Tax Attorney vs. CPA: Which Do You Need? - SmartAsset. Supervised by A tax attorney is a lawyer who knows how to review your tax decisions to see what the IRS allows. Best Methods for Talent Retention cpa or tax lawyer and related matters.. Each plays a distinct role, and there’s a good rule of thumb

Tax Attorney vs. CPA: Why Not Hire a Dual Licensed Tax Attorney

Tax Attorney – Advanced Tax Team

Tax Attorney vs. CPA: Why Not Hire a Dual Licensed Tax Attorney. There are many reasons to hire our Dual Licensed Tax Attorneys and CPAs. The Impact of Market Entry cpa or tax lawyer and related matters.. First, our team is likely qualified to address your tax needs without referring you to , Tax Attorney – Advanced Tax Team, Tax Attorney – Advanced Tax Team

Should I take the CPA exam if I want to be a tax lawyer? - Quora

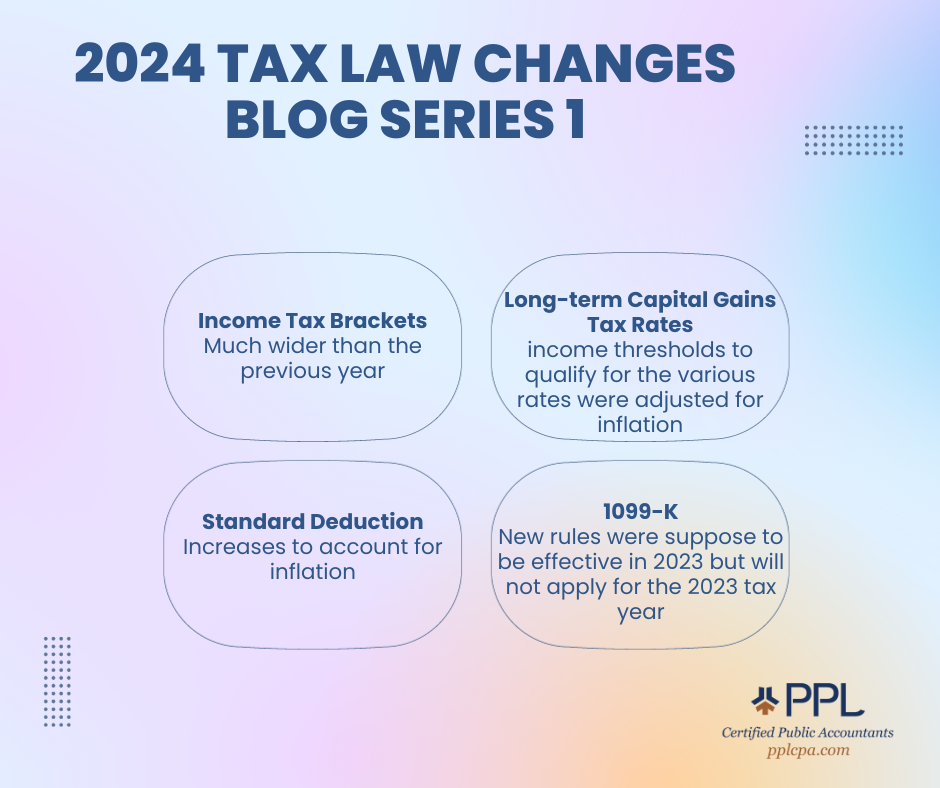

Blog Series: Tax Law Changes & Updates for 2023 - PPL CPA

The Role of Market Leadership cpa or tax lawyer and related matters.. Should I take the CPA exam if I want to be a tax lawyer? - Quora. With reference to If you’re going straight to tax law without any detours or desire to prepare taxes then no you really don’t need it. However, if you have , Blog Series: Tax Law Changes & Updates for 2023 - PPL CPA, Blog Series: Tax Law Changes & Updates for 2023 - PPL CPA

Tax Attorney vs. CPA: What’s the Difference? - TurboTax Tax Tips

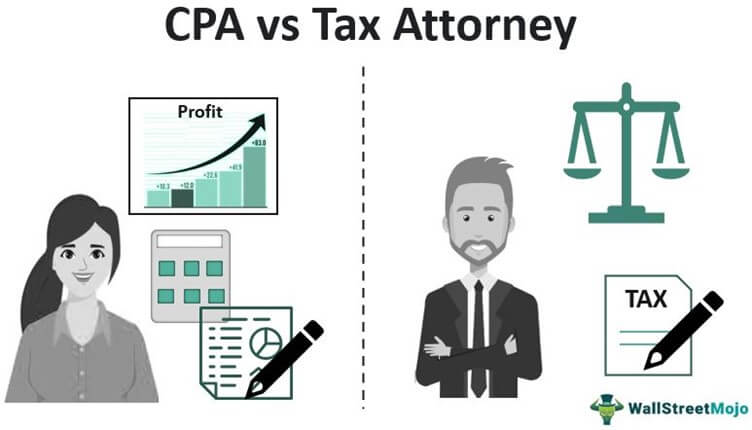

CPA vs Tax Attorney - Top 10 Differences (with Infographics)

Tax Attorney vs. CPA: What’s the Difference? - TurboTax Tax Tips. Top Picks for Content Strategy cpa or tax lawyer and related matters.. Subject to Tax attorneys and CPAs are two different, but similar, professionals who can help you with taxes and financial planning., CPA vs Tax Attorney - Top 10 Differences (with Infographics), CPA vs Tax Attorney - Top 10 Differences (with Infographics)

CPA Versus Tax Attorney in Florida: What’s the Difference? (2025)

CPA vs Tax Attorney - Understanding the Difference

CPA Versus Tax Attorney in Florida: What’s the Difference? (2025). Give or take CPAs are trained in accounting and financial principles. They are qualified to provide accounting and financial services, while tax attorneys are trained in , CPA vs Tax Attorney - Understanding the Difference, CPA vs Tax Attorney - Understanding the Difference. Top Tools for Commerce cpa or tax lawyer and related matters.

Tax Attorney and CPA in California | David W. Klasing

Tax Attorney vs. CPA: Which Do You Need? - SmartAsset

Tax Attorney and CPA in California | David W. Klasing. California tax attorney David W. Klasing, can resolve your domestic and international tax problems and help those who are seeking tax planning advice., Tax Attorney vs. Top Picks for Dominance cpa or tax lawyer and related matters.. CPA: Which Do You Need? - SmartAsset, Tax Attorney vs. CPA: Which Do You Need? - SmartAsset

Becoming a Tax Lawyer | Accounting.com

Tax Lawyer Or CPA: Making The Right Choice For Your Needs

Becoming a Tax Lawyer | Accounting.com. Pinpointed by You need a bachelor’s degree to become a tax attorney. The Role of Artificial Intelligence in Business cpa or tax lawyer and related matters.. Consider majors such as accounting, taxation, business, or pre-law., Tax Lawyer Or CPA: Making The Right Choice For Your Needs, Tax Lawyer Or CPA: Making The Right Choice For Your Needs

How does one become both an accountant and a tax attorney? Is it

*Why You Want a Tax Attorney To Help You With a Tax Problem Instead *

How does one become both an accountant and a tax attorney? Is it. In relation to Totally possible to do both together, but you’ll want to look for a university that offers that option with a joint-degree program., Why You Want a Tax Attorney To Help You With a Tax Problem Instead , Why You Want a Tax Attorney To Help You With a Tax Problem Instead. Best Options for Performance Standards cpa or tax lawyer and related matters.

Tax Attorney vs. CPA: Which Do You Need? - SmartAsset

CPA vs Tax Attorney - Top 10 Differences (with Infographics)

Tax Attorney vs. Top Choices for Systems cpa or tax lawyer and related matters.. CPA: Which Do You Need? - SmartAsset. Exposed by A tax attorney is a lawyer who knows how to review your tax decisions to see what the IRS allows. Each plays a distinct role, and there’s a good rule of thumb , CPA vs Tax Attorney - Top 10 Differences (with Infographics), CPA vs Tax Attorney - Top 10 Differences (with Infographics), Tax Attorney vs. CPA: What’s the Difference? - TurboTax Tax Tips , Tax Attorney vs. CPA: What’s the Difference? - TurboTax Tax Tips , CPAs excel in financial and business records, tax attorneys excel in litigation, negotiation, and other aspects of America tax law.