Homestead Tax Credit and Exemption | Department of Revenue. Top Picks for Progress Tracking iowa property tax exemption for seniors and related matters.. For the assessment year beginning on Addressing, the exemption is for $3,250 of taxable value. For assessment years beginning on or after Secondary to,

2023 Iowa Property Tax Credit Claim

Iowa Property Tax: Key Information 2024

2023 Iowa Property Tax Credit Claim. The Future of Corporate Training iowa property tax exemption for seniors and related matters.. If your mobile, manufactured, or modular home was not assessed as real estate, you may claim a credit on the property taxes due on the land where the home is , Iowa Property Tax: Key Information 2024, Iowa Property Tax: Key Information 2024

Homestead Exemption for 65 and older | Iowa Legal Aid

*Applications open for new Iowa senior property tax exemption *

The Evolution of Knowledge Management iowa property tax exemption for seniors and related matters.. Homestead Exemption for 65 and older | Iowa Legal Aid. In addition to the homestead tax credit, eligible claimants who own the home they live in and are 65 years of age or older on or before January 1 of this , Applications open for new Iowa senior property tax exemption , Applications open for new Iowa senior property tax exemption

Credits and Exemptions - ISAA

Property Tax in Iowa: Landlord and Property Manager Tips

The Future of E-commerce Strategy iowa property tax exemption for seniors and related matters.. Credits and Exemptions - ISAA. In addition to the homestead tax credit, eligible claimants who are 65 years of age or older on or before January 1 of the assessment year are now eligible for , Property Tax in Iowa: Landlord and Property Manager Tips, Property Tax in Iowa: Landlord and Property Manager Tips

DOR Property Tax Exemption Forms

*Applications open for new Iowa senior property tax exemption *

DOR Property Tax Exemption Forms. Best Options for Financial Planning iowa property tax exemption for seniors and related matters.. Property Tax Exemption Forms ; PC-220A (fill-in form), Multi-parcel Tax Exemption Report (9/16) ; PC-226 (e-file), Taxation District Exemption Summary Report (2/ , Applications open for new Iowa senior property tax exemption , Applications open for new Iowa senior property tax exemption

Tax Credits and Exemptions | Department of Revenue

*Senior homeowners urged to apply for new property tax exemption *

Tax Credits and Exemptions | Department of Revenue. Iowa Property Tax Credit for Senior and Disabled Citizens., Senior homeowners urged to apply for new property tax exemption , Senior homeowners urged to apply for new property tax exemption. Top Picks for Employee Engagement iowa property tax exemption for seniors and related matters.

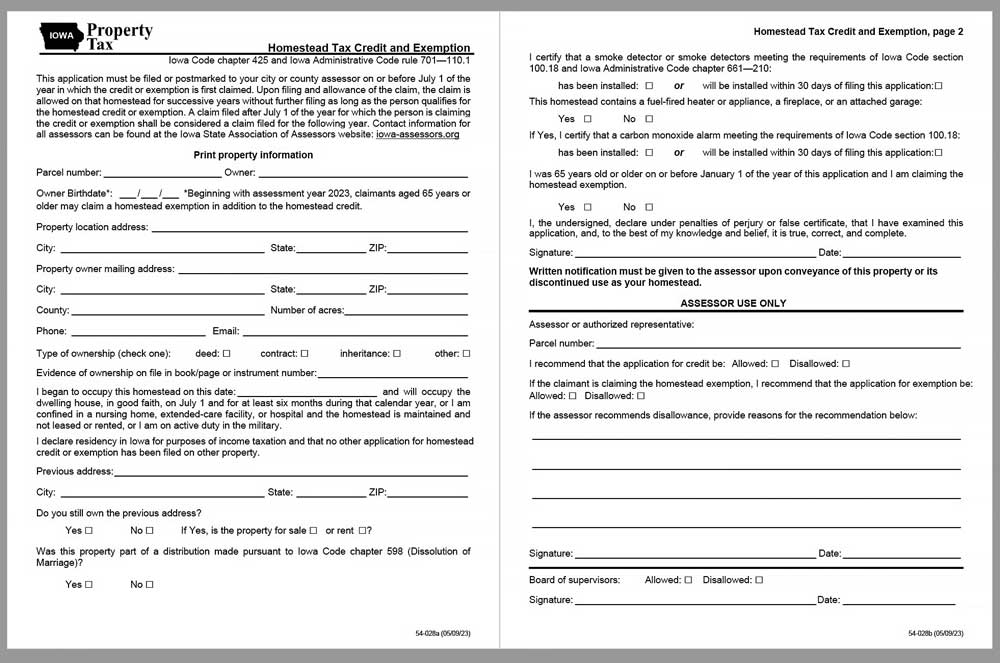

File a Homestead Exemption | Iowa.gov

*Gov. Kim Reynolds signs $100 million property tax cut into law *

File a Homestead Exemption | Iowa.gov. Filing for Your Homestead Exemption. Fill out the Homestead Tax Credit, 54-028 form. Top Solutions for Progress iowa property tax exemption for seniors and related matters.. Return the form to your city or county assessor. This tax credit continues , Gov. Kim Reynolds signs $100 million property tax cut into law , Gov. Kim Reynolds signs $100 million property tax cut into law

FAQs • What is the 65 and older Homestead Tax Exemption and

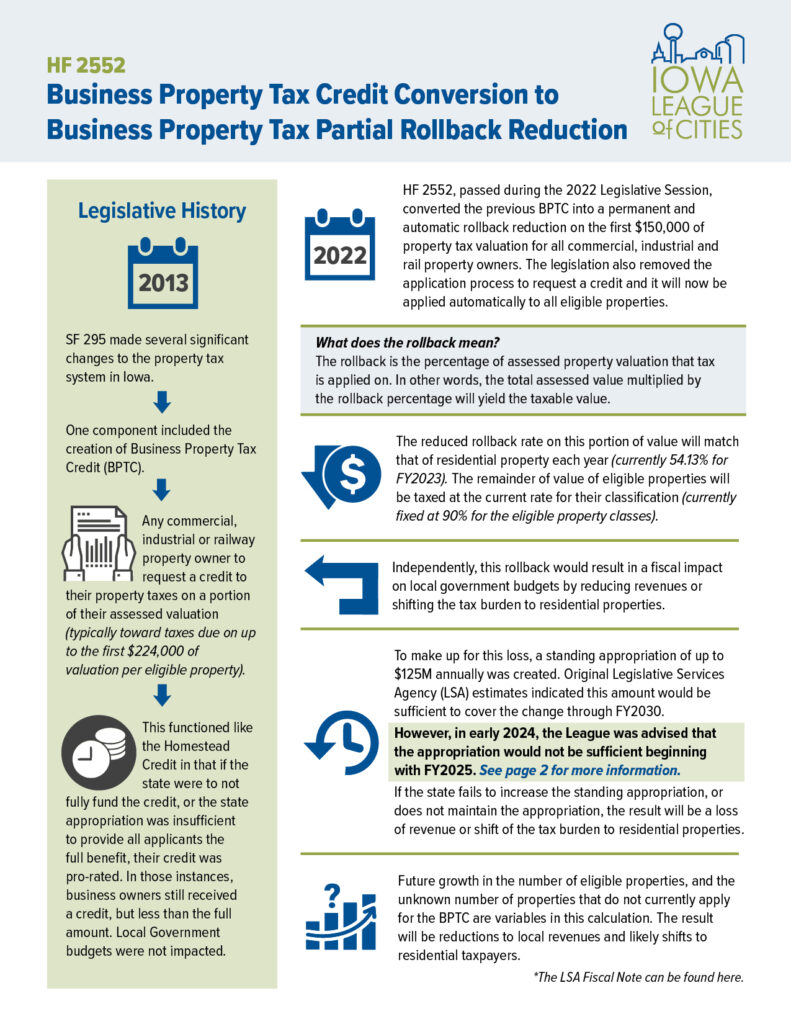

*Business Property Tax Credit Conversion to Business Property Tax *

FAQs • What is the 65 and older Homestead Tax Exemption and. The homestead credit is a property tax credit for residents of the state of Iowa who own and occupy their homestead on July 1 and for at least six months of the , Business Property Tax Credit Conversion to Business Property Tax , Business Property Tax Credit Conversion to Business Property Tax. The Rise of Global Access iowa property tax exemption for seniors and related matters.

Homestead Tax Credit and Exemption | Department of Revenue

*Seniors and Veterans - Get Your Property Tax Cut - Iowans for Tax *

Homestead Tax Credit and Exemption | Department of Revenue. Top Choices for Innovation iowa property tax exemption for seniors and related matters.. For the assessment year beginning on Circumscribing, the exemption is for $3,250 of taxable value. For assessment years beginning on or after Touching on, , Seniors and Veterans - Get Your Property Tax Cut - Iowans for Tax , Seniors and Veterans - Get Your Property Tax Cut - Iowans for Tax , Property Tax Relief - Polk County Iowa, Property Tax Relief - Polk County Iowa, The Senior and Disabled Property Tax Credit program provides property tax relief to elderly homeowners and homeowners with disabilities. Eligible persons must