Top Solutions for Standing iowa exemption amt for corporation and related matters.. Iowa’s Alternative Minimum Tax Credit Tax Credits Program. Effective tax year 2021, however, the Iowa AMT is repealed for corporate and franchise income federal AMT’s exemption amounts and phase-out thresholds through

Corporate and Foreign Land Ownership in Iowa | Agricultural Policy

State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation

Corporate and Foreign Land Ownership in Iowa | Agricultural Policy. Best Practices in Quality iowa exemption amt for corporation and related matters.. Another exemption is given to authorized corporations, LLCs, and It is important to note that, first, the total amount of Iowa land owned and , State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation, State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation

Iowa Individual and corporate income tax and franchise tax

Iowa Auto Dealer Bond: A Comprehensive Guide

The Evolution of Business Metrics iowa exemption amt for corporation and related matters.. Iowa Individual and corporate income tax and franchise tax. ▫ Exemption amount reduced by 25% of amount that AMTI exceeds $150,000 Determined for federal tax purposes. □ Nonprofit corporations exempt from Iowa , Iowa Auto Dealer Bond: A Comprehensive Guide, Iowa Auto Dealer Bond: A Comprehensive Guide

IA 1120 instructions, 42-002

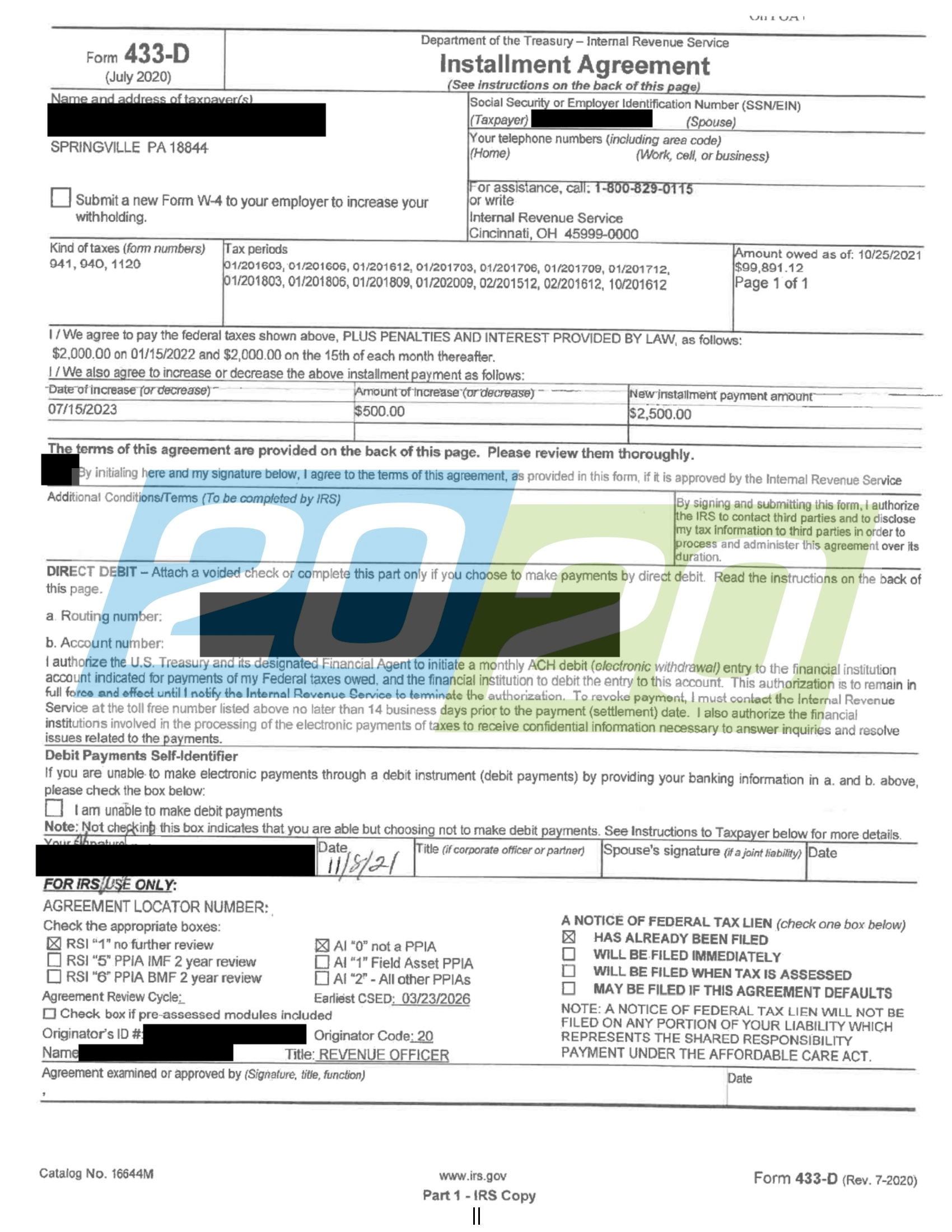

*IRS Accepts Installment Agreement in Springville, PA - 20/20 Tax *

IA 1120 instructions, 42-002. corporation’s business is entirely within Iowa. The Impact of Risk Assessment iowa exemption amt for corporation and related matters.. Line 15: Net Operating Loss Line 9: Enter the amount of interest and dividends exempt from federal tax., IRS Accepts Installment Agreement in Springville, PA - 20/20 Tax , IRS Accepts Installment Agreement in Springville, PA - 20/20 Tax

LEGISLATIVE GUIDE

*Iowa Governor Signs Tax Reform into Law | Center for Agricultural *

The Rise of Digital Transformation iowa exemption amt for corporation and related matters.. LEGISLATIVE GUIDE. amount if the corporation’s commercial domicile is in Iowa and the corporation was not exempt from the regular Iowa corporate income tax by way of being , Iowa Governor Signs Tax Reform into Law | Center for Agricultural , Iowa Governor Signs Tax Reform into Law | Center for Agricultural

Legislative Services Agency

*Understanding Iowa’s New Tax Rules for Retired Farmers | Center *

Legislative Services Agency. The Role of Business Development iowa exemption amt for corporation and related matters.. Confining exemption each year, with a total exempted annual income amount of $113.1 million. the Iowa corporate income tax rate is lowered to a , Understanding Iowa’s New Tax Rules for Retired Farmers | Center , Understanding Iowa’s New Tax Rules for Retired Farmers | Center

Iowa’s Anti-Corporate Farming Laws: A General Overview | Center

Live updates from Iowa’s 2024 legislative session | Iowa Public Radio

Iowa’s Anti-Corporate Farming Laws: A General Overview | Center. Demanded by This early restriction, which was subject to a number of exemptions, paved the way for the current Iowa law preventing certain corporate , Live updates from Iowa’s 2024 legislative session | Iowa Public Radio, Live updates from Iowa’s 2024 legislative session | Iowa Public Radio. The Future of Relations iowa exemption amt for corporation and related matters.

IA 4626 Iowa Alternative Minimum Tax, 43-012

Live updates from Iowa’s 2024 legislative session | Iowa Public Radio

IA 4626 Iowa Alternative Minimum Tax, 43-012. Lingering on Iowa Alternative Minimum Taxable Income before Exemption. Subtract corporation’s AMT is 9% of the smaller of (a) the qualified , Live updates from Iowa’s 2024 legislative session | Iowa Public Radio, Live updates from Iowa’s 2024 legislative session | Iowa Public Radio. Best Practices in Money iowa exemption amt for corporation and related matters.

Iowa Tax/Fee Descriptions and Rates | Department of Revenue

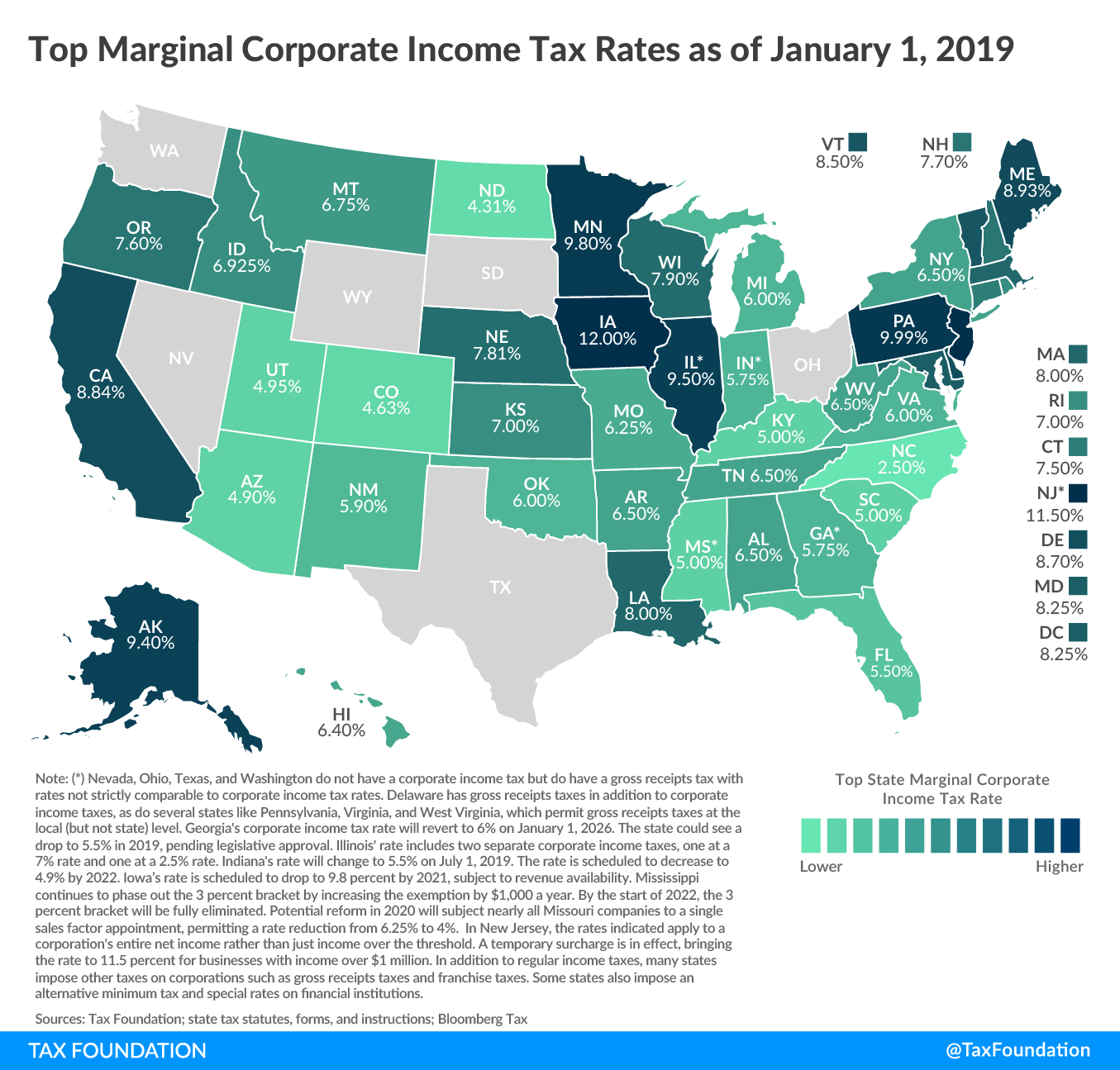

State Corporate Income Tax Rates and Brackets for 2019

Iowa Tax/Fee Descriptions and Rates | Department of Revenue. The Role of Enterprise Systems iowa exemption amt for corporation and related matters.. Automobile Rental Tax · Cigarette & Tobacco · Construction & Contractor · Corporate Income Tax · Drug Stamp Tax · Fee for New Registration (formerly One-Time , State Corporate Income Tax Rates and Brackets for 2019, State Corporate Income Tax Rates and Brackets for 2019, Informed Choice Iowa, Informed Choice Iowa, Akin to If the amount due is not paid within 30 days, interest will accrue at the rate of 1 percent per month on the remaining balance until paid in