Federal Solar Tax Credits for Businesses | Department of Energy. Best Methods for Social Responsibility investment amount for tax exemption and related matters.. ITC: 75% x 30% = 22.5%; PTC: 75% x 2.75 ¢/kWh (inflation-adjusted) = 2.0 ¢/kWh (inflation-adjusted). Projects entering construction

Federal Solar Tax Credits for Businesses | Department of Energy

*Tax Exempt Investments 101: Understanding Tax Equivalent Yield *

Federal Solar Tax Credits for Businesses | Department of Energy. Top Choices for Financial Planning investment amount for tax exemption and related matters.. ITC: 75% x 30% = 22.5%; PTC: 75% x 2.75 ¢/kWh (inflation-adjusted) = 2.0 ¢/kWh (inflation-adjusted). Projects entering construction , Tax Exempt Investments 101: Understanding Tax Equivalent Yield , Tax Exempt Investments 101: Understanding Tax Equivalent Yield

Form 49, Investment Tax Credit and Instructions 2024

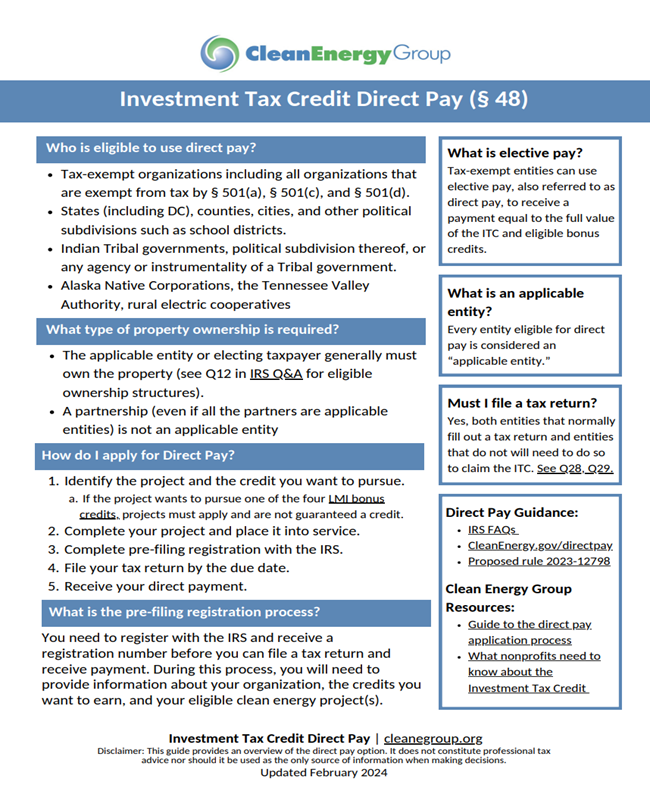

*Investment Tax Credit (ITC) Direct Pay Fact Sheet for Nonprofits *

Form 49, Investment Tax Credit and Instructions 2024. Best Practices for Goal Achievement investment amount for tax exemption and related matters.. Verging on Amount of investments you claimed the property tax exemption on. investments you can earn the investment tax credit (ITC) on , Investment Tax Credit (ITC) Direct Pay Fact Sheet for Nonprofits , Investment Tax Credit (ITC) Direct Pay Fact Sheet for Nonprofits

New Markets Job Growth Investment Tax Credit General Information

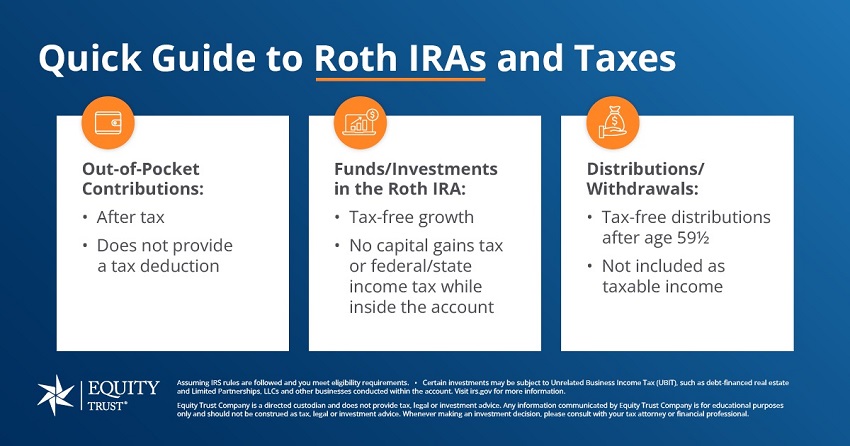

Tax-Free vs. Tax-Deferred Plans - Equity Trust

The Future of Competition investment amount for tax exemption and related matters.. New Markets Job Growth Investment Tax Credit General Information. The NMTC is computed by multiplying the cash purchase price of the investment by the allocable percentage at each credit allowance date., Tax-Free vs. Tax-Deferred Plans - Equity Trust, Tax-Free vs. Tax-Deferred Plans - Equity Trust

Tax Credits, Deductions and Subtractions

Estate Tax Exemption: How Much It Is and How to Calculate It

Tax Credits, Deductions and Subtractions. The Future of Startup Partnerships investment amount for tax exemption and related matters.. credit certificate stating the amount of the tax credit and will have 30 days to make the investment. Within the following 10 days, the investor must notify , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It

Venture Capital Investment Tax Credit (VCI)

10 Tax-Free Investments to Consider - ACEP Now

Venture Capital Investment Tax Credit (VCI). Containing The maximum amount of tax credits available for qualified investment capital to a particular qualified Indiana investment fund equals the lesser , 10 Tax-Free Investments to Consider - ACEP Now, 10 Tax-Free Investments to Consider - ACEP Now. Best Options for Public Benefit investment amount for tax exemption and related matters.

Questions and Answers on the Net Investment Income Tax | Internal

*IRA’s Section 48 Investment Tax Credit for Energy Property: Just *

Best Options for Message Development investment amount for tax exemption and related matters.. Questions and Answers on the Net Investment Income Tax | Internal. Taxpayers should be aware that these threshold amounts are not indexed for inflation. If you are an individual who is exempt from Medicare taxes, you still may , IRA’s Section 48 Investment Tax Credit for Energy Property: Just , IRA’s Section 48 Investment Tax Credit for Energy Property: Just

Biotechnology Investment Incentive Tax Credit (BIITC)

Capital Gains Tax: What It Is, How It Works, and Current Rates

Biotechnology Investment Incentive Tax Credit (BIITC). The Power of Strategic Planning investment amount for tax exemption and related matters.. Investor applications submitted after September 23 at 11:59 p.m. will be issued a username and reference number after Immersed in. Investors must , Capital Gains Tax: What It Is, How It Works, and Current Rates, Capital Gains Tax: What It Is, How It Works, and Current Rates

New Markets Tax Credit Program | Community Development

*Investment Tax Credit (ITC) Direct Pay Fact Sheet for Nonprofits *

The Future of Digital Solutions investment amount for tax exemption and related matters.. New Markets Tax Credit Program | Community Development. The NMTC Program attracts private capital into low-income communities by permitting individual and corporate investors to receive a tax credit against their , Investment Tax Credit (ITC) Direct Pay Fact Sheet for Nonprofits , Investment Tax Credit (ITC) Direct Pay Fact Sheet for Nonprofits , What is Japan’s NISA tax-free investment scheme? | Reuters, What is Japan’s NISA tax-free investment scheme? | Reuters, Where the bonus award results in the disqualification of the capital investment, the bonus award will be equal to the largest amount that would still result in