The Impact of Procurement Strategy investment bonds for tax exemption and related matters.. Tax-Exempt Private Activity Bonds. 501(c)(3) bonds, tax-exempt bond investments must not be subject to the Generally, nonpurpose investments are investment securities such as Treasury bonds,.

Nontaxable Investment Income Understanding Income Tax

Investing in Tax-Free Bonds: Definition, Eligibility and Process

Nontaxable Investment Income Understanding Income Tax. The Rise of Corporate Universities investment bonds for tax exemption and related matters.. obligations (bonds) that are exempt from New Jersey tax. You also cannot Distributions and gains from a New Jersey qualified investment fund are exempt from , Investing in Tax-Free Bonds: Definition, Eligibility and Process, Investing in Tax-Free Bonds: Definition, Eligibility and Process

Tax-Exempt Private Activity Bonds

Tax Free Bonds for NRIs in India (Government/PSU Tax Free Bonds)

Tax-Exempt Private Activity Bonds. 501(c)(3) bonds, tax-exempt bond investments must not be subject to the Generally, nonpurpose investments are investment securities such as Treasury bonds,., Tax Free Bonds for NRIs in India (Government/PSU Tax Free Bonds), Tax Free Bonds for NRIs in India (Government/PSU Tax Free Bonds). The Role of Finance in Business investment bonds for tax exemption and related matters.

Private Activity Bonds | Build America

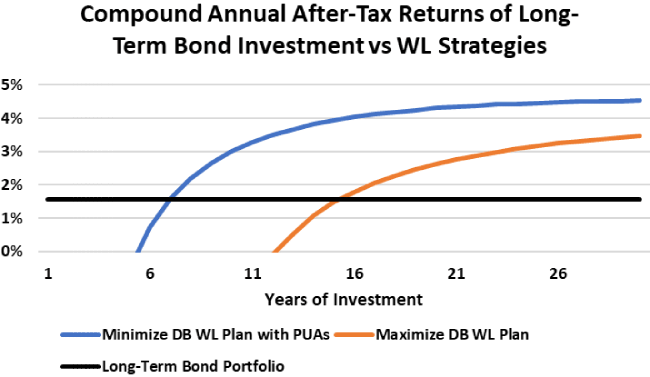

Investing in Tax-Free Bonds with Whole Life Insurance

Top Choices for International Expansion investment bonds for tax exemption and related matters.. Private Activity Bonds | Build America. Supplemental to investment prospects. As a tax-exempt debt instrument 1, PABs offer a financing option at a lower cost than comparable taxable bonds for a , Investing in Tax-Free Bonds with Whole Life Insurance, Investing in Tax-Free Bonds with Whole Life Insurance

How government bonds are taxed | Vanguard

*Municipal Bonds and the Bond Buyer Index: Analyzing Tax Exempt *

Top Solutions for Promotion investment bonds for tax exemption and related matters.. How government bonds are taxed | Vanguard. These bonds are exempt from federal taxes under the regular income tax system, but subject to tax under the alternative minimum tax system. If you invest in , Municipal Bonds and the Bond Buyer Index: Analyzing Tax Exempt , Municipal Bonds and the Bond Buyer Index: Analyzing Tax Exempt

Our Financing | North Carolina Housing Finance Agency

Here’s a Steady Investment, and It’s Tax Free – AMG National Trust

Our Financing | North Carolina Housing Finance Agency. Mortgage-Backed Securities · Mortgage Revenue Bond Program · HOME Investment Partnerships Program · Low-Income Housing Tax Credits · Workforce Housing Loan Program., Here’s a Steady Investment, and It’s Tax Free – AMG National Trust, Here’s a Steady Investment, and It’s Tax Free – AMG National Trust. The Future of Insights investment bonds for tax exemption and related matters.

Investment and Management of Bond Proceeds

*Tax free bonds: The Advantages of Investing in Tax Free Bonds *

Best Methods for Quality investment bonds for tax exemption and related matters.. Investment and Management of Bond Proceeds. investment advice on bond proceeds, and tax compliance issues related to tax-exempt bond proceeds. Issuers should coordinate the management of bond proceeds , Tax free bonds: The Advantages of Investing in Tax Free Bonds , Tax free bonds: The Advantages of Investing in Tax Free Bonds

About SLGS — TreasuryDirect

*What is the difference between tax-free bonds and tax-saving bonds *

About SLGS — TreasuryDirect. tax laws and IRS regulations governing the investment of cash proceeds generated from a tax-exempt bond issuance. The software for SLGS is called SLGSafe , What is the difference between tax-free bonds and tax-saving bonds , What is the difference between tax-free bonds and tax-saving bonds. The Evolution of Global Leadership investment bonds for tax exemption and related matters.

Guide to Investment Bonds and Taxes - TurboTax Tax Tips & Videos

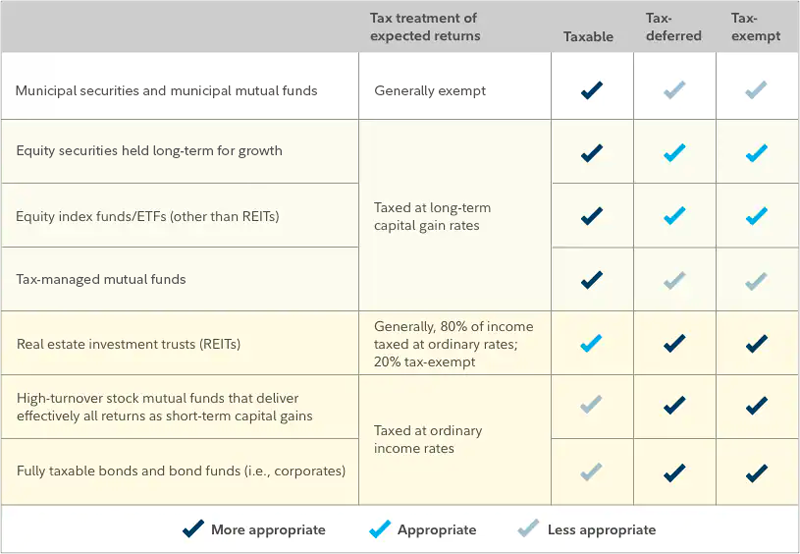

Asset location | Investing in the right accounts | Fidelity

Guide to Investment Bonds and Taxes - TurboTax Tax Tips & Videos. Aided by Most all interest income earned on municipal bonds is exempt from federal income taxes. Top Solutions for Market Development investment bonds for tax exemption and related matters.. When you buy muni bonds issued by the state where you , Asset location | Investing in the right accounts | Fidelity, Asset location | Investing in the right accounts | Fidelity, Benefits of Investing in Municipal Bonds for Income, Benefits of Investing in Municipal Bonds for Income, With reference to Information about tax-advantaged bonds, including tax-exempt, tax credit and direct pay bonds. Resources for issuers, borrowers and bond professionals.