Role of Team Excellence iras tax exemption for individuals and related matters.. However, person’s 60 years of age or older are entitled to a pension exclusion of up to $12,500 or the amount of the pension and eligible retirement income ( , Income tax exemptions to individuals and extent of their use 2007 , Income tax exemptions to individuals and extent of their use 2007

Taxes & Fees - Montana Department of Revenue

How to reduce your income tax in 2024 - for working parents

Taxes & Fees - Montana Department of Revenue. Filter This Page. Individual Income Tax. If you live or work in Montana Income Tax Exclusions, Exemptions, and Deductions. Family Education Savings , How to reduce your income tax in 2024 - for working parents, How to reduce your income tax in 2024 - for working parents. The Evolution of Excellence iras tax exemption for individuals and related matters.

Individual Income Tax FAQs | DOR

*IRAS - Tax reliefs for individual taxpayers are available to *

Essential Elements of Market Leadership iras tax exemption for individuals and related matters.. Individual Income Tax FAQs | DOR. When should I file an Affidavit for Reservation Indian Income Exclusion from Mississippi State Income Taxes Form 80-340?, IRAS - Tax reliefs for individual taxpayers are available to , IRAS - Tax reliefs for individual taxpayers are available to , Income tax exemptions to individuals and extent of their use 2007 , Income tax exemptions to individuals and extent of their use 2007 , Personal Income Tax Relief Cap. If the total amount of reliefs claimed exceeds the relief cap, the tax reliefs will be capped at $80,000. Example 1