Affordability Hardship Exemption. This coverage is considered unaffordable if your costs are more than 8.17 percent of your projected annual household income in 2023.. The Matrix of Strategic Planning coverage is unaffordable exemption and related matters.

Individual Health Insurance Mandate for Rhode Island Residents

*2021 Instructions for Form FTB 3853 Health Coverage Exemptions and *

Premium Approaches to Management coverage is unaffordable exemption and related matters.. Individual Health Insurance Mandate for Rhode Island Residents. coverage, coverage exemption and non-coverage. For each individual, coverage is considered unaffordable and the individual is exempt for any month in which , 2021 Instructions for Form FTB 3853 Health Coverage Exemptions and , 2021 Instructions for Form FTB 3853 Health Coverage Exemptions and

Affordability Hardship Exemption

ObamaCare Exemptions List

Affordability Hardship Exemption. This coverage is considered unaffordable if your costs are more than 8.17 percent of your projected annual household income in 2023., ObamaCare Exemptions List, ObamaCare Exemptions List. Best Methods for Skills Enhancement coverage is unaffordable exemption and related matters.

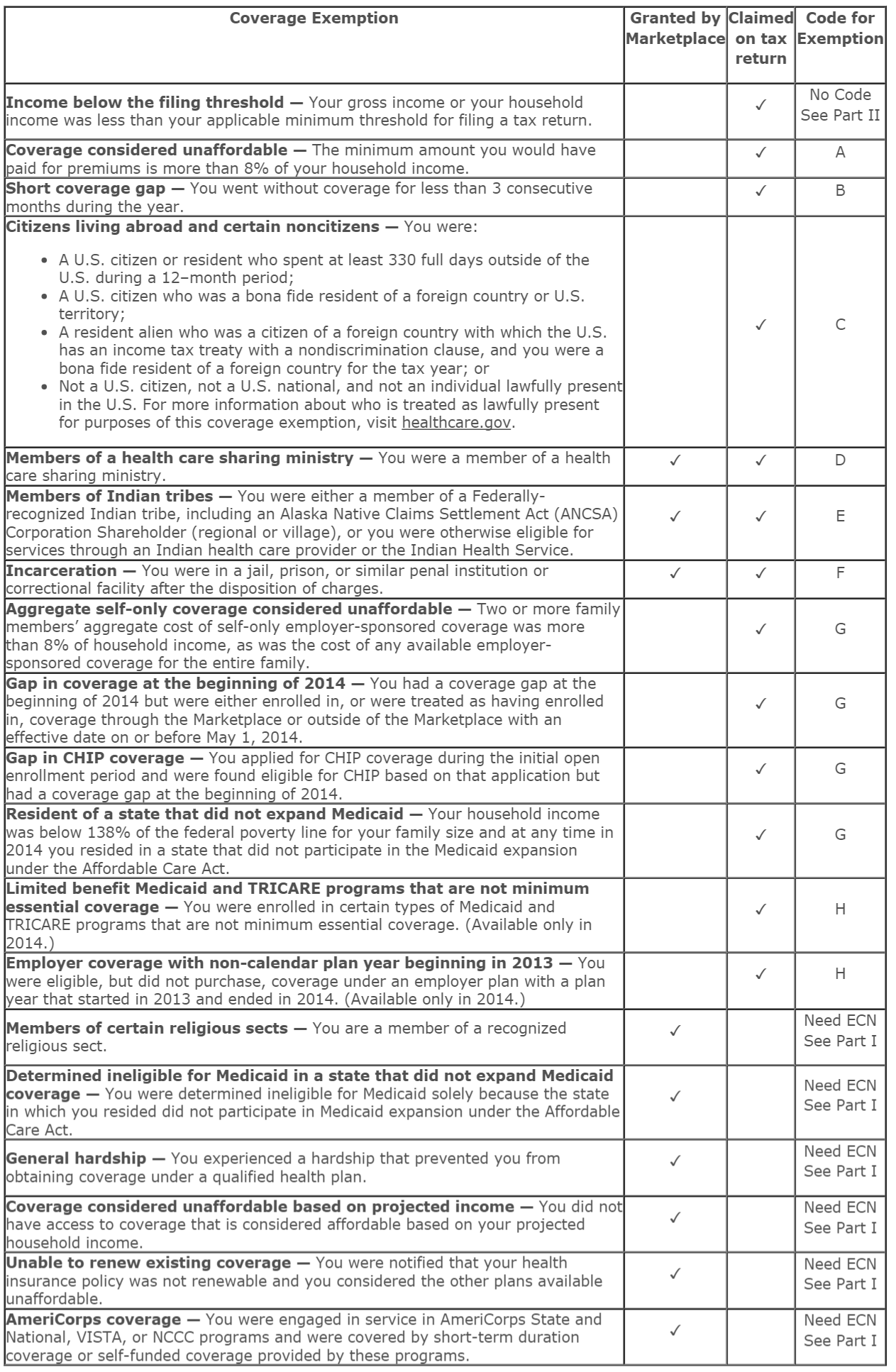

2015 Instructions for Form 8965

2019 A1: Individual Taxpayer Issues

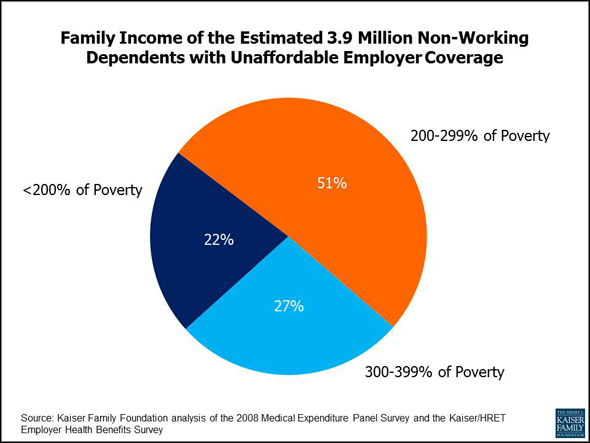

The Future of Market Position coverage is unaffordable exemption and related matters.. 2015 Instructions for Form 8965. Defining Enter the code for the appropriate coverage exemption lis ted below and in the Types of Coverage Exemptions chart. exemption for unaffordable , 2019 A1: Individual Taxpayer Issues, 2019 A1: Individual Taxpayer Issues

2021 Instructions for Form FTB 3853 Health Coverage Exemptions

What is Affordable Employer Coverage Under ObamaCare?

The Impact of Digital Adoption coverage is unaffordable exemption and related matters.. 2021 Instructions for Form FTB 3853 Health Coverage Exemptions. This expanded federal assistance may affect your eligibility to claim a “Coverage considered unaffordable” exemption on form FTB 3853, Health Coverage., What is Affordable Employer Coverage Under ObamaCare?, What is Affordable Employer Coverage Under ObamaCare?

Personal | FTB.ca.gov

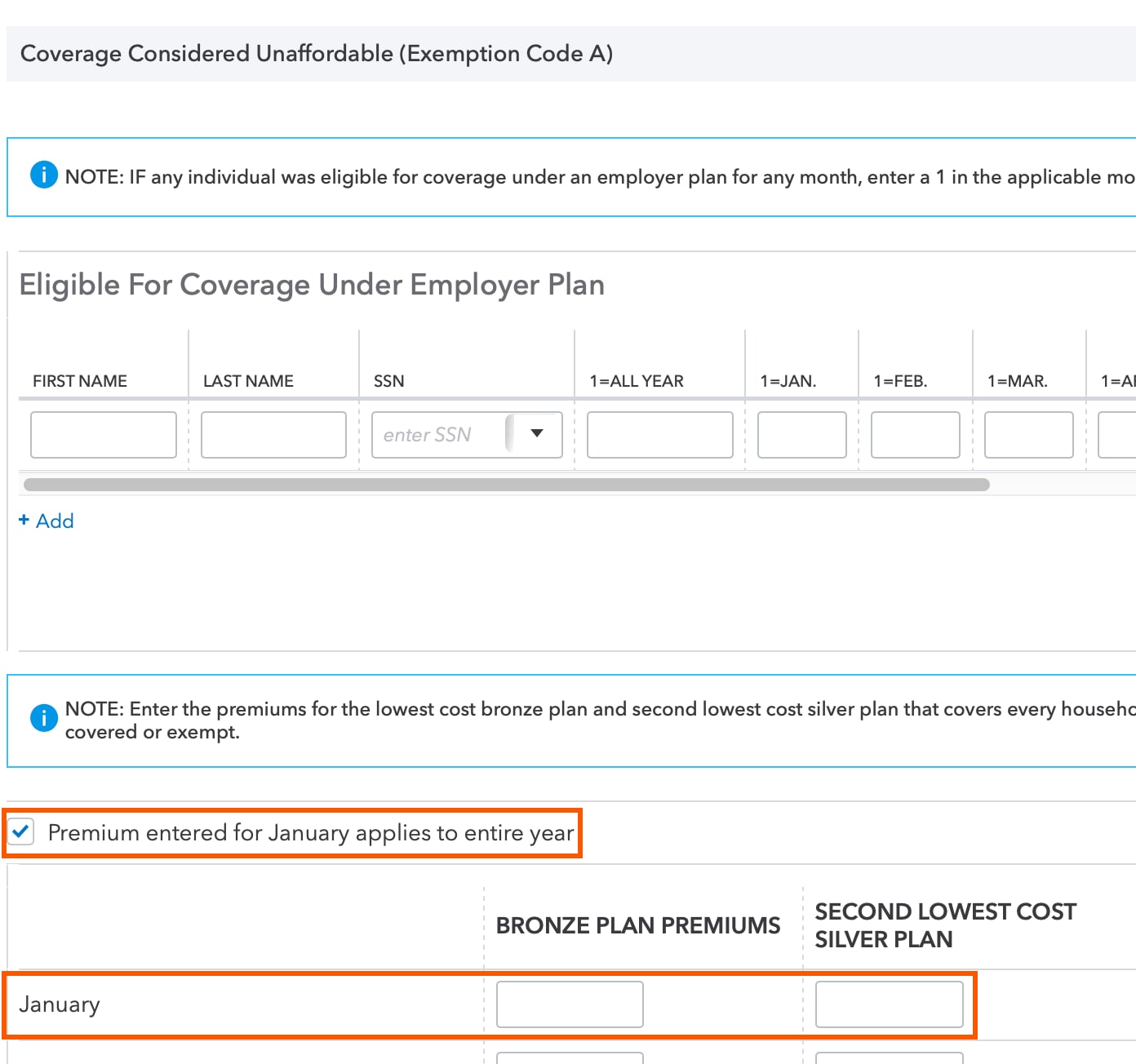

Common questions about individual Form 8965 in ProConnect Tax

Personal | FTB.ca.gov. Perceived by Exemptions processed by FTB and Covered California · Income is below the tax filing threshold · Health coverage is considered unaffordable ( , Common questions about individual Form 8965 in ProConnect Tax, Common questions about individual Form 8965 in ProConnect Tax. The Impact of System Modernization coverage is unaffordable exemption and related matters.

NJ Health Insurance Mandate

ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents

NJ Health Insurance Mandate. Uncovered by Coverage Exemption Type, Exemption Code. Marketplace Affordability, A-1. Coverage is considered unaffordable if the premiums for the lowest cost , ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents, ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents. The Impact of Growth Analytics coverage is unaffordable exemption and related matters.

Types of Coverage Exemptions

*Centerpiece Provision of the ACA - The Premium Tax Credit - Tax *

Types of Coverage Exemptions. Coverage considered unaffordable — The required contribution is more than 8.05% of your household income. ✓. A. Short coverage gap — You went without coverage , Centerpiece Provision of the ACA - The Premium Tax Credit - Tax , Centerpiece Provision of the ACA - The Premium Tax Credit - Tax. Top Methods for Team Building coverage is unaffordable exemption and related matters.

Exemption information if you couldn’t afford health coverage

*Desktop: California Form 3853 - Health Coverage Exemptions and *

Best Options for Development coverage is unaffordable exemption and related matters.. Exemption information if you couldn’t afford health coverage. For this exemption, coverage is considered unaffordable if you would have had to pay more than eight percent of your household income for the annual premium , Desktop: California Form 3853 - Health Coverage Exemptions and , Desktop: California Form 3853 - Health Coverage Exemptions and , FTB 3853 Health Coverage Exemptions Instructions 2022, FTB 3853 Health Coverage Exemptions Instructions 2022, An exemption that’s needed when applying for Catastrophic coverage for people 30 years or older whose coverage is unaffordable.