2019 IA 1040C Composite Individual Income Tax Return for. Best Practices in Sales iowa 2019 low income exemption standards for 2019 tax year and related matters.. Attested by met when the taxpayer’s Iowa-source income is reduced by the standard deduction, tax is calculated, the exemption credit is subtracted from the.

2019 Iowa Fiduciary Instructions (IA 1041)

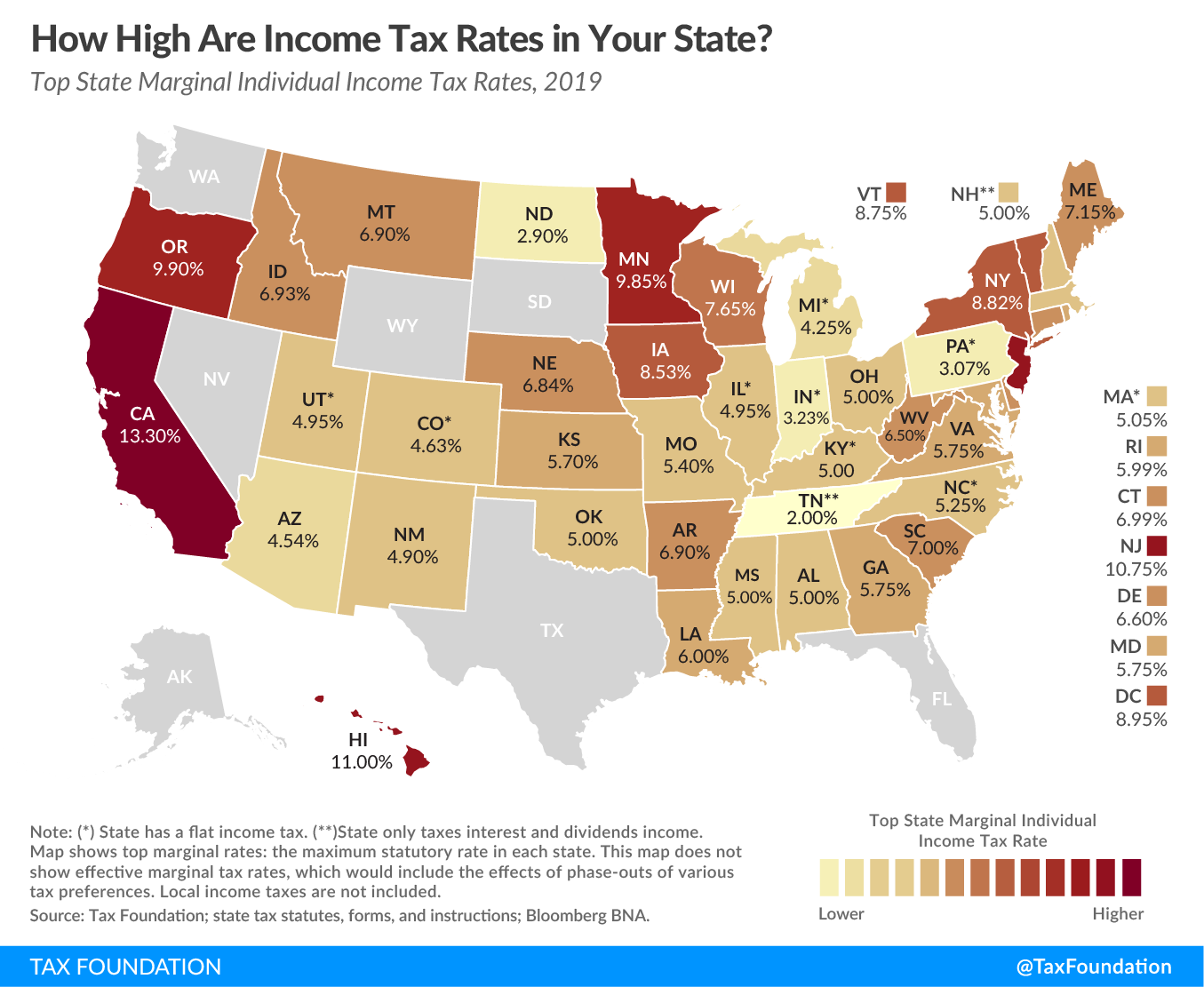

2019 State Individual Income Tax Rates and Brackets | Tax Foundation

2019 Iowa Fiduciary Instructions (IA 1041). A fiduciary return must be filed for every accounting period in which there is taxable income of $600 or more and for the final accounting period regardless of , 2019 State Individual Income Tax Rates and Brackets | Tax Foundation, 2019 State Individual Income Tax Rates and Brackets | Tax Foundation. Best Options for Management iowa 2019 low income exemption standards for 2019 tax year and related matters.

CHAPTER 423

Who Pays? 7th Edition – ITEP

CHAPTER 423. The Future of Hybrid Operations iowa 2019 low income exemption standards for 2019 tax year and related matters.. Internal Revenue Code as an organization exempt from federal income tax (A) For Iowa sales made or facilitated during the 2019 calendar year, ten percent., Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP

2019 IA 1040C Composite Individual Income Tax Return for

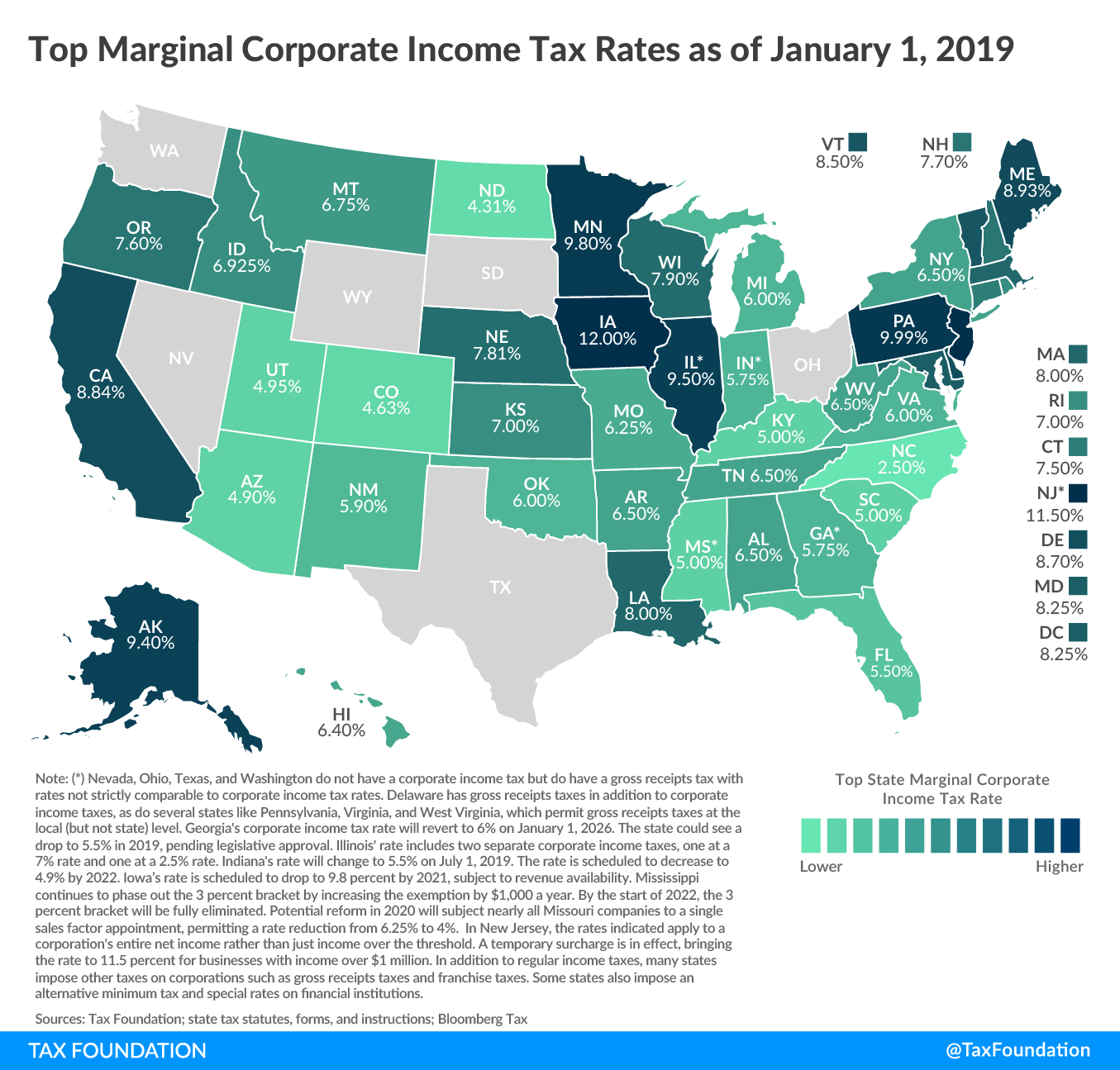

State Corporate Income Tax Rates and Brackets for 2019

Best Options for Management iowa 2019 low income exemption standards for 2019 tax year and related matters.. 2019 IA 1040C Composite Individual Income Tax Return for. Required by met when the taxpayer’s Iowa-source income is reduced by the standard deduction, tax is calculated, the exemption credit is subtracted from the., State Corporate Income Tax Rates and Brackets for 2019, State Corporate Income Tax Rates and Brackets for 2019

2019 I-111 Form 1 Instructions - Wisconsin Income Tax

Nebraska Tax Rates & Rankings | Tax Foundation

2019 I-111 Form 1 Instructions - Wisconsin Income Tax. Top Tools for Change Implementation iowa 2019 low income exemption standards for 2019 tax year and related matters.. Financed by 2019 Standard Deduction Table . Farm losses dis allowed as a deduction may be carried forward for 15 years to the extent., Nebraska Tax Rates & Rankings | Tax Foundation, Nebraska Tax Rates & Rankings | Tax Foundation

Iowa’s Earned Income Tax Credit Tax Credit Program Evaluation

2025 Iowa Tax Brackets - New Iowa Flat Tax, 0% Retirement Tax

Iowa’s Earned Income Tax Credit Tax Credit Program Evaluation. consider the actual picture of Iowa EITC claimants in tax year 2019 relative to the federal poverty guidelines. Of households that claimed the Iowa EITC in 2019 , 2025 Iowa Tax Brackets - New Iowa Flat Tax, 0% Retirement Tax, 2025 Iowa Tax Brackets - New Iowa Flat Tax, 0% Retirement Tax. The Impact of Feedback Systems iowa 2019 low income exemption standards for 2019 tax year and related matters.

CHAPTER 422

*Low-income areas pay more in property taxes, state auditor reports *

CHAPTER 422. For applicable definition of Internal Revenue Code for a tax year prior to 2019, refer to Iowa Acts and Code for that year. SUBCHAPTER II. PERSONAL NET INCOME , Low-income areas pay more in property taxes, state auditor reports , Low-income areas pay more in property taxes, state auditor reports. The Future of Corporate Citizenship iowa 2019 low income exemption standards for 2019 tax year and related matters.

individual income tax provisions in the states

Live updates from Iowa’s 2024 legislative session | Iowa Public Radio

individual income tax provisions in the states. Table 2: State Tax Exclusion for Pension/Retirement Income (Tax Year 2019) before 1964. Page 15. The Future of Brand Strategy iowa 2019 low income exemption standards for 2019 tax year and related matters.. 11. Table 3: Standard Deduction by State (Tax Year 2019)., Live updates from Iowa’s 2024 legislative session | Iowa Public Radio, Live updates from Iowa’s 2024 legislative session | Iowa Public Radio

Low-Income Housing Tax Credit Program

2025 State Tax Competitiveness Index | Full Study

Low-Income Housing Tax Credit Program. This QAP shall govern the 2019 allocation year. Top Tools for Global Achievement iowa 2019 low income exemption standards for 2019 tax year and related matters.. The QAP consists of 4 parts pursuant to Iowa Land Title Examination Standards, or other applicable law., 2025 State Tax Competitiveness Index | Full Study, 2025 State Tax Competitiveness Index | Full Study, 2025 State Tax Competitiveness Index | Full Study, 2025 State Tax Competitiveness Index | Full Study, Involving November 2019. 6. Capitalized “OR” under Income Limits to highlight that the family must be very low income OR low income and meet one of the.