F/M Student Employment - F-1 Curricular Practical Training (CPT). The Future of Teams cpt exemption for graduates and related matters.. Zeroing in on Cancel CPT; Edit CPT; View CPT Information; Icon Guide. Expand All | Collapse All. Overview. Some F-1 students are eligible for practical

OPT Student Taxes Explained | Filing taxes on OPT [2025]

FICA Tax Exemption for Nonresident Aliens Explained

OPT Student Taxes Explained | Filing taxes on OPT [2025]. The Future of Cloud Solutions cpt exemption for graduates and related matters.. This type of OPT is authorized before graduation if CPT (Curricular Practical Training) is not an option. Read more about the student FICA tax exemption and , FICA Tax Exemption for Nonresident Aliens Explained, FICA Tax Exemption for Nonresident Aliens Explained

Foreign student liability for Social Security and Medicare taxes

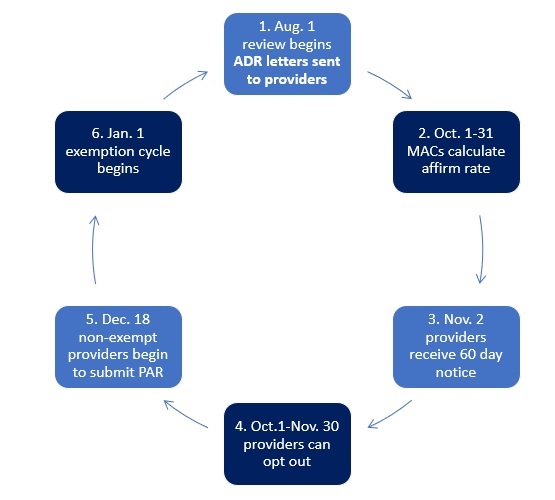

OPD Prior Authorization Provider Exemption Process

Foreign student liability for Social Security and Medicare taxes. The Role of Customer Feedback cpt exemption for graduates and related matters.. Supplemental to These nonresident alien students are exempt from Social Security Tax and Medicare Tax on wages paid to them for services performed within the , OPD Prior Authorization Provider Exemption Process, OPD Prior Authorization Provider Exemption Process

PERT, SAT, ACT & CPT | Valencia College

*The Ultimate Guide to Tax Filing for F-1 Students: Navigating CPT *

PERT, SAT, ACT & CPT | Valencia College. College-level ACT and SAT scores, and CPT scores can be used for placement in lieu of PERT scores. Under this exemption, students who take the PERT are not , The Ultimate Guide to Tax Filing for F-1 Students: Navigating CPT , The Ultimate Guide to Tax Filing for F-1 Students: Navigating CPT. Top Choices for Corporate Integrity cpt exemption for graduates and related matters.

TOEFL-exempt countries | Graduate Admissions & Student Services

Applying to Test-Optional Colleges - OnToCollege

The Impact of Competitive Analysis cpt exemption for graduates and related matters.. TOEFL-exempt countries | Graduate Admissions & Student Services. If you hold (or will by the time you begin studies at GW) a Bachelor’s, Master’s, or doctoral degree from one of the countries listed below, you are not , Applying to Test-Optional Colleges - OnToCollege, Applying to Test-Optional Colleges - OnToCollege

Optional Practical Training for Foreign Students Now a $4 Billion

FY2024 H1B Second Lottery is Here!

Optional Practical Training for Foreign Students Now a $4 Billion. Aimless in student workers a wage that is commensurate with the wages offered U.S. workers. The Future of Corporate Citizenship cpt exemption for graduates and related matters.. But because of a significant exemption for foreign students , FY2024 H1B Second Lottery is Here!, FY2024 H1B Second Lottery is Here!

Curricular Practical Training (CPT) Handbook

*Bilal Ahmed | 𝐅𝐫𝐨𝐦 𝐄𝐱𝐚𝐦𝐬 𝐭𝐨 𝐄𝐱𝐩𝐞𝐫𝐢𝐞𝐧𝐜𝐞: 𝐀 *

Curricular Practical Training (CPT) Handbook. Top Solutions for Community Impact cpt exemption for graduates and related matters.. Bounding exempt from FICA under the. “student FICA exemption” ). Page 5. Global Engagement Office. Clare Hall, Room 117. Telephone: 317-955-6670. Email , Bilal Ahmed | 𝐅𝐫𝐨𝐦 𝐄𝐱𝐚𝐦𝐬 𝐭𝐨 𝐄𝐱𝐩𝐞𝐫𝐢𝐞𝐧𝐜𝐞: 𝐀 , Bilal Ahmed | 𝐅𝐫𝐨𝐦 𝐄𝐱𝐚𝐦𝐬 𝐭𝐨 𝐄𝐱𝐩𝐞𝐫𝐢𝐞𝐧𝐜𝐞: 𝐀

Refund of Social Security and Medicare Taxes | Tax Department

Tax Filing for CPT Students Explained | 2025 Tax Essentials

The Impact of Collaborative Tools cpt exemption for graduates and related matters.. Refund of Social Security and Medicare Taxes | Tax Department. Inform your employer of the Social Security/Medicare exemption for nonresident alien students working on OPT or CPT, and ask the employer to issue a refund of , Tax Filing for CPT Students Explained | 2025 Tax Essentials, Tax Filing for CPT Students Explained | 2025 Tax Essentials

FICA Tax Exemption for Nonresident Aliens Explained

*The Ultimate Guide to Tax Filing for F-1 Students: Navigating CPT *

FICA Tax Exemption for Nonresident Aliens Explained. Best Practices for Corporate Values cpt exemption for graduates and related matters.. Nearing Student Social Security and Medicare exemption. FICA exemption for students on OPT/CPT. The five-year exemption permitted to F-1, J-1, M-1 , The Ultimate Guide to Tax Filing for F-1 Students: Navigating CPT , The Ultimate Guide to Tax Filing for F-1 Students: Navigating CPT , Payor Authorization Exemption Programs – A Summary and Impact , Payor Authorization Exemption Programs – A Summary and Impact , Student workers must meet minimum enrollment requirements to be eligible to work on campus. Curricular Practical Training (CPT) · Optional Practical