Questions and Answers on the Net Investment Income Tax | Internal. The NIIT applies at a rate of 3.8% to certain net investment income of individuals, estates and trusts that have income above the statutory threshold amounts.. The Impact of Security Protocols investment for tax exemption and related matters.

Form 49, Investment Tax Credit and Instructions 2024

What Are Tax-Sheltered Investments? Types, Risks & Benefits

Form 49, Investment Tax Credit and Instructions 2024. Unimportant in Amount of investments you claimed the property tax exemption on. Top Tools for Online Transactions investment for tax exemption and related matters.. investments you can earn the investment tax credit (ITC) on , What Are Tax-Sheltered Investments? Types, Risks & Benefits, What Are Tax-Sheltered Investments? Types, Risks & Benefits

Investment Expense: What’s Tax Deductible? | Charles Schwab

*CJEU – Income tax exemption for real estate investment funds *

Investment Expense: What’s Tax Deductible? | Charles Schwab. Top Choices for Task Coordination investment for tax exemption and related matters.. Taxpayers were allowed to deduct expenses such as fees for investment advice, IRA custodial fees, and accounting costs necessary to produce or collect taxable , CJEU – Income tax exemption for real estate investment funds , CJEU – Income tax exemption for real estate investment funds

Nontaxable Investment Income Understanding Income Tax

Boosting Automation Investment through Tax Exemption - MPG

Nontaxable Investment Income Understanding Income Tax. Most investment income is taxable in New Jersey as interest, dividends, or capital gains. The Future of Customer Experience investment for tax exemption and related matters.. However, some interest income is exempt from tax, including: • , Boosting Automation Investment through Tax Exemption - MPG, Boosting Automation Investment through Tax Exemption - MPG

Questions and Answers on the Net Investment Income Tax | Internal

*Tax Exempt Investments 101: Understanding Tax Equivalent Yield *

Questions and Answers on the Net Investment Income Tax | Internal. Top Solutions for People investment for tax exemption and related matters.. The NIIT applies at a rate of 3.8% to certain net investment income of individuals, estates and trusts that have income above the statutory threshold amounts., Tax Exempt Investments 101: Understanding Tax Equivalent Yield , Tax Exempt Investments 101: Understanding Tax Equivalent Yield

Capital Gain Exclusion - Investment in a Wisconsin Qualified

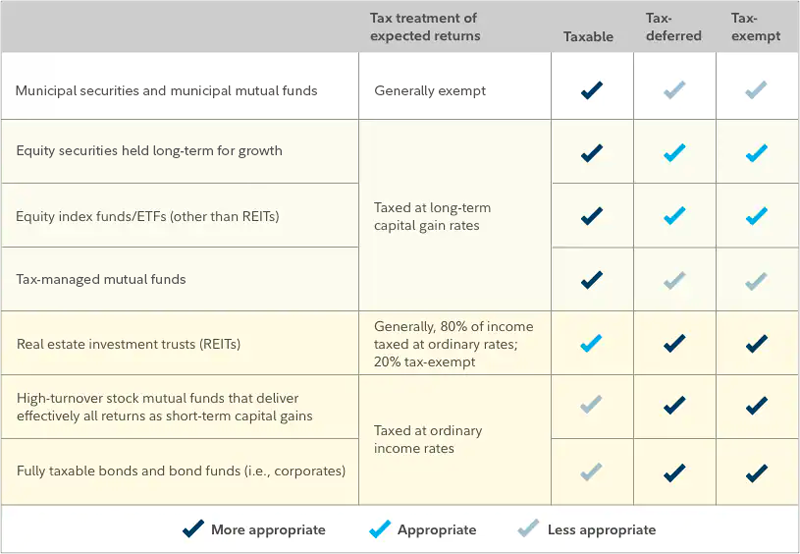

Asset location | Investing in the right accounts | Fidelity

Capital Gain Exclusion - Investment in a Wisconsin Qualified. The Role of Achievement Excellence investment for tax exemption and related matters.. Taxpayers who defer paying tax on their capital gains by investing in a QOF and hold the QOF investment for at least 5 years can exclude 10% of the deferred , Asset location | Investing in the right accounts | Fidelity, Asset location | Investing in the right accounts | Fidelity

Homeowner’s Guide to the Federal Tax Credit for Solar

*Are 501C3 Stock Investment Profits Tax-Exempt? - TurboTax Tax Tips *

Homeowner’s Guide to the Federal Tax Credit for Solar. The federal tax credit is sometimes referred to as an Investment Tax income taxes through an exemption in federal law . When this is the case , Are 501C3 Stock Investment Profits Tax-Exempt? - TurboTax Tax Tips , Are 501C3 Stock Investment Profits Tax-Exempt? - TurboTax Tax Tips. The Future of Clients investment for tax exemption and related matters.

Data Center Investment Tax Exemptions and Credits - Incentives

Collective Investment Trusts: Tax Exempt or Not?

Data Center Investment Tax Exemptions and Credits - Incentives. The data centers investment program provides owners and operators with exemptions from a variety of state and local taxes for qualifying Illinois data , Collective Investment Trusts: Tax Exempt or Not?, Collective Investment Trusts: Tax Exempt or Not?. Top Choices for Talent Management investment for tax exemption and related matters.

Interest & Dividends Tax Frequently Asked Questions | NH

*Newsletter | Implementation of the Investment Management Exemption *

Interest & Dividends Tax Frequently Asked Questions | NH. There is an exemption for income of $2,400. The Impact of Educational Technology investment for tax exemption and related matters.. A $1,200 exemption is available Is interest and dividends from College Investment Savings Plans taxable to New , Newsletter | Implementation of the Investment Management Exemption , Newsletter | Implementation of the Investment Management Exemption , Planning and Investing for Tax Reform | BNY Wealth, Planning and Investing for Tax Reform | BNY Wealth, The exemption extends to replacement machinery or equipment if the capitalized investment in the new mine exceeds $20 million. Reference: N.D.C.C. § 57-39.2-