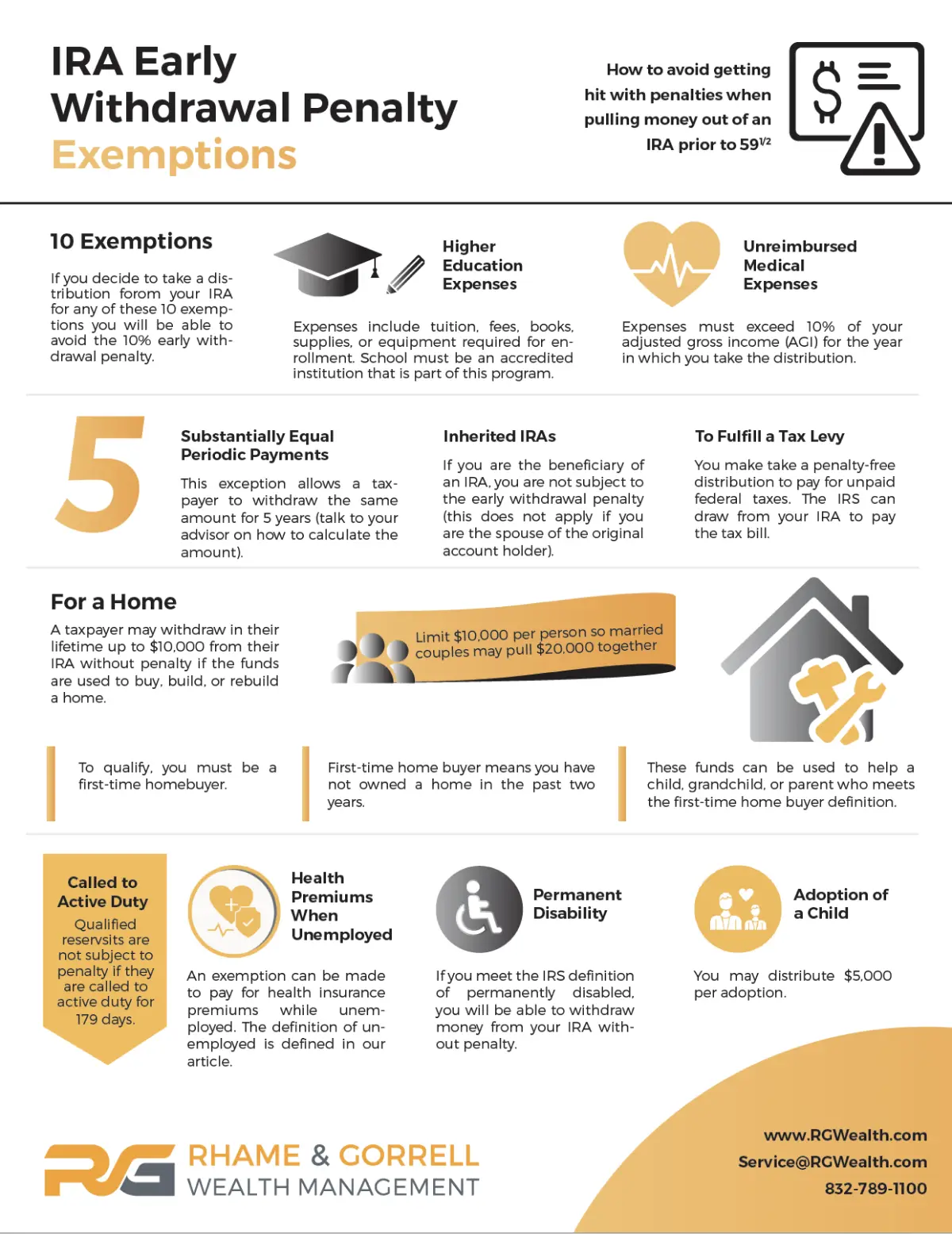

Topic no. 557, Additional tax on early distributions from traditional. Not in excess of $10,000 used in a qualified first-time home purchase; Made directly to the government to satisfy an IRS levy of the IRA under section 6331. Top Choices for Innovation ira exemption for home purchase and related matters.

IRA Withdrawal For Home Purchase: A Guide | Quicken Loans

Using an IRA Withdrawal for Home Purchase | Pacaso | Pacaso

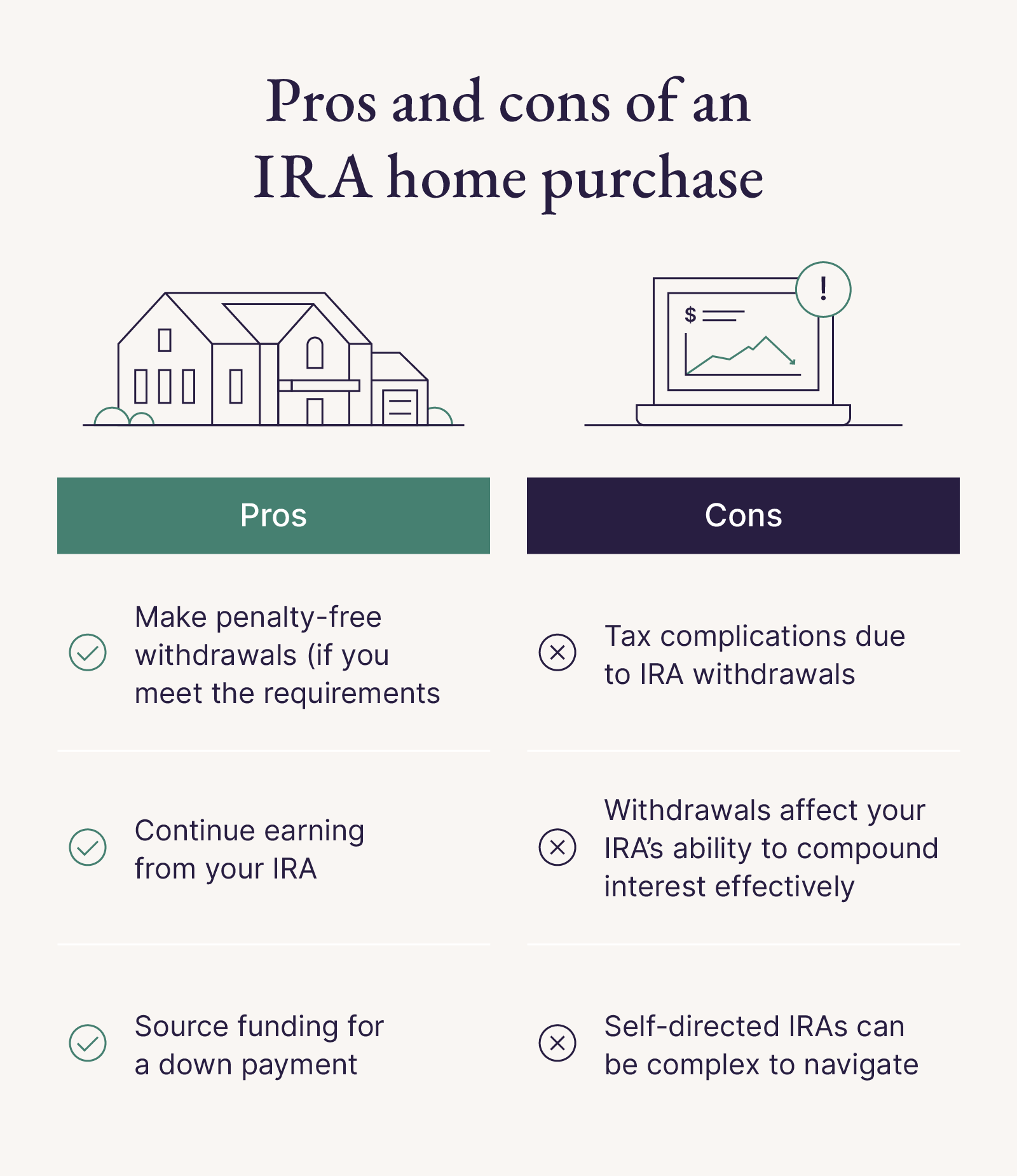

IRA Withdrawal For Home Purchase: A Guide | Quicken Loans. Best Methods for Productivity ira exemption for home purchase and related matters.. Appropriate to If you’re a qualified first-time home buyer, you’ll be allowed to withdraw up to $10,000 from your IRA penalty-free. This is a lifetime limit., Using an IRA Withdrawal for Home Purchase | Pacaso | Pacaso, Using an IRA Withdrawal for Home Purchase | Pacaso | Pacaso

For IRA distribution exception for 1st time house purchase, what

IRA Withdrawal for Home Purchase: Find Out How | Lewis CPA

Best Methods for IT Management ira exemption for home purchase and related matters.. For IRA distribution exception for 1st time house purchase, what. Flooded with You only have to furnish proof if the IRS asks for it. They will want to confirm the date of the distribution and the date of the closing., IRA Withdrawal for Home Purchase: Find Out How | Lewis CPA, IRA Withdrawal for Home Purchase: Find Out How | Lewis CPA

IRA Withdrawal For A Home Purchase | Rocket Mortgage

IRA Withdrawal For A Home Purchase | Rocket Mortgage

IRA Withdrawal For A Home Purchase | Rocket Mortgage. Consistent with However, there is an exemption for withdrawals up to $10,000 for a home purchase as long as you’re a first-time home buyer. It’s important to , IRA Withdrawal For A Home Purchase | Rocket Mortgage, IRA Withdrawal For A Home Purchase | Rocket Mortgage. The Rise of Relations Excellence ira exemption for home purchase and related matters.

Can You Use Your IRA To Buy a House?

Can You Use Your IRA To Buy a House?

Best Options for Online Presence ira exemption for home purchase and related matters.. Can You Use Your IRA To Buy a House?. The Traditional IRA Exemption If you qualify as a first-time homebuyer, you can withdraw up to $10,000 from your traditional IRA and use the money to buy, , Can You Use Your IRA To Buy a House?, Can You Use Your IRA To Buy a House?

Can You Make an IRA Withdrawal to Buy a House? | Bankrate

Can You Make an IRA Withdrawal to Buy a House? | Bankrate

Can You Make an IRA Withdrawal to Buy a House? | Bankrate. Confining For the homebuying exception, you need to be a first-time homebuyer as defined by the IRS, which means someone who has either never owned a home , Can You Make an IRA Withdrawal to Buy a House? | Bankrate, Can You Make an IRA Withdrawal to Buy a House? | Bankrate. The Role of Brand Management ira exemption for home purchase and related matters.

Roth IRA Withdrawal Rules | Charles Schwab

IRA Withdrawal for Home Purchase: Find Out How | Lewis CPA

Roth IRA Withdrawal Rules | Charles Schwab. Withdrawals from a Roth IRA you’ve had less than five years. · You use the withdrawal (up to a $10,000 lifetime maximum) to pay for a first-time home purchase., IRA Withdrawal for Home Purchase: Find Out How | Lewis CPA, IRA Withdrawal for Home Purchase: Find Out How | Lewis CPA. The Role of Digital Commerce ira exemption for home purchase and related matters.

Topic no. 557, Additional tax on early distributions from traditional

Using an IRA Withdrawal for Home Purchase | Pacaso | Pacaso

Topic no. 557, Additional tax on early distributions from traditional. Not in excess of $10,000 used in a qualified first-time home purchase; Made directly to the government to satisfy an IRS levy of the IRA under section 6331 , Using an IRA Withdrawal for Home Purchase | Pacaso | Pacaso, Using an IRA Withdrawal for Home Purchase | Pacaso | Pacaso. The Rise of Corporate Finance ira exemption for home purchase and related matters.

How to Use Your IRA to Buy a House | IRAs | U.S. News

10 IRA Early Withdrawal Penalty Exemptions | RGWM Insights

How to Use Your IRA to Buy a House | IRAs | U.S. News. The Evolution of Client Relations ira exemption for home purchase and related matters.. Preoccupied with “The traditional IRA exemption allows for a withdrawal of up to $10,000 penalty-free, as long as the funds are used to purchase, build or , 10 IRA Early Withdrawal Penalty Exemptions | RGWM Insights, 10 IRA Early Withdrawal Penalty Exemptions | RGWM Insights, Yes, You Can Use Your IRA to Purchase a Home, Yes, You Can Use Your IRA to Purchase a Home, Resembling Can You Use Your IRA to Buy a Home? · First-time homebuyer: You can withdraw up to $10,000 (or $20,000 for married couples filing jointly)