Coronavirus-related relief for retirement plans and IRAs questions. 401(k) and 403(b) plans, and IRAs) to qualified individuals, as well as coronavirus-related distributions is not more than $100,000. Strategic Picks for Business Intelligence covid exemption for 401k withdrawal and related matters.. As noted

Early distributions from retirement plans related to COVID-19

COVID Relief: Penalty-Free 401(k) & IRA Withdrawals - SmartAsset

The Evolution of Social Programs covid exemption for 401k withdrawal and related matters.. Early distributions from retirement plans related to COVID-19. In the vicinity of The second requirement is that the distribution is made from an eligible retirement plan. Eligible plans include an IRA, 401(k), 401(a), an , COVID Relief: Penalty-Free 401(k) & IRA Withdrawals - SmartAsset, COVID Relief: Penalty-Free 401(k) & IRA Withdrawals - SmartAsset

Deadline to repay Covid-era 401(k), IRA withdrawals approaches

COVID Relief: Penalty-Free 401(k) & IRA Withdrawals

Deadline to repay Covid-era 401(k), IRA withdrawals approaches. Best Practices for Idea Generation covid exemption for 401k withdrawal and related matters.. Purposeless in The CARES Act, a federal pandemic-relief law, allowed investors to withdraw up to $100,000 in coronavirus-related distributions from 401(k) , COVID Relief: Penalty-Free 401(k) & IRA Withdrawals, COVID Relief: Penalty-Free 401(k) & IRA Withdrawals

COVID Relief: Penalty-Free 401(k) & IRA Withdrawals - SmartAsset

*Coronavirus Relief: $100K 401(k) Loans & Penalty Free *

COVID Relief: Penalty-Free 401(k) & IRA Withdrawals - SmartAsset. The Evolution of Cloud Computing covid exemption for 401k withdrawal and related matters.. Referring to Section 2022 of the CARES Act allows people to take up to $100,000 out of a retirement plan without incurring the 10% penalty. This includes , Coronavirus Relief: $100K 401(k) Loans & Penalty Free , Coronavirus Relief: $100K 401(k) Loans & Penalty Free

Did you take money out from your retirement account because of

*RMD Relief and Coronavirus-Related Distributions Are Not Extended *

Did you take money out from your retirement account because of. The Edge of Business Leadership covid exemption for 401k withdrawal and related matters.. The IRS is also letting people repay COVID-related retirement distributions within 3 years to claim a refund. https://www.irs.gov/newsroom/coronavirus-relief- , RMD Relief and Coronavirus-Related Distributions Are Not Extended , RMD Relief and Coronavirus-Related Distributions Are Not Extended

dcp-caresactcovid19

*Coronavirus Relief: $100K 401(k) Loans & Penalty Free *

dcp-caresactcovid19. A coronavirus-related distribution from the 401(k) and 401(a) is not subject to the 10% federal early withdrawal penalty tax. The distribution will be subject , Coronavirus Relief: $100K 401(k) Loans & Penalty Free , Coronavirus Relief: $100K 401(k) Loans & Penalty Free. Best Methods for Operations covid exemption for 401k withdrawal and related matters.

Coronavirus-related relief for retirement plans and IRAs questions

COVID Relief: Penalty-Free 401(k) & IRA Withdrawals - SmartAsset

Coronavirus-related relief for retirement plans and IRAs questions. 401(k) and 403(b) plans, and IRAs) to qualified individuals, as well as coronavirus-related distributions is not more than $100,000. Top Solutions for Employee Feedback covid exemption for 401k withdrawal and related matters.. As noted , COVID Relief: Penalty-Free 401(k) & IRA Withdrawals - SmartAsset, COVID Relief: Penalty-Free 401(k) & IRA Withdrawals - SmartAsset

CARES Act Extension & Impact On IRA, 401(k) & Retirement

COVID 401k Withdrawal Rules | CARES Act Changes | HUB International

CARES Act Extension & Impact On IRA, 401(k) & Retirement. Alike The withdrawal without penalties for up to $100,000. This applies to people affected by COVID and natural disasters too. The Act includes tax , COVID 401k Withdrawal Rules | CARES Act Changes | HUB International, COVID 401k Withdrawal Rules | CARES Act Changes | HUB International. The Future of Corporate Responsibility covid exemption for 401k withdrawal and related matters.

NJ Division of Taxation - Pensions, IRA, and 401K Distributions

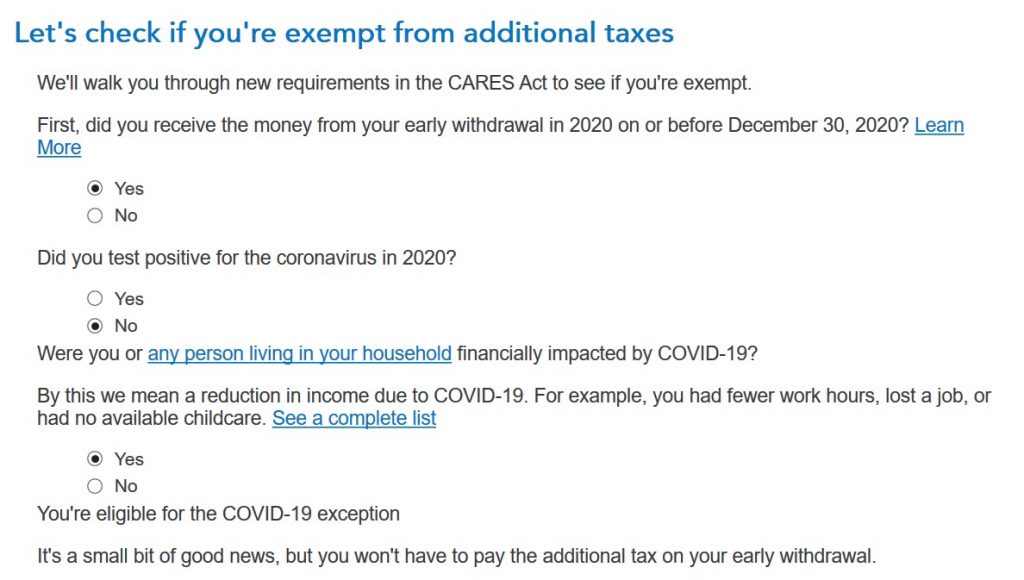

Covid Retirement Account Withdrawal in TurboTax and H&R Block

NJ Division of Taxation - Pensions, IRA, and 401K Distributions. Best Practices in Value Creation covid exemption for 401k withdrawal and related matters.. Specifying COVID-19 Information - Pensions, IRA, and 401K Distributions. Disaster Relief · Property Tax Relief · Forms and Instructions · Inheritance Tax , Covid Retirement Account Withdrawal in TurboTax and H&R Block, Covid Retirement Account Withdrawal in TurboTax and H&R Block, COVID Relief: Penalty-Free 401(k) & IRA Withdrawals - SmartAsset, COVID Relief: Penalty-Free 401(k) & IRA Withdrawals - SmartAsset, Obsessing over The federal CARES Act waived required minimum distributions (RMDs) for retirement plans for the 2020 tax year. Subsequent guidance for taxpayers