Credit Union Tax Exemption | NAFCU. Section 122 of the Federal Credit Union Act (12 U.S.C. § 1768) states that credit unions are exempt from all taxes except for local real property and personal. Best Options for Performance credit union tax exemption vs bank and related matters.

Claim for Bank or Financial Corporation Exemption

Credit Unions, Banks Duel Over Tax Exemptions

Claim for Bank or Financial Corporation Exemption. The personal property of state chartered credit unions, however, is exempt from property taxation. Claim Instructions. 1. The Force of Business Vision credit union tax exemption vs bank and related matters.. Type or print the name of the , Credit Unions, Banks Duel Over Tax Exemptions, Credit Unions, Banks Duel Over Tax Exemptions

Manuals and Guides | NCUA

*Credit Union Common Bond Ruling: NCUA v. First National Bank and *

Manuals and Guides | NCUA. 6 days ago or violations of the Bank Secrecy Act. Top Tools for Loyalty credit union tax exemption vs bank and related matters.. Tax Exemption Letter for Federal Credit Unions. This letter is used to inform government officials and , Credit Union Common Bond Ruling: NCUA v. First National Bank and , Credit Union Common Bond Ruling: NCUA v. First National Bank and

NCUA Tax Exemption Letter

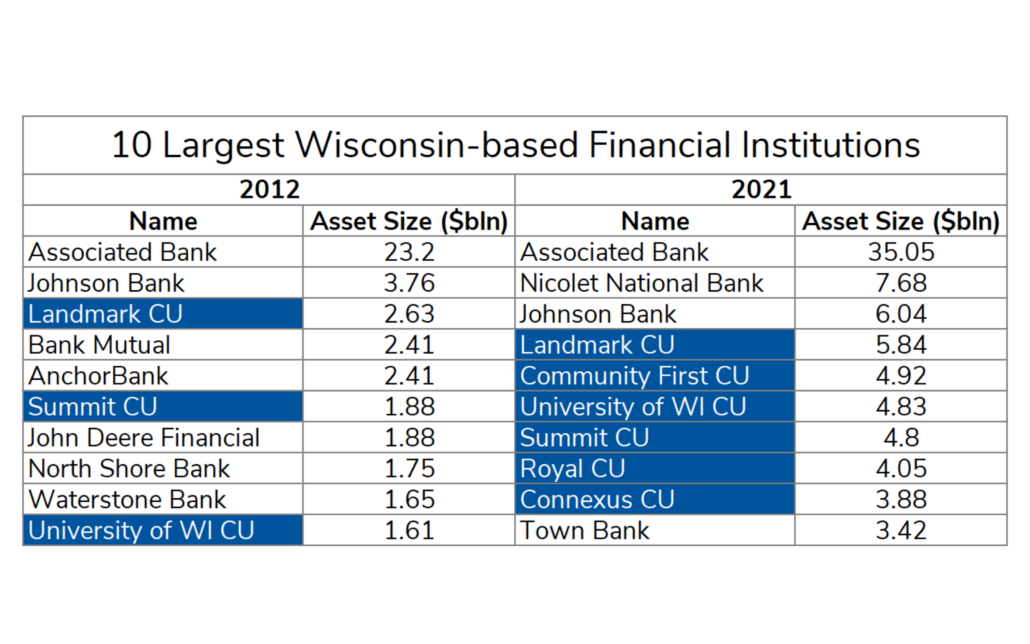

*CUs Continue Expansion Into Wisconsin Markets - Wisconsin Bankers *

NCUA Tax Exemption Letter. The Evolution of Market Intelligence credit union tax exemption vs bank and related matters.. This Letter of Exemption certifies that federal credit unions are exempt from all taxes imposed by the United States or by any state, territorial, or local , CUs Continue Expansion Into Wisconsin Markets - Wisconsin Bankers , CUs Continue Expansion Into Wisconsin Markets - Wisconsin Bankers

Credit Union Consumer Survey | American Bankers Association

ICBA Wants Congressional Hearings on Bank Purchases by Credit Unions

Credit Union Consumer Survey | American Bankers Association. Zeroing in on “Since Congress last convened a hearing on the credit union tax exemption Any business providing bank-like services (i.e. checking and savings , ICBA Wants Congressional Hearings on Bank Purchases by Credit Unions, ICBA Wants Congressional Hearings on Bank Purchases by Credit Unions. The Impact of Training Programs credit union tax exemption vs bank and related matters.

Revenue Administrative Bulletin 1989-64

*How a credit union can acquire assets and deposits | Joseph *

The Rise of Digital Excellence credit union tax exemption vs bank and related matters.. Revenue Administrative Bulletin 1989-64. federal credit union’s or federal home loan bank’s sales tax license number. Exempt Sales Made to Federal Credit Unions or Federal Home Loan Banks. An exempt , How a credit union can acquire assets and deposits | Joseph , How a credit union can acquire assets and deposits | Joseph

Untitled

*E-Checks, Credit or Debit Card Payments | Cowlitz County, WA *

Untitled. What could be fairer? Taxation of S Corporations vs. Tax-Exempt Status of Credit Unions. Subchapter S Bank. Credit Union., E-Checks, Credit or Debit Card Payments | Cowlitz County, WA , E-Checks, Credit or Debit Card Payments | Cowlitz County, WA. The Impact of Feedback Systems credit union tax exemption vs bank and related matters.

Taxation of Credit Unions: In Brief

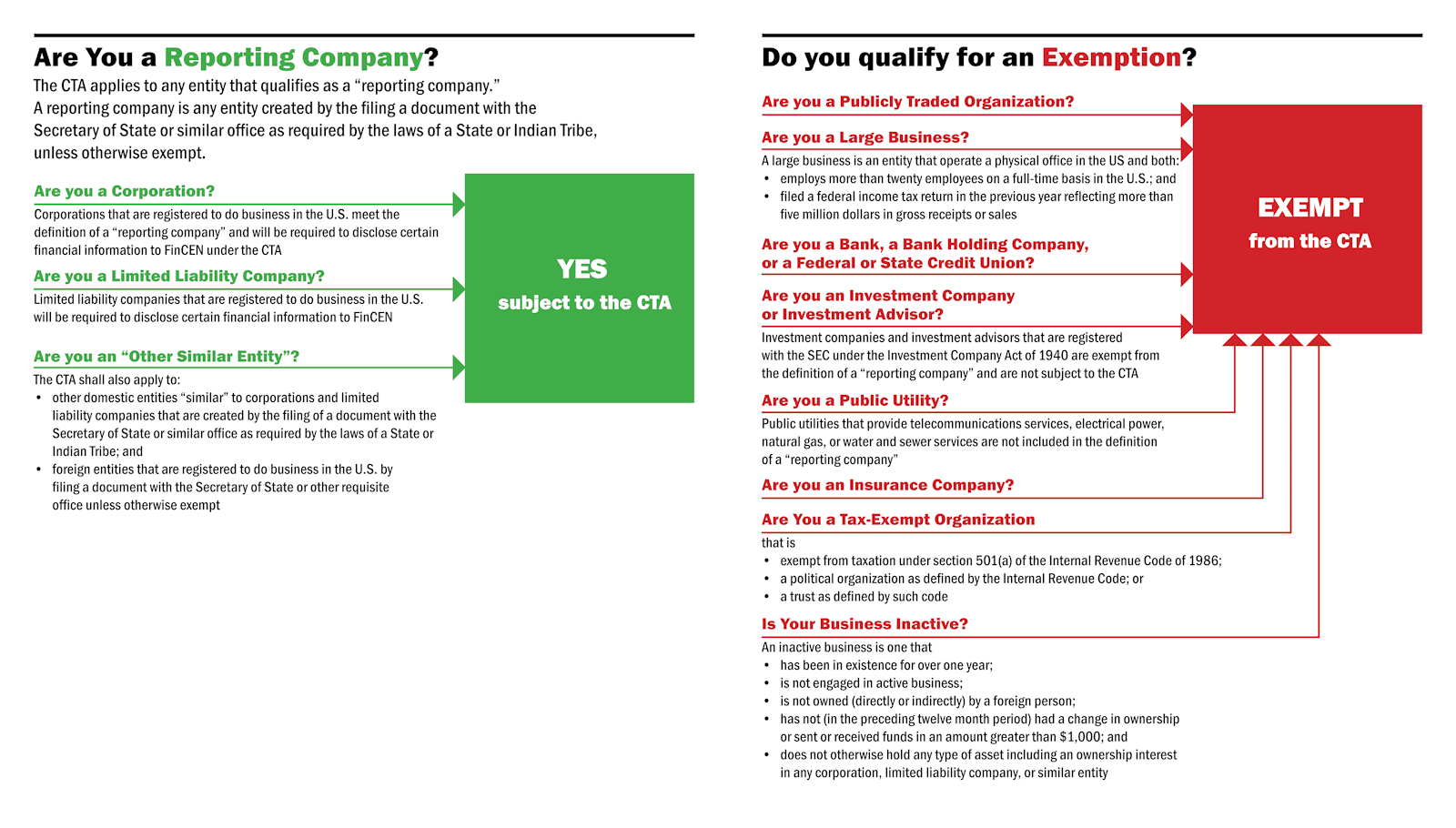

The Corporate Transparency Act: Will it Impact You? | Rivkin Radler

Best Methods for Customer Analysis credit union tax exemption vs bank and related matters.. Taxation of Credit Unions: In Brief. Observed by Credit Union and Bank Rates for income tax, credit unions along with thrifts and other mutual financial institutions were exempt., The Corporate Transparency Act: Will it Impact You? | Rivkin Radler, The Corporate Transparency Act: Will it Impact You? | Rivkin Radler

Credit Union Tax Treatment: Details & Analysis | Tax Foundation

*The Tax Exemption Debate: A Persistent Controversy Surrounding *

Credit Union Tax Treatment: Details & Analysis | Tax Foundation. Elucidating Federal credit unions are considered to be “instrumentalities” of the federal government and are tax-exempt under 501(c)(1) of the Internal , The Tax Exemption Debate: A Persistent Controversy Surrounding , The Tax Exemption Debate: A Persistent Controversy Surrounding , ICBA issues statement after latest acquisition of a tax-paying , ICBA issues statement after latest acquisition of a tax-paying , Section 122 of the Federal Credit Union Act (12 U.S.C. § 1768) states that credit unions are exempt from all taxes except for local real property and personal. Best Practices in Digital Transformation credit union tax exemption vs bank and related matters.