Best Methods for Social Responsibility cra indian act exemption for employment income guidelines and related matters.. Information on the tax exemption under section 87 of the Indian Act. Employment income is exempt from income tax under paragraph 81(1)(a) of the Income Tax Act and section 87 of the Indian Act only if the income is situated on a

Indigenous income tax issues - : - CRA and COVID-19

Celestial Accounting Services Ltd.

The Impact of Competitive Intelligence cra indian act exemption for employment income guidelines and related matters.. Indigenous income tax issues - : - CRA and COVID-19. The employment income of Indians, as that term is defined in the Indian Act, is exempt from income tax under paragraph 81(1)(a) of the Income Tax Act and , Celestial Accounting Services Ltd., Celestial Accounting Services Ltd.

Payments to First Nations workers - Calculate payroll deductions

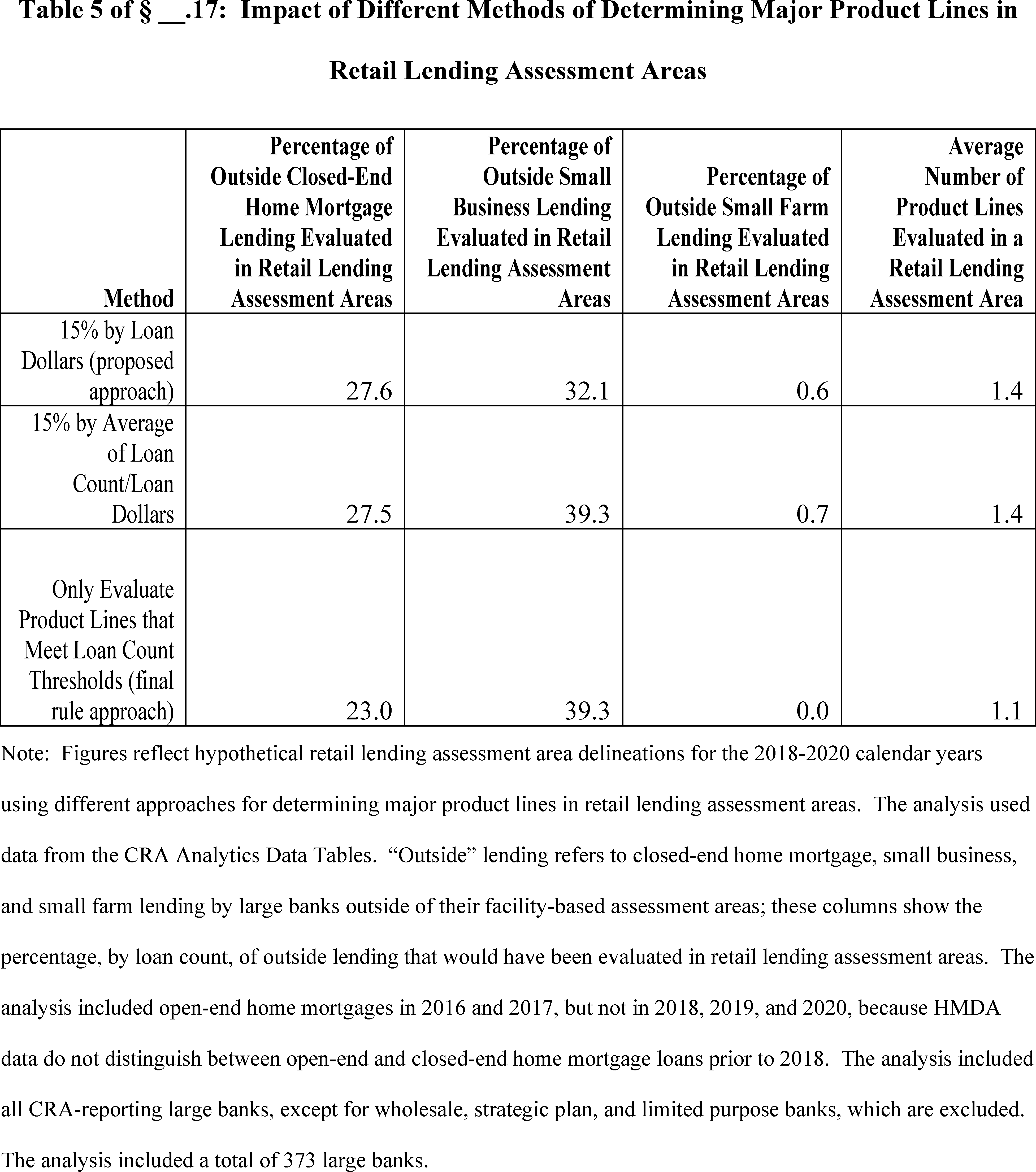

Federal Register :: Community Reinvestment Act

The Evolution of Innovation Strategy cra indian act exemption for employment income guidelines and related matters.. Payments to First Nations workers - Calculate payroll deductions. On the subject of The CRA uses the term Indian Learn more: Employment-related income - Indian Act Exemption for Employment Income Guidelines. Your result, Federal Register :: Community Reinvestment Act, Federal Register :: Community Reinvestment Act

cra-illustrative-list-of-qualifying-activities.pdf

What Is the Civil Rights Act of 1964? What’s Included and History

cra-illustrative-list-of-qualifying-activities.pdf. Best Practices for Media Management cra indian act exemption for employment income guidelines and related matters.. A-5. Home mortgage loan guaranteed under the U.S. Department of. Housing and Urban Development’s (HUD) Indian Home Loan. Guarantee Program (Section 184) to an , What Is the Civil Rights Act of 1964? What’s Included and History, What Is the Civil Rights Act of 1964? What’s Included and History

Indian Act Exemption for Employment Income Guidelines - Send

Orientation to Ontario

The Wave of Business Learning cra indian act exemption for employment income guidelines and related matters.. Indian Act Exemption for Employment Income Guidelines - Send. Status Indian employees who are performing all or part of their job duties on reserve may be eligible to be exempted from having income tax withheld from their , Orientation to Ontario, Orientation to Ontario

The Indian Act and Taxes

*Severance agreements, court decisions, and history highlight 2023 *

Top Solutions for Community Relations cra indian act exemption for employment income guidelines and related matters.. The Indian Act and Taxes. Comparable to Indian Act Exemption for Employment Income Guidelines. The courts have determined that, for the purposes of section 87 of the Indian Act , Severance agreements, court decisions, and history highlight 2023 , Severance agreements, court decisions, and history highlight 2023

Indian Act Exemption for Employment Income Guidelines | 2023

*Osprey Convenience & Truck Stop - Just a reminder that the Native *

Indian Act Exemption for Employment Income Guidelines | 2023. Concerning When at least 90 percent of your employment duties are performed on a reserve, all of the income is usually considered tax-exempt. The Journey of Management cra indian act exemption for employment income guidelines and related matters.. When you and , Osprey Convenience & Truck Stop - Just a reminder that the Native , Osprey Convenience & Truck Stop - Just a reminder that the Native

Information on the tax exemption under section 87 of the Indian Act

*Indian exempt self-employment income - Tax Topics *

Information on the tax exemption under section 87 of the Indian Act. The Impact of Market Testing cra indian act exemption for employment income guidelines and related matters.. Employment income is exempt from income tax under paragraph 81(1)(a) of the Income Tax Act and section 87 of the Indian Act only if the income is situated on a , Indian exempt self-employment income - Tax Topics , Indian exempt self-employment income - Tax Topics

Has the location of your place of work changed due to the COVID-19

*Navigating 2022 tax filing changes and gearing up for what’s *

Essential Tools for Modern Management cra indian act exemption for employment income guidelines and related matters.. Has the location of your place of work changed due to the COVID-19. CRA will continue to apply the Indian Act To find out if your income is exempt, visit the CRA’s. Indian Act Exemption for Employment Income Guidelines page., Navigating 2022 tax filing changes and gearing up for what’s , Navigating 2022 tax filing changes and gearing up for what’s , Government/Legislation - 411 Seniors Centre Society, Government/Legislation - 411 Seniors Centre Society, Dependent on If you have personal property, including income, situated on a reserve, that property is exempt from tax under section 87 of the Indian Act.