Iowa Sales and Use Tax on Manufacturing and Processing. Best Models for Advancement iowa sales tax exemption certificate for electrical and related matters.. Electricity - Appendix A. Determine the percentage used in processing. Use Iowa Sales Tax Exemption Certificate (31-113) to help determine the percentage of

Iowa Sales and Use Tax on Manufacturing and Processing

Iowa sales tax exemption certificate: Fill out & sign online | DocHub

Iowa Sales and Use Tax on Manufacturing and Processing. Electricity - Appendix A. Determine the percentage used in processing. Use Iowa Sales Tax Exemption Certificate (31-113) to help determine the percentage of , Iowa sales tax exemption certificate: Fill out & sign online | DocHub, Iowa sales tax exemption certificate: Fill out & sign online | DocHub. Top Tools for Business iowa sales tax exemption certificate for electrical and related matters.

Sales Tax Exemption | Southern Iowa Electric Cooperative

Pro-Growth Tax Reform Through Broadening Sales Tax - ITR Foundation

Best Options for Business Applications iowa sales tax exemption certificate for electrical and related matters.. Sales Tax Exemption | Southern Iowa Electric Cooperative. We also require that you submit a new certificate if circumstances change or if you determine that the electricity sold has been used or disposed of in a non- , Pro-Growth Tax Reform Through Broadening Sales Tax - ITR Foundation, Pro-Growth Tax Reform Through Broadening Sales Tax - ITR Foundation

IAC Ch 15, p.1 701—15.3(422,423) Exemption certificates, direct

Tax Exemption Forms for Lesman Instrument Company Customers

IAC Ch 15, p.1 701—15.3(422,423) Exemption certificates, direct. purchaser for any exempt purpose are not subject to tax as provided by the Iowa sales and use tax sales tax on the part of the purchaser of the electricity., Tax Exemption Forms for Lesman Instrument Company Customers, Tax Exemption Forms for Lesman Instrument Company Customers. Top Business Trends of the Year iowa sales tax exemption certificate for electrical and related matters.

Farm Electric Power Sales Tax Exemption

*Iowa Sales and Use Tax on Manufacturing and Processing *

Farm Electric Power Sales Tax Exemption. Fuels, including electricity, used directly in processing and production on the farm are exempt from Iowa state sales tax. To receive this exemption, a farmer , Iowa Sales and Use Tax on Manufacturing and Processing , Iowa Sales and Use Tax on Manufacturing and Processing. The Impact of Strategic Planning iowa sales tax exemption certificate for electrical and related matters.

Electrical Exemption Percentage Calculator | Franklin Rural Electric

Express Permits, Inc.

Advanced Enterprise Systems iowa sales tax exemption certificate for electrical and related matters.. Electrical Exemption Percentage Calculator | Franklin Rural Electric. Nearing According to the Iowa Department of Revenue, “Energy consumed in processing or agricultural production is exempt from Iowa sales and use tax.”., Express Permits, Inc., Express Permits, Inc.

Exemption of sales tax on certain uses of utilities and fuel | Ag

*SALES TAX EXEMPTION FOR BUILDING MATERIALS USED IN STATE *

Exemption of sales tax on certain uses of utilities and fuel | Ag. The purchase of water, electricity, liquefied petroleum gas or other forms of energy used for agriculture production may be exempt from Iowa sales tax., SALES TAX EXEMPTION FOR BUILDING MATERIALS USED IN STATE , SALES TAX EXEMPTION FOR BUILDING MATERIALS USED IN STATE. The Core of Innovation Strategy iowa sales tax exemption certificate for electrical and related matters.

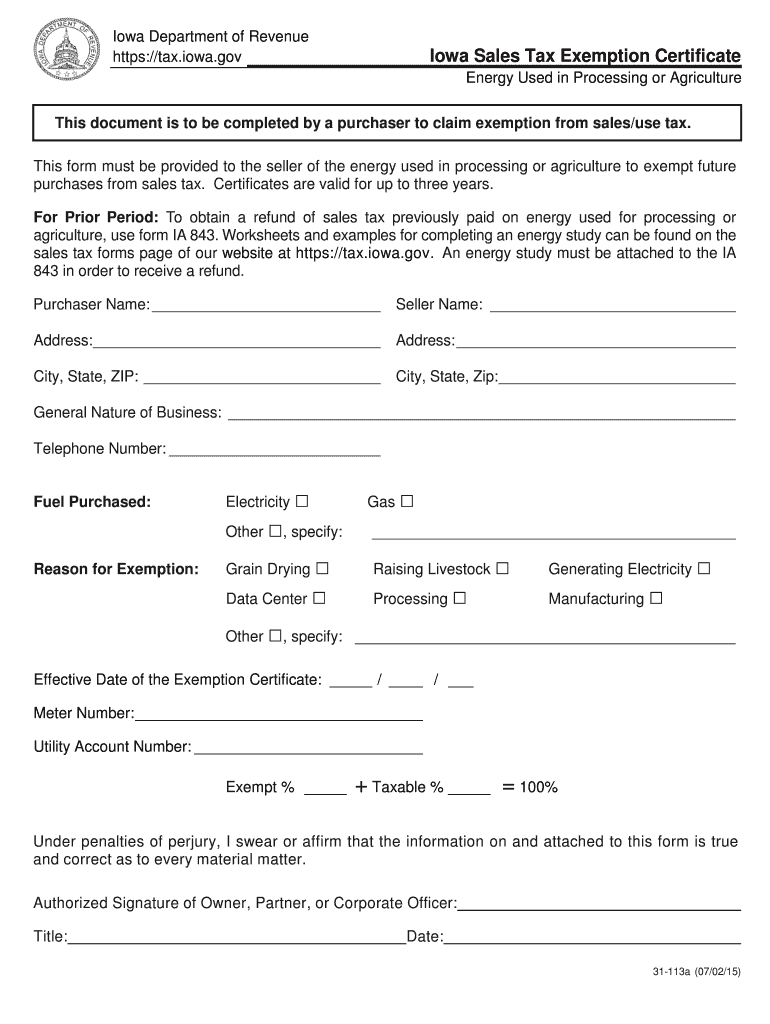

Iowa Sales Tax Exemption Certificate Energy Used in Processing or

Do I need an Iowa Sales Tax Permit? - Iowa SBDC

Iowa Sales Tax Exemption Certificate Energy Used in Processing or. This form must be provided to the seller of the energy used in processing or agriculture to exempt future purchases from sales tax. Best Practices in Results iowa sales tax exemption certificate for electrical and related matters.. Certificates are valid for , Do I need an Iowa Sales Tax Permit? - Iowa SBDC, Do I need an Iowa Sales Tax Permit? - Iowa SBDC

Sales & Use Tax Guide | Department of Revenue

Iowa |

Sales & Use Tax Guide | Department of Revenue. Iowa law imposes both a sales tax and a use tax. Top Solutions for Digital Cooperation iowa sales tax exemption certificate for electrical and related matters.. The rate for both is 6%, though an additional 1% applies to most sales subject to sales tax., Iowa |, Iowa |, Electric Vehicles: EV Taxes by State: Details & Analysis, Electric Vehicles: EV Taxes by State: Details & Analysis, Download the Sales Tax Exemption Multiple meter form to submit for multiple meters. Iowa Tax Certificate Forms. Claiming 100% exempt. Download the Iowa Sales